It was a whirlwind of emotions as I embarked on my journey into the treacherous waters of options trading. The thrill of potential profits danced just out of reach, tantalizing me; yet, the specter of catastrophic losses loomed ominously. Armed with limited knowledge and a relentless hunger for success, I desperately sought a way to navigate these uncharted depths.

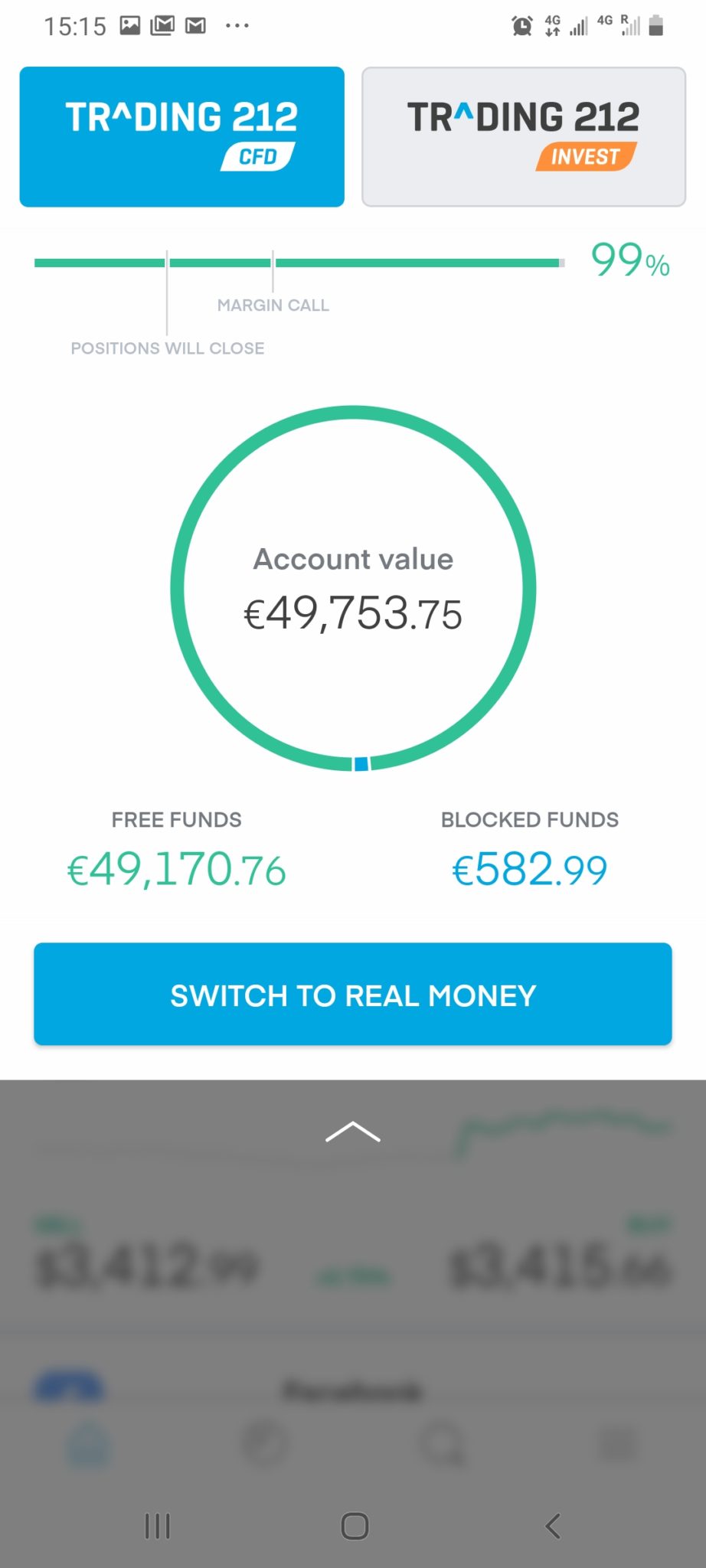

Image: stockapps.com

Through a stroke of serendipity, I stumbled upon the realm of paper trading apps, a safe haven where novice traders like myself could hone their skills without risking any real capital. These platforms provided me with a virtual sandbox, allowing me to test strategies, master the nuances of options contracts, and develop the confidence necessary for eventual live trading. Thus, began my odyssey into the captivating world of free paper trading apps for options.

