Imagine yourself standing on the deck of a ship during a raging storm. The waves are crashing, the winds are howling, and the seas are rough. Just like this tumultuous sea, the world of options trading can also experience periods of intense volatility, where prices fluctuate rapidly, making it a risky yet potentially lucrative endeavor.

Image: explosiveoptions.net

During times of high volatility, options traders must be equipped with strategies and a solid understanding of the market dynamics to navigate these choppy waters successfully.

Understanding Options Trading

Options trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price, known as the strike price, on or before a certain date, known as the expiration date.

Options come in two main types: calls and puts. Call options give the holder the right to buy the underlying asset, while put options give the holder the right to sell the underlying asset. The value of an option contract is determined by factors such as the underlying asset’s price, the strike price, the time remaining until expiration, and the prevailing market volatility.

High Volatility and its Impact on Options Trading

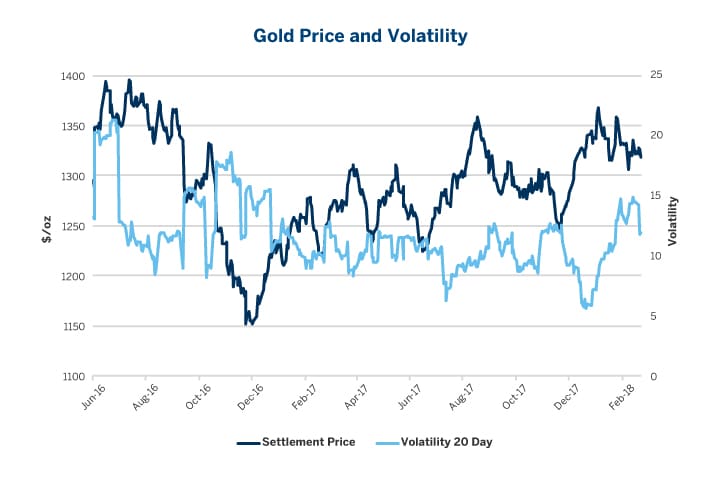

Volatility measures the magnitude of price fluctuations in an underlying asset. High volatility indicates rapid and significant price swings, which can create both opportunities and challenges for options traders.

On the one hand, high volatility can amplify potential profits, as options prices tend to increase in value when volatility rises. However, it also magnifies potential losses, as rapid price movements can quickly eat into the trader’s investment.

Strategies for Options Trading During High Volatility

Adapting to the ever-changing landscape of high volatility requires a strategic approach.

1. Short-Term Trading:

Opt for short-term trades with shorter durations, such as intraday or weekly options. These strategies allow traders to capitalize on short-term price movements while limiting exposure to longer-term volatility.

2. Defined-Risk Strategies:

Employ techniques like spreads, which involve buying and selling options of different strike prices or expiration dates. Spreads limit potential losses and define the maximum risk before entering the trade.

3. Covered Strategies:

Consider covered calls or cash-secured puts where you have the underlying asset or cash to cover the potential obligation. These strategies reduce the inherent leverage of options trading and provide some cushion against adverse price movements.

4. Volatility Hedging:

Utilize options to hedge against potential losses in your existing portfolio. For example, buying put options on an underlying stock can offset potential declines in its value.

Image: www.cmegroup.com

The Latest Trends and Developments

Staying abreast of the evolving landscape of options trading is crucial. Recent advancements include:

- Increased ETF Option Trading: The surge in popularity of exchange-traded funds (ETFs) has led to a corresponding growth in options trading on ETFs, offering traders exposure to a diversified basket of underlying assets.

- Rise of Binary Options: Binary options, which provide a fixed payout based on a yes/no outcome, have gained traction, offering traders an alternative to traditional options contracts.

- Adoption of Derivatives Technology: Advanced platforms and trading algorithms have streamlined options trading, enabling traders to execute complex strategies and manage risk more efficiently.

Tips and Expert Advice

Navigating the turbulent seas of options trading during high volatility requires guidance from experienced traders.

1. Manage Risk First and Foremost:

Prioritize risk management by understanding your risk tolerance and trading within your means. Set clear stop-loss orders to limit potential losses.

2. Understand the Underlying Asset:

Research and thoroughly understand the underlying asset, its market dynamics, and factors that drive its price movements. Conduct thorough due diligence before executing any trades.

Common FAQ on Options Trading During High Volatility

Q: Is it wise to trade options during periods of high volatility?

A: While high volatility can present opportunities, it also amplifies potential losses. Traders must assess their risk tolerance and select appropriate strategies to navigate this market environment.

Q: What is the best approach to options trading during high volatility?

A: Consider short-term trades, defined-risk strategies, or covered strategies to manage volatility. It’s crucial to employ risk management techniques and continuously monitor market movements.

Options Trading During High Volatility

Image: www.pinterest.com

Conclusion

Options trading during high volatility can be a daring and rewarding endeavor. By understanding market dynamics, employing tailored strategies, and seeking guidance from experts, traders can navigate the turbulent waters of these volatile times. Remember, trading involves risk, and it’s essential to trade responsibly within your financial means.

Are you intrigued by the potential of options trading during high volatility? Share your thoughts and experiences in the comments below.