Options trading can be an alluring prospect, offering the potential for substantial returns. However, it’s imperative to approach it with a comprehensive understanding of the intricacies involved. One crucial factor that can impact your trading strategy is minimum open interest.

Image: redot.com

In this article, we’ll delve into the concept of minimum open interest, exploring its significance in options trading and providing valuable tips and guidance for traders seeking to maximize their success.

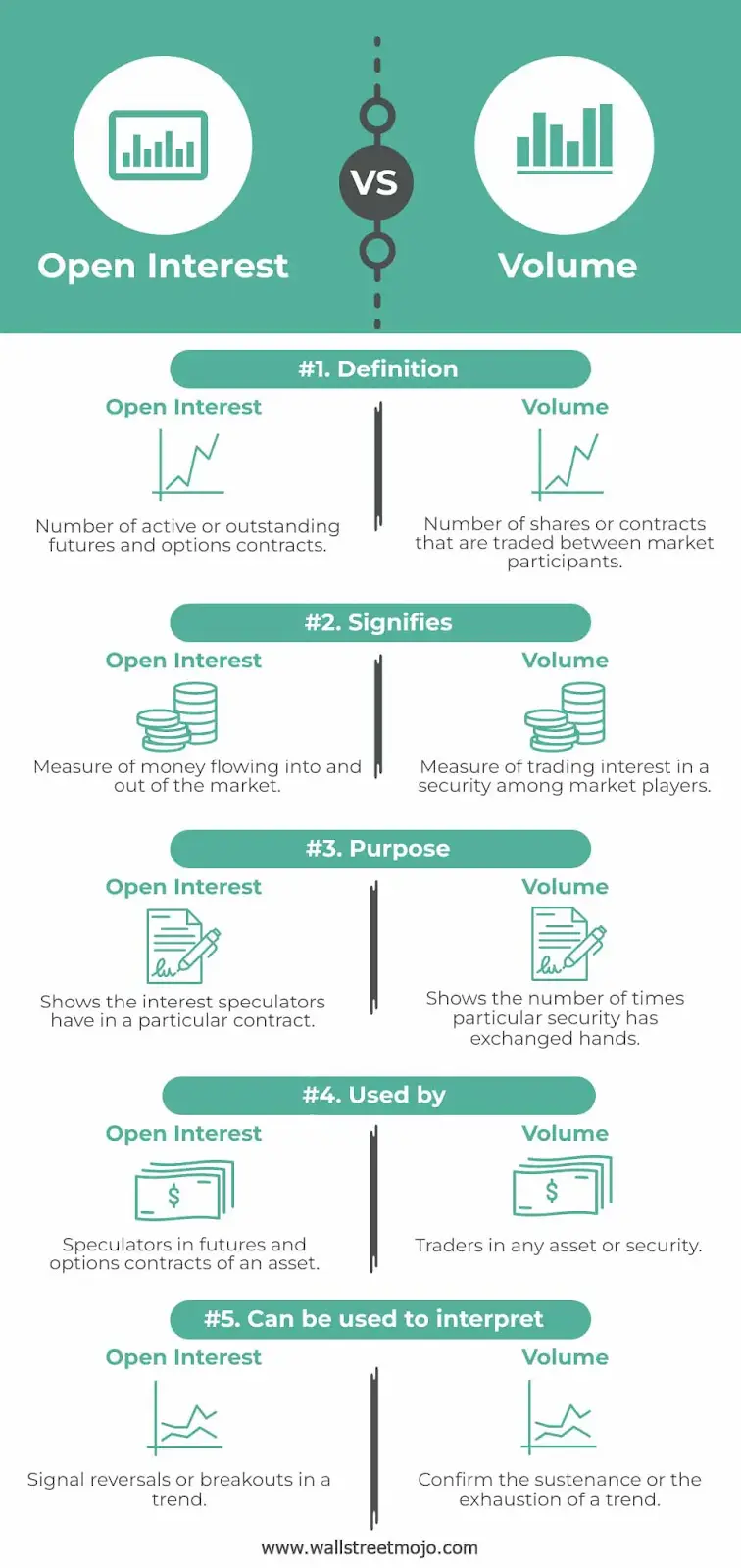

Understanding Open Interest

Open interest represents the total number of contracts for a specific option that are outstanding in the market at a particular time. It reflects the overall interest and trading activity in that option.

A high open interest typically indicates a liquid option with a large number of traders actively participating. This liquidity can facilitate smoother execution of trades, as there are more potential buyers and sellers willing to take the other side of the contract.

Minimum Open Interest Requirements

Many options exchanges stipulate minimum open interest requirements for their listed options contracts. These requirements vary depending on the exchange and the specific option being traded.

For example, the CBOE (Chicago Board Options Exchange) often sets a minimum open interest of 50 contracts for options to qualify for trading. Options that fail to meet this threshold are deemed illiquid and may not be traded.

Impact of Minimum Open Interest on Options Trading

Minimum open interest requirements can have several implications for options traders:

- Reduced Liquidity: Options with low open interest may experience reduced liquidity, leading to wider bid-ask spreads and increased execution costs.

- Order Execution Difficulties: It can be challenging to execute orders for options with low open interest, especially when trying to trade large quantities.

- Increased Risk: Options with low open interest may be subject to greater price volatility due to a limited pool of potential counterparties.

Image: redot.com

Tips for Navigating Minimum Open Interest

If you encounter options with low open interest, consider these strategies:

- Monitor Open Interest Data: Regularly track open interest data to identify options with sufficient liquidity.

- Consider Alternative Options: Explore options for similar underlying assets or strike prices with higher open interest.

- Contact Market Makers: Reach out to market makers who specialize in providing liquidity for options with low open interest.

FAQs on Minimum Open Interest

Q: Why are minimum open interest requirements important?

A: They ensure sufficient liquidity, enable smoother order execution, and minimize risks associated with illiquid options.

Q: How do I find the minimum open interest for an option?

A: Check with the exchange where the option is listed or consult options data providers such as Bloomberg or Reuters.

Q: What should I do if an option has insufficient open interest?

A: Consider trading an alternative option with higher liquidity or reaching out to market makers for assistance.

Minimum Open Interest For Options Trading

Image: tradingtuitions.com

Conclusion

Understanding minimum open interest for options trading is crucial for making informed trading decisions. By adhering to minimum requirements, traders can increase the likelihood of successful trade executions, reduce risk, and maximize their profit potential. Whether you are an experienced trader or embarking on your options journey, consider incorporating these tips into your strategy for enhanced results.

Are you interested in further exploring the intricacies of minimum open interest for options trading? Leave a comment below, and let’s discuss how we can optimize your trading experience.