Introduction

In the dynamic realm of financial markets, Canada has emerged as a prominent hub for options trading. With a robust regulatory framework, innovative platforms, and a growing investor base, accessing the potential of options trading in Canada has become easier than ever. This article delves into the intricacies of using a Canadian option trading app, providing a comprehensive guide to help you navigate this exciting investment arena.

Image: techidroid.com

Understanding Options Trading

An option is a financial instrument that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. Options provide investors with flexibility and offer the potential for substantial returns, but they also involve risk. Canadian option trading apps streamline the process, enabling you to execute sophisticated trades with ease.

Benefits of Using a Canadian Option Trading App

Canadian option trading apps offer several advantages that enhance your trading experience:

- Convenience and Accessibility: Mobile apps allow you to trade options on the go, providing flexibility and real-time access to market data.

- User-Friendly Interface: Designed with intuitive interfaces, these apps simplify complex concepts and provide a seamless trading experience.

- Advanced Features: Most reputable Canadian option trading apps offer advanced features such as real-time quotes, customizable charts, and technical indicators to empower your decision-making.

- Integrated Tools: Apps often integrate with trading platforms, providing a comprehensive suite of tools for managing your portfolio and executing trades.

Choosing the Right App

Selecting the right Canadian option trading app depends on your individual needs and preferences. When evaluating options, consider factors such as:

- Commission Structure: Compare the fees and commission rates of different apps to ensure cost-effectiveness.

- Trading Features: Choose an app that supports your desired trading strategies and provides essential tools for analysis.

- Security and Regulation: Ensure the app operates under a reputable regulatory body and employs robust security measures to protect your funds and personal information.

- Customer Support: Reliable and responsive customer support is crucial for troubleshooting and resolving any issues you may encounter.

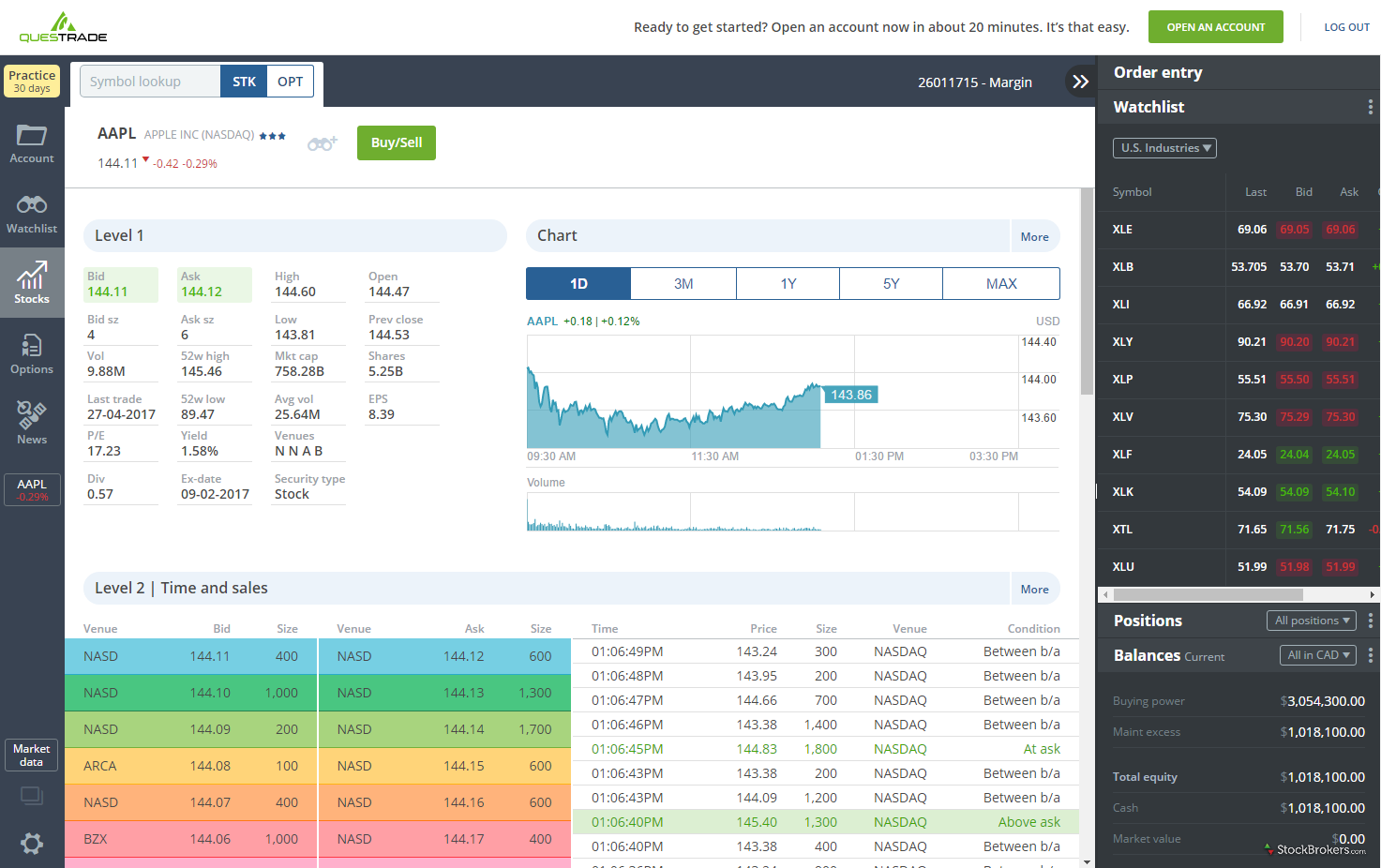

Image: reviewlution.ca

Getting Started with an Option Trading App

Once you’ve chosen an app, follow these steps to begin trading options:

- Open an Account: Create a brokerage account with the app provider and undergo necessary onboarding procedures.

- Fund Your Account: Transfer funds into your trading account to initiate your investments.

- Research and Plan: Identify the underlying assets and trading strategies that align with your risk tolerance and financial goals.

- Place Your Trade: Select an option and specify parameters such as the strike price, expiration date, and number of contracts.

- Monitor and Adjust: Track the performance of your trades and adjust your strategy as needed based on market conditions.

Canada Option Trading App

Image: moneyforlunch.com

Conclusion

Embracing a Canadian option trading app empowers you with the tools and flexibility to navigate the world of options trading. With a comprehensive understanding of the benefits and considerations associated with these apps, you can make informed choices and embark on a rewarding investment journey. Remember that options trading involves risk, and careful research and strategic planning are essential for maximizing your potential in this dynamic market.