Imagine yourself at the helm of a sailboat, navigating through choppy waters. The wind gusts and lulls, the waves rise and fall, and you must expertly adjust your sails to harness the power of the elements while mitigating the risks.

Image: forexbrainbox.com

Trading options is not unlike sailing. It requires a keen understanding of market volatility, the ever-changing tides that can either propel you forward or send you crashing down. Mastering this dynamic landscape can lead to significant profits but also potential pitfalls if not approached strategically.

Understanding Volatility: The Key to Capturing Market Movements

Volatility, in financial terms, measures the magnitude of price fluctuations in a security or market over a specific period. High volatility indicates significant price swings, while low volatility implies relatively stable prices.

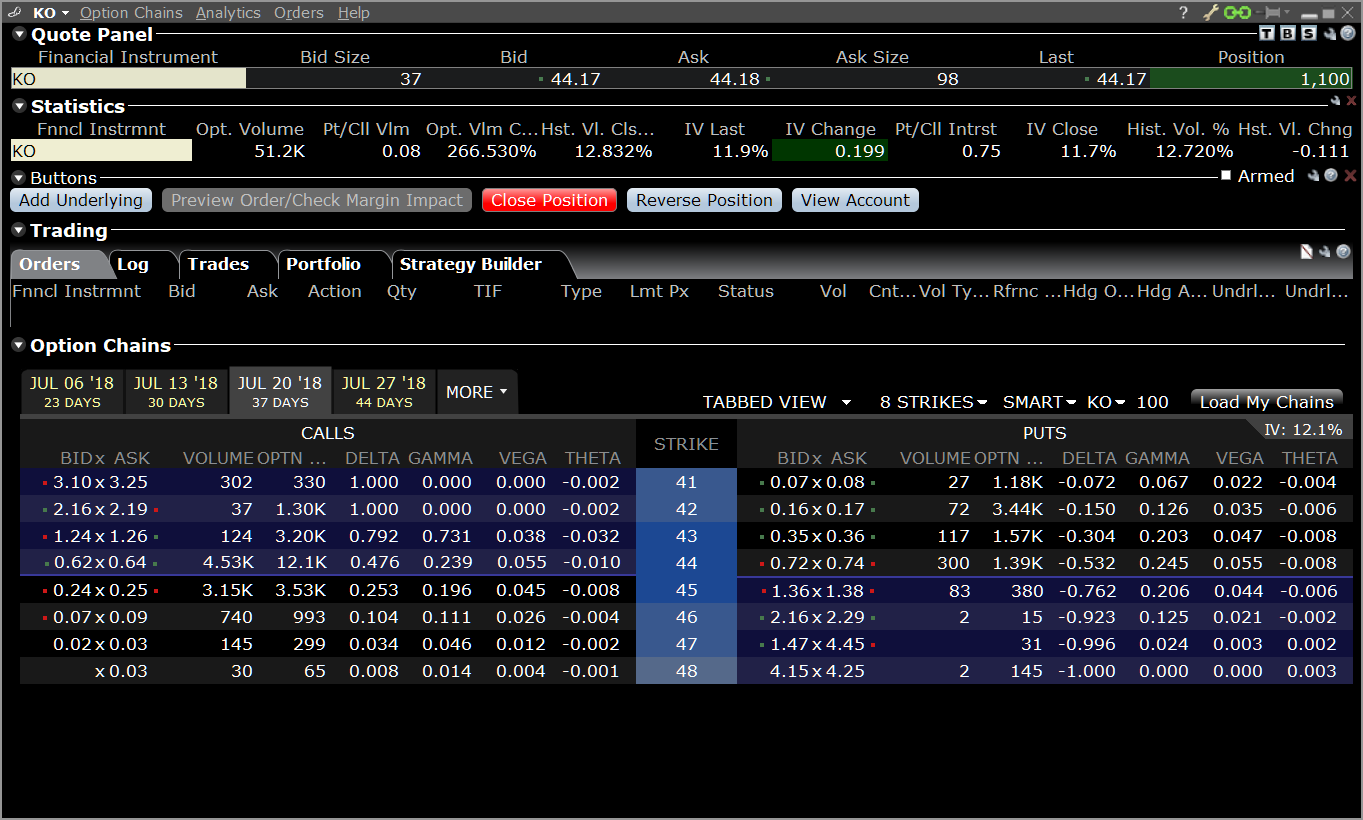

Options traders excel at exploiting volatility. They purchase or sell options contracts that grant them the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on a specified date (expiration date). By leveraging options, traders can gain exposure to and potentially profit from market movements without owning the underlying asset itself.

Capitalizing on Volatility: Strategies for Success

There are numerous options trading strategies that capitalize on volatility. Here are some popular approaches:

- Buying Calls: When traders anticipate a price increase, they can purchase call options, which give them the right to buy an asset at the strike price.

- Selling Puts: When traders expect a price decline, they can sell put options, which give them the right to sell an asset at the strike price.

- Selling Straddles: This strategy involves simultaneously selling both a call and a put option with the same strike price and expiration date. Traders profit when the underlying asset experiences a significant price movement in either direction.

- Trading Volatility Indices: VIX, the Chicago Board Options Exchange (CBOE) Volatility Index, measures market expectations of volatility. Traders can speculate on VIX’s movement using futures or options contracts.

Expert Insights and Practical Tips

To enhance your options trading strategies, consider the following expert recommendations:

- Thoroughly Research: Understand the factors that drive volatility in the underlying asset or market.

- Monitor Market News: Stay up-to-date on economic events and market trends that can impact volatility.

- Manage Risk: Carefully calculate the potential loss and adjust your trading positions accordingly.

- Use Implied Volatility: Consider implied volatility (IV) when pricing options. IV indicates the market’s expectation of future volatility.

- Seek Professional Guidance: Consult with experienced traders or financial advisors for personalized advice.

Image: forextraininggroup.com

FAQ on Volatility and Options Trading

Q: What is the difference between realized and implied volatility?

A: Realized volatility measures actual price fluctuations over a historical period, while implied volatility estimates future volatility based on options prices.

Q: Can you lose money trading options?

A: Yes, options trading involves risk. You can lose the premium paid for the option contract if the underlying asset does not move as anticipated.

Q: What are the benefits of using options?

A: Options provide leverage, allowing traders to control a large position with limited capital. They also offer flexibility and customization, enabling traders to tailor strategies to different market conditions.

Trading Options Using Volatility

Image: zulassung-pieske.de

Conclusion

Mastering the art of trading options using volatility requires a deep understanding of market dynamics, strategic execution, and unwavering risk management. By embracing the thrill and challenges of navigating the ever-changing tides of the market, traders can harness the power of volatility to their advantage and position themselves for success in the financial arena.

If you have an appetite for risk and a keen eye for market movements, trading options using volatility may be an exciting path worth exploring. Dive deeper into this fascinating realm, and unlock the potential to ride the waves of the market towards financial triumphs.