In the fast-paced world of options trading, mastering the art of optimizing entry and exit strategies is crucial for success. One essential technique that can enhance your trading prowess is the use of a trailing stop. Acting as a dynamic safety net, it allows you to secure profits while managing risk in a proactive manner. This comprehensive guide will delve into the intricacies of changing a trailing stop for option trading on YouTube, empowering you to elevate your trading strategies and navigate market fluctuations with confidence.

Image: www.forexfactory.com

Understanding Trailing Stops: A Flexible Risk Management Tool

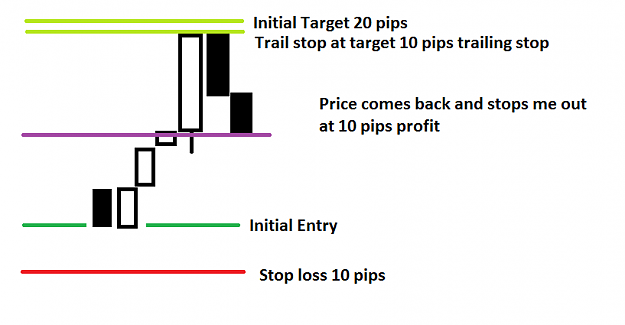

A trailing stop is a dynamic stop-loss order that automatically adjusts itself in response to price movements. Unlike traditional stop-loss orders, which remain fixed at a predetermined price, trailing stops maintain a predefined distance from the current market price. This feature enables them to trail your profits when the market moves favorably while simultaneously safeguarding your capital when the market turns against you.

In the context of option trading, trailing stops can be used to protect your profits on long positions and minimize losses on short positions. By setting a trailing stop at a certain percentage above (for long positions) or below (for short positions) the current market price, you can lock in gains as the price rises or limit losses as the price falls.

Changing a Trailing Stop on YouTube: A Step-by-Step Tutorial

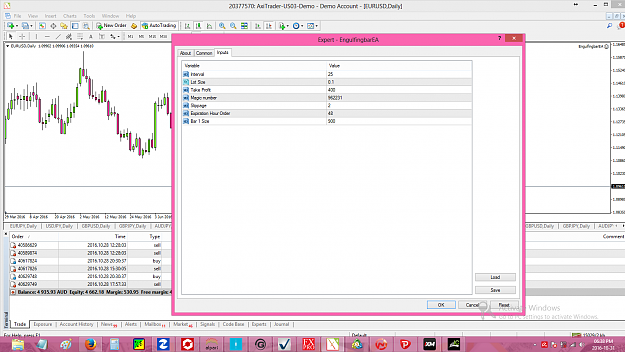

YouTube is a treasure trove of educational content, and there are numerous videos available that can guide you through the process of changing a trailing stop for option trading. Here’s a step-by-step breakdown:

-

Identify a Reputable YouTube Channel: Begin by searching for YouTube channels dedicated to option trading. Look for channels with a substantial following and positive user reviews, indicating credibility and expertise.

-

Locate Videos on Trailing Stops: Within the selected channel, use the search bar or browse the video library to find videos specifically covering trailing stops in option trading.

-

Choose a Video: Select a video that appears comprehensive and well-produced. Consider factors such as the presenter’s knowledge, the video’s length, and the overall production quality.

-

Follow the Instructions: Pay close attention to the instructions provided in the video. Most tutorials will guide you through the necessary steps to change a trailing stop on your preferred trading platform.

-

Pause and Rewind: Don’t hesitate to pause or rewind the video if you need more time to understand a specific step. Repetition and careful review are key to ensuring you grasp the concepts thoroughly.

Tips for Effective Trailing Stop Management

-

Choose the Right Percentage: The percentage distance between the trailing stop and the current market price is crucial. Too small a percentage may limit your profit potential, while too large a percentage may expose you to unnecessary risk. Experiment with different percentages to find what works best for your trading style.

-

Consider Volatility: Market volatility plays a significant role in determining the effectiveness of trailing stops. In volatile markets, wider trailing stop percentages are recommended to prevent premature exits. Conversely, in less volatile markets, narrower trailing stop percentages can help lock in profits more quickly.

-

Monitor Your Positions: It’s essential to monitor your option positions regularly and adjust your trailing stops as market conditions change. Ignoring your positions can lead to missed opportunities or unexpected losses.

-

Use Multiple Trailing Stops: Consider using multiple trailing stops at different percentages to create a more robust risk management strategy. This allows you to lock in profits at various levels and protect against sudden market reversals.

Image: www.forexfactory.com

Youtube How To Change A Trailing Stop For Option Trading

Image: www.youtube.com

Conclusion

Mastering the art of changing a trailing stop for option trading is a valuable skill that can significantly enhance your trading outcomes. By utilizing the educational resources available on YouTube and adhering to the best practices outlined in this guide, you can confidently adjust your trailing stops to protect your profits and minimize losses. Remember, risk management is an ongoing process that requires constant attention and adaptation to changing market conditions.