Have you ever found yourself entering a trade only to discover that the underlying stock price has moved significantly against you within minutes? Options trading can be a lucrative endeavor, but it also comes with risks. High options trading refers to a trading strategy that involves buying or selling large numbers of options contracts in a short period. This strategy can be profitable, but it also carries a higher degree of risk than traditional options trading.

Image: www.myalgomate.com

Options Trading Basics

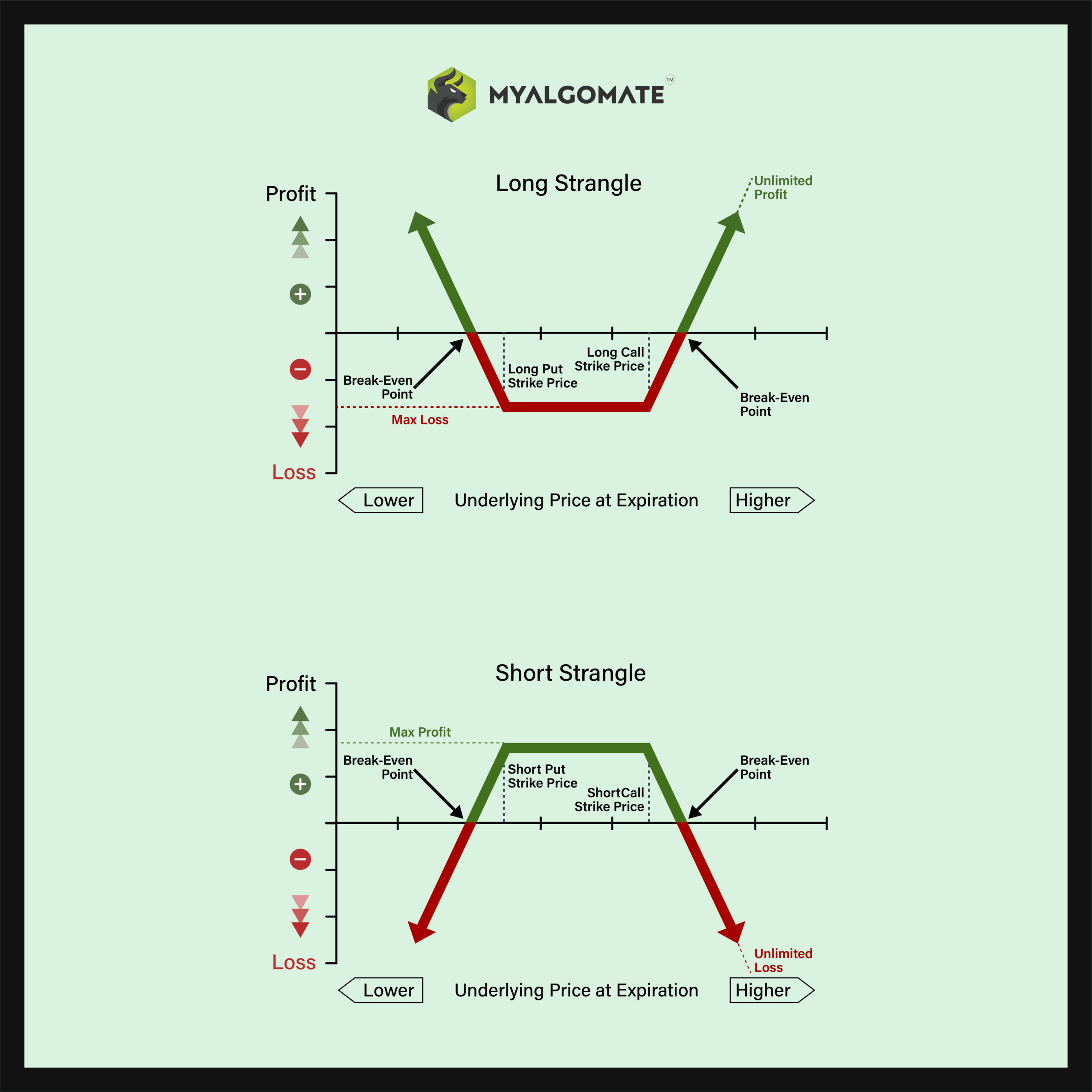

Before we delve into high options trading, let’s review the basics of options trading. Options are derivative financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. There are two main types of options: calls and puts. Call options give the holder the right to buy the underlying asset, while put options give the holder the right to sell the underlying asset.

High Options Trading Strategies

High options trading involves buying or selling a large number of options contracts, often in a single transaction. This strategy can be used to take advantage of short-term price movements in the underlying asset. The goal is to enter and exit a trade quickly, capturing a profit from the difference between the option’s purchase price and its sale price. Some common high options trading strategies include:

- Delta hedging: Buying or selling a large number of options contracts to offset the risk of owning the underlying asset.

- Gamma scalping: Taking advantage of the gamma of an option contract to generate profits from small price movements.

- Theta decay trading: Selling options contracts that are close to expiration to capture the time value premium.

Trends and Developments in High Options Trading

The high options trading market has seen several trends and developments in recent years. These include:

- Increased use of technology: The advent of electronic trading platforms has made it easier for traders to execute high options trading strategies quickly and efficiently.

- Volatility trading: High options trading has become increasingly popular during periods of high market volatility, when options prices can fluctuate rapidly.

- Rise of retail investors: The availability of online brokerage platforms has led to a growing number of retail investors entering the high options trading market.

Image: www.pinterest.com.au

Tips and Expert Advice for High Options Trading

Navigating the high options trading market successfully requires knowledge, skill, and discipline. Here are some tips and expert advice to help you:

- Understand your risk tolerance: High options trading can be risky. Only trade with capital that you can afford to lose.

- Do your research: Thoroughly research the underlying asset and the options contracts you’re considering trading.

- Use a trading plan: Develop a clear trading plan that outlines your trading goals, risk parameters, and entry and exit strategies.

- Manage your risk: Utilize stop-loss orders and other risk management tools to mitigate potential losses.

- Stay disciplined: Follow your trading plan and avoid making emotional trades.

Benefits and Drawbacks of High Options Trading

Benefits:

- Potential for high profits: High options trading can generate significant profits if executed successfully.

- Leverage: Options trading allows you to leverage your capital to control a larger position.

- Flexibility: High options trading offers a wide range of strategies to suit different risk appetites.

Drawbacks:

- High risk: High options trading can involve substantial losses, especially during periods of high volatility.

- Complexity: The high options trading market can be complex and requires a thorough understanding of options strategies.

- Transaction costs: Trading fees and commissions can significantly reduce your profits.

Common Questions About High Options Trading

Q: Is high options trading suitable for beginners?

A: No. High options trading is not appropriate for beginner traders due to its high risk and complexity.

Q: Can I make money with high options trading?

A: Yes, high options trading can be profitable, but it also carries a significant risk of loss.

Q: What is the best high options trading strategy?

A: There is no single “best” strategy. The best strategy depends on the trader’s risk tolerance, trading experience, and market conditions.

What Does High Options Trading Mean

Image: www.youtube.com

Conclusion

High options trading can be a rewarding but risky endeavor. By understanding the basics, developing a trading plan, and managing your risk, you can increase your chances of success. However, it’s important to remember that high options trading is not suitable for all investors. If you’re considering entering the high options trading market, carefully weigh the risks and benefits and consult with a financial advisor to determine if it’s right for you.

Are you interested in learning more about high options trading? Share your questions or insights in the comments section below.