For a moment, imagine yourself standing in the midst of choppy waters. The waves are unpredictable, constantly shifting in intensity. Just as you think you’ve found your balance, a sudden gust of wind forces you to adapt quickly to the changing conditions. Welcome to the world of volatility trading, a high-stakes arena where traders navigate the ever-fluctuating markets armed with options strategies.

Image: www.youtube.com

Options, financial instruments that provide the right to buy or sell an underlying asset at a predetermined price within a specific time frame, offer an invaluable tool for trading volatility. By leveraging options, traders can profit from both rising and falling markets, often reducing their exposure to potential losses.

Understanding Volatility Trading

Volatility, a measure of the magnitude of price fluctuations, is a key factor in options trading. When markets are volatile, options tend to be more expensive, as the potential for significant price swings increases. Conversely, in periods of low volatility, options premiums are typically lower, as the likelihood of substantial price movements decreases.

Traders who specialize in volatility trading employ a range of strategies to capitalize on market fluctuations. These strategies can be complex, involving sophisticated options combinations and risk management techniques. However, even seasoned traders recognize the importance of fundamental understanding and strategic execution.

The Latest Trends and Developments

The world of volatility trading is constantly evolving, shaped by both economic and technological advancements. Volatility indices, such as the VIX, have become popular gauges of market expectations and serve as valuable tools for traders. Additionally, the rise of algorithmic trading and high-frequency trading has transformed the execution landscape.

Social media platforms and online forums provide valuable insights into the latest market sentiment and trading strategies. By staying abreast of industry news, updates, and expert opinions, traders can position themselves for success in this ever-changing environment.

Tips and Expert Advice

To succeed in volatility trading, a combination of patience, discipline, and a solid understanding of options is crucial. Experienced traders emphasize the following tips to enhance profitability:

- Diversify your portfolio: Spread your investments across different options strategies and underlying assets to mitigate risk.

- Understand the risks: Options trading involves significant potential gains and losses. Thoroughly assess your risk tolerance before placing any trades.

- Manage your emotions: Avoid impulsive decisions driven by fear or greed. Stay disciplined and stick to your trading plan.

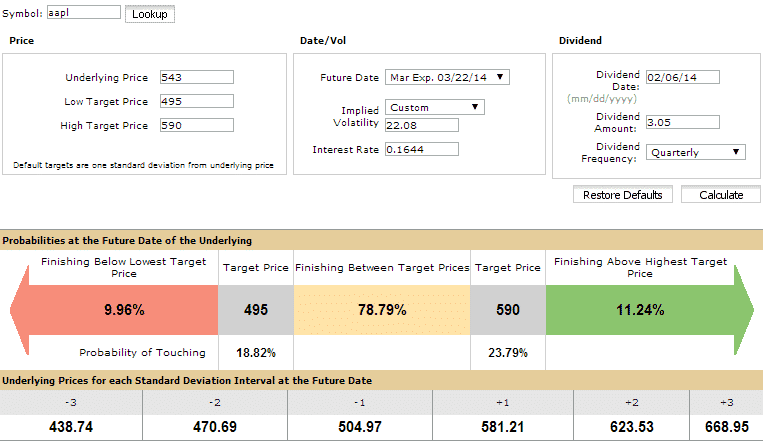

Image: optionstradingiq.com

Frequently Asked Questions

Q: Can I profit from options trading without owning the underlying asset?

A: Yes, options allow you to speculate on price movements without taking direct ownership of the underlying asset.

Q: What are some common volatility trading strategies?

A: Popular strategies include long straddles, short strangles, and iron condors, each designed for different volatility scenarios.

Trading Volatility With Options

Conclusion

Trading volatility with options demands a deep understanding of options markets, volatility dynamics, and risk management principles. By embracing a strategic approach, traders can capitalize on market fluctuations and potentially generate substantial returns. Remember, success in this arena requires patience, discipline, and a commitment to continual learning. Are you ready to navigate the choppy waters of volatility trading and seize the opportunities it presents?