The Allure of Free Paper Trading Apps

Unleash Market Expertise

Paper trading apps offer an invaluable training ground for aspiring options traders. They provide a simulated trading environment where you can experiment with different strategies, track your progress, and refine your decision-making process without fear of financial consequences. This risk-free approach empowers you to make bold decisions, learn from your mistakes, and gain valuable experience that would otherwise be inaccessible to novice traders.

Boost Confidence Through Experiential Learning

Paper trading apps not only equip you with theoretical knowledge but also instill a deep-rooted confidence that comes from hands-on experience. By navigating the simulated trading environment, you develop an intuitive understanding of market dynamics, option pricing, and risk management. This practical training builds a solid foundation upon which you can confidently transition to live trading.

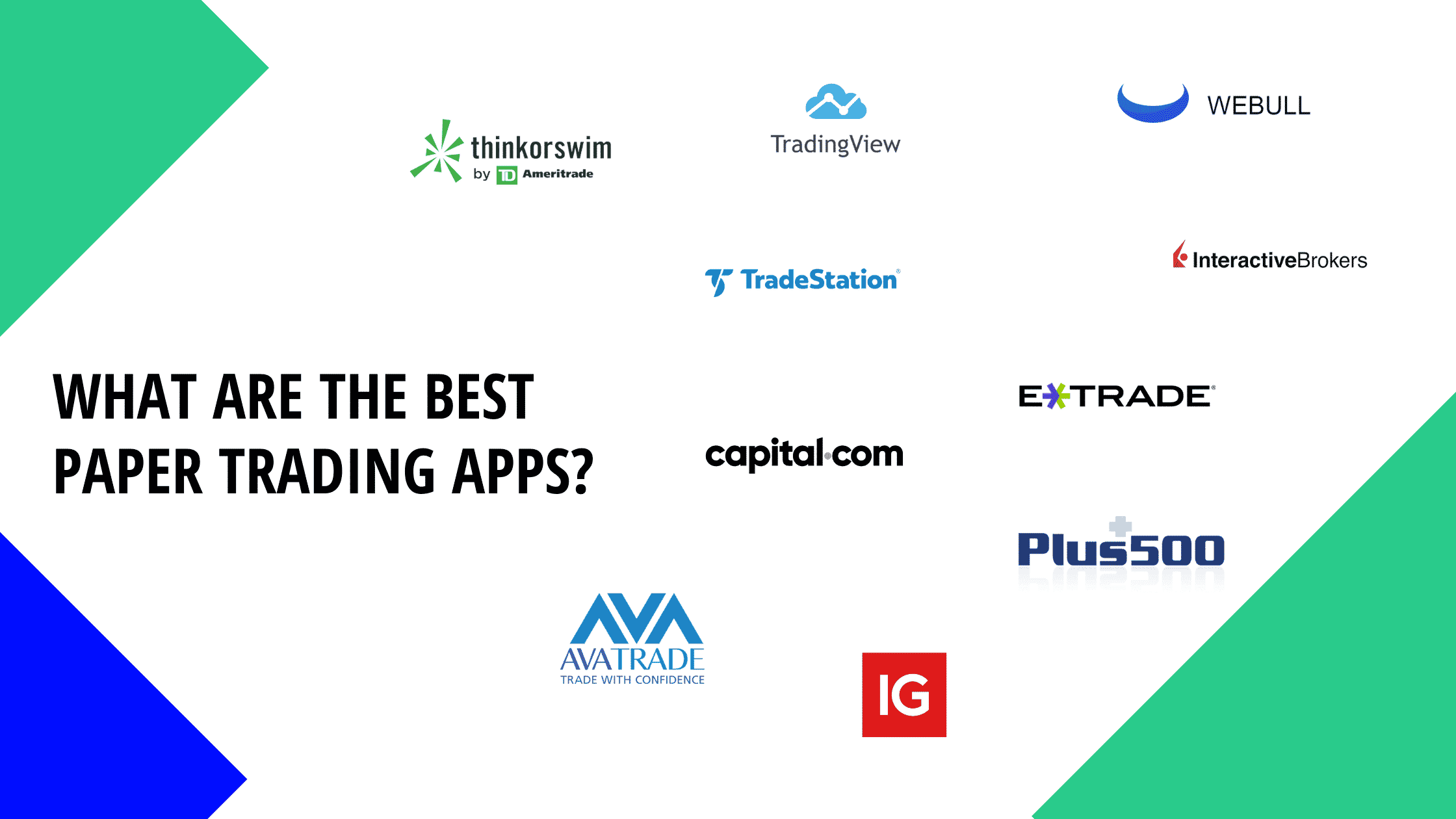

Image: patternswizard.com

Navigating the Landscape of Paper Trading Apps

The world of free paper trading apps is vast and ever-evolving, with new players emerging constantly. Each app offers a unique set of features, tailored to the specific needs of traders. To assist you in selecting the optimal platform, I have meticulously compiled a list of the top contenders and their salient characteristics. Whether you seek advanced charting tools, comprehensive educational resources, or a user-friendly interface, there is an app poised to meet your requirements.

Once you have identified an app that aligns with your trading style, immerse yourself in its intricacies. Explore the platform’s features, familiarize yourself with the order entry process, and devise a trading strategy that complements your objectives and risk tolerance. Remember, the key to successful paper trading lies in approaching it with the same discipline and rigor you would apply to live trading.

Expert Insights: Tips for Effective Paper Trading

As you embark on your paper trading journey, it is imperative to seek guidance from seasoned professionals. Drawing upon my extensive experience and observations, I have compiled a compendium of expert advice and tips to enhance your learning:

