The realm of options trading can be both thrilling and intimidating, rife with intricacies and complexities that can send even seasoned investors into a tizzy. But just as Odysseus had his loyal crew to guide his perilous journey, traders have their faithful companions—Greeks—to navigate the choppy waters of the options market. In this comprehensive guide, we’ll delve into the captivating world of Greeks, deciphering their significance in monitoring and managing option positions.

Image: positron-investments.com

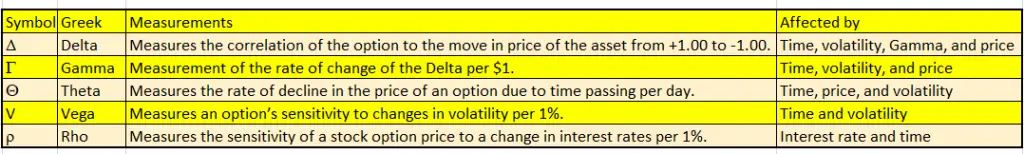

Introducing the Greek Guardians

Greeks are financial metrics that quantify the impact of various factors on an option’s price. They are the telltale signs of how an option’s worth will sway with the ebb and flow of underlying asset prices, time decay, volatility, and interest rates. These Greek guardians stand ever vigilant, guiding traders in their decision-making, lest they succumb to the perils of unchecked risk.

Delta: The Path Follower

Delta, a measure of price sensitivity, unveils how much the option’s price will change in response to a unit shift in the underlying asset’s price. Imagine you own a call option on Apple stock. If Apple’s stock price gains $1, your call option’s value will rise by $0.70 (assuming a Delta of 0.7). Delta serves as a barometer of potential profit or loss, crucial for assessing the impact of underlying asset price movements.

Gamma: The Acceleration Gauge

Gamma, the rate of change in Delta, reflects how Delta itself will change as the underlying asset price fluctuates. A high Gamma indicates a rapid acceleration in Delta, signaling heightened sensitivity to price changes. Imagine driving a sports car with a responsive accelerator. As you press down harder, the car’s speed increases at an accelerating rate—just like Delta does with Gamma’s influence.

Image: www.newtraderu.com

Theta: The Timekeeper

Theta, the enemy of time decay, measures the value erosion of an option as it approaches its expiration date. Time is the relentless foe of options, steadily chewing away at their value. Theta, the watchful timekeeper, keeps track of this inexorable decline, aiding traders in determining how quickly an option’s value will diminish.

Vega: The Volatility Whisperer

Vega, a measure of sensitivity to volatility, unveils how the option’s price will vary with changes in implied volatility. Imagine a sailboat navigating through choppy waters. As the waves intensify (higher implied volatility), Vega ensures the option’s sails adjust accordingly, increasing its value.

Rho: The Interest Rate Navigator

Rho, the interest rate compass, measures the sensitivity of an option’s price to changes in interest rates. When interest rates rise, bond prices tend to drop, prompting a chain reaction that can influence the price of options. Rho guides traders through this complex interplay, enabling them to chart the course in the fluctuating interest rate landscape.

Greeks Option Trading

Image: tradeoptionswithme.com

Conclusion

Like the Greek philosophers who shaped Western thought, Greeks in option trading are invaluable tools that decipher the enigmatic dance of options prices. By understanding the intricacies of Delta, Gamma, Theta, Vega, and Rho, traders gain a deeper comprehension of risk and reward, empowering them to make informed decisions in the ever-evolving options market. And just as Achilles relied on his armor to conquer Troy, traders can wield Greeks as their steadfast allies, navigating the perils and unlocking the potential of the options arena.