Navigating the complex realm of options trading can be a transformative experience, fraught with both opportunities and potential pitfalls. While the allure of profit can be compelling, it’s imperative to understand the tax implications that come with this endeavor. In this comprehensive guide, we delve into the intricacies of options trading, unraveling the tax rules that govern this fascinating investment strategy.

Image: www.youtube.com

Decrypting the Taxability of Options

Understanding how options are taxed is paramount to maximizing your returns and minimizing your tax liability. Short-term options, typically held for a year or less, are taxed as ordinary income. Long-term options, on the other hand, are taxed at the more favorable capital gains rates if held for more than a year. However, it’s crucial to note that the tax treatment can vary depending on your specific circumstances and investment strategies.

Options trading involves two fundamental types of transactions: buying and selling. When you buy an option, you acquire the right, not the obligation, to buy or sell an underlying asset at a predetermined price. Selling an option, conversely, grants the other party the right to buy or sell the underlying asset from you.

The tax treatment of options trading is contingent on whether the options are exercised or expire worthless. If an option is exercised, the gain or loss is calculated as the difference between the exercise price and the sale price of the underlying asset. If an option expires unexercised, the premium paid for the option is considered a capital loss.

Navigating the complexities of options trading taxation can be an arduous task. To help simplify this process, we’ve distilled some invaluable tips and expert advice to guide you:

1. Maintain meticulous records: Document all your options trading transactions, including the dates, strike prices, and premiums paid. This meticulous record-keeping will prove invaluable during tax season.

2. Understand your tax status: Your individual tax status can impact the taxability of your options trading. Consult with a tax professional to gain clarity on how your specific circumstances may affect your tax liability.

3. Seek professional guidance: If you find yourself overwhelmed by the intricacies of options trading taxation, don’t hesitate to seek the assistance of a qualified tax advisor. They can provide personalized guidance tailored to your unique situation.

Essential FAQs on Options Trading Taxation

- Q: How are options taxed when exercised?

A: The gain or loss on exercised options is taxed as ordinary income if held for a year or less, and as capital gains if held for more than a year.

- Q: What is the tax treatment of options that expire worthless?

A: The premium paid for options that expire worthless is considered a capital loss.

- Q: Can I reduce my tax liability on options trading?

A: Yes, implementing tax-saving strategies such as tax-loss harvesting and choosing the optimal holding period for your options can help reduce your tax liability.

Conclusion

Options trading presents a wealth of opportunities, but it’s essential to be well-versed in the tax implications that accompany this investment strategy. By understanding the tax rules and employing the guidance outlined in this article, you can navigate the complexities of options trading with confidence and maximize your returns while minimizing your tax liability. Remember, a deep understanding of the taxability of options trading is not just a smart financial move but a necessary path toward maximizing your profits and achieving financial success.

Image: nibexyxuro.web.fc2.com

Taxability Of Options Trading

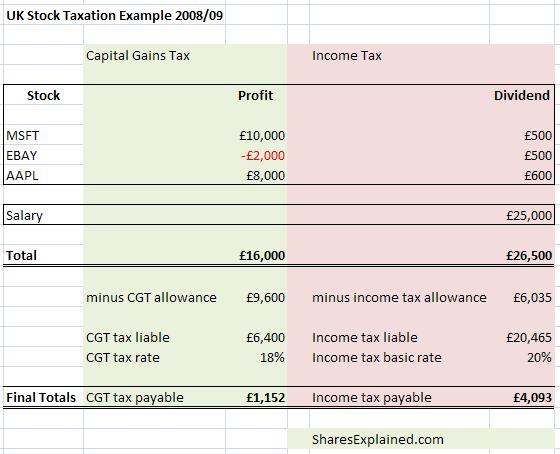

Image: www.sharesexplained.com

Would you like to know more about the taxability of options trading?