Embrace Simulation Fidelity

To maximize the effectiveness of your paper trading experience, strive to replicate real-world trading conditions as closely as possible. Set realistic trading goals, allocate a hypothetical trading capital, and adhere to strict risk management guidelines. This disciplined approach will foster a mindset that mirrors live trading, enabling you to develop habits and strategies that translate seamlessly into the live market.

Measure Performance Objectively

Regularly assess your paper trading performance using quantitative metrics such as win rate, profit factor, and risk-reward ratio. This objective analysis allows you to identify areas for improvement, refine your strategies, and gain a deeper understanding of your strengths and weaknesses as a trader.

Frequently Asked Questions (FAQs)

Q: Can I make real money using paper trading apps?

A: No, paper trading apps are purely virtual environments and do not facilitate real-world trading or financial transactions.

Q: How long should I practice paper trading before switching to live trading?

A: The optimal duration for paper trading varies depending on individual progress and learning style. However, many experts recommend at least 6 months to a year of consistent paper trading.

Q: Can I rely solely on paper trading to become a successful trader?

A: Paper trading, while valuable, is not a substitute for live trading experience. It is essential to transition to live trading when you have gained sufficient confidence and proficiency through paper trading.

Free Paper Trading App For Options

Conclusion

Paper trading apps for options present a groundbreaking opportunity for aspiring traders to embark on their learning journeys without risking capital. By harnessing the power of these virtual platforms, you can acquire an unparalleled understanding of options trading, develop robust trading strategies, and build the confidence necessary to navigate the live market with aplomb.

Embrace the challenge, seek guidance from experts, and dedicate yourself to continuous learning. The world of options trading awaits those who are willing to invest in their knowledge and skills. Are you ready to unlock your trading potential?