Introduction

In the dynamic realm of financial markets, options trading stands as a versatile and powerful tool for managing risk and seizing profit-making opportunities. At the heart of effective options trading lies the humble yet essential sheet, a blank canvas upon which traders map out their strategies with meticulous precision. This comprehensive guide will delve into the intricacies of options trading sheets, empowering you with the knowledge to harness their potential and navigate the complexities of options markets with confidence.

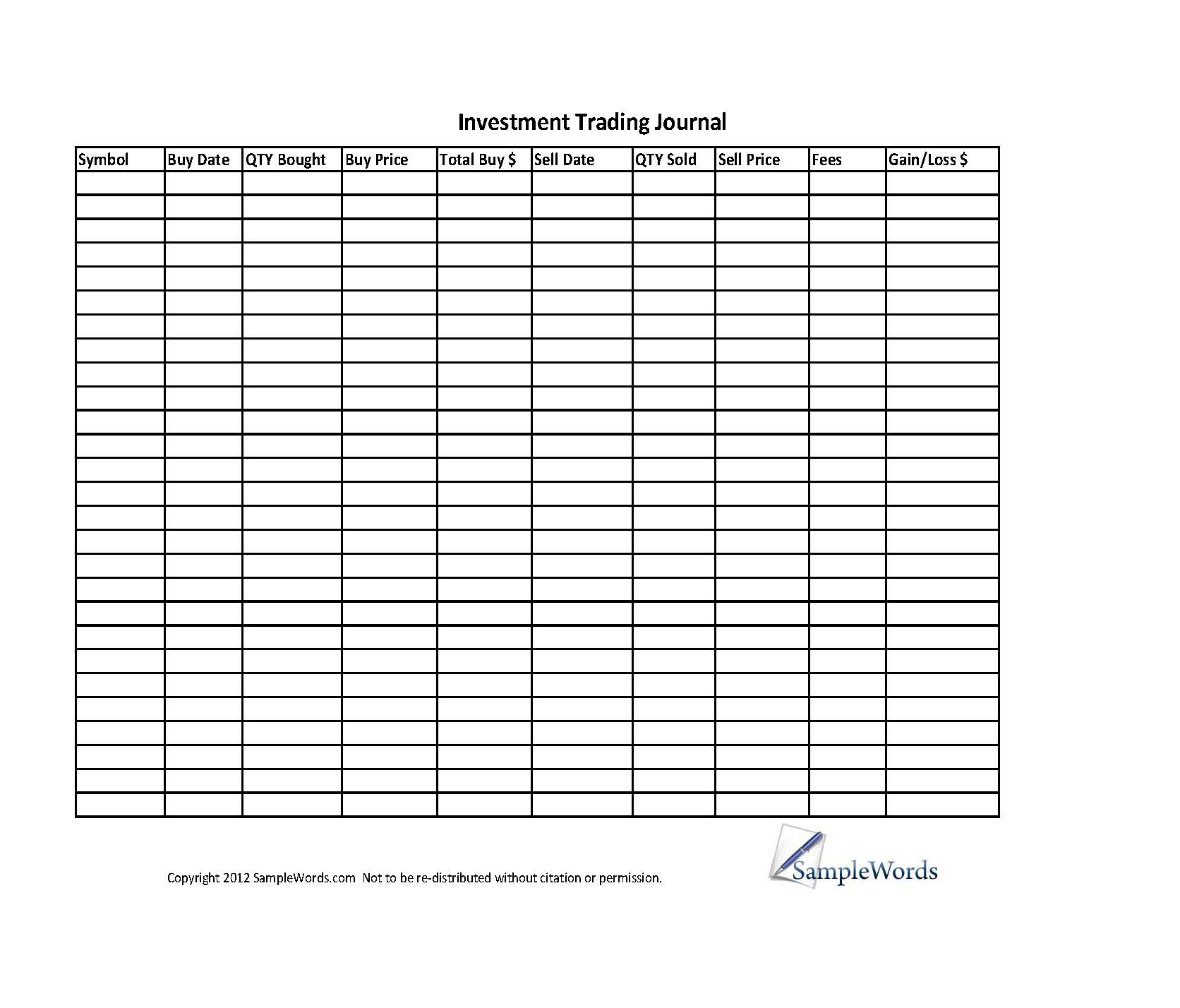

Image: db-excel.com

Section 1: Anatomy of an Options Trading Sheet

The options trading sheet serves as a central hub for documenting and tracking essential information related to options trades. Its structure typically comprises distinct sections, each catering to specific aspects of trade management:

- Trade Details: This section captures the nitty-gritty of the trade, including the underlying asset, contract type, strike price, expiration date, and trade date.

- Market Information: Real-time market data, such as current price, volatility, and open interest, provides a snapshot of the underlying asset’s market dynamics.

- Order Information: Orders placed with the broker are recorded here, including order type, quantity, price, and status.

- Trade Analysis: Detailed calculations are performed to assess trade performance, such as risk analysis, profit/loss projections, and breakeven points.

- Notes and Observations: Traders can utilize this section for personal notes, observations, or any other relevant information that may aid their decision-making process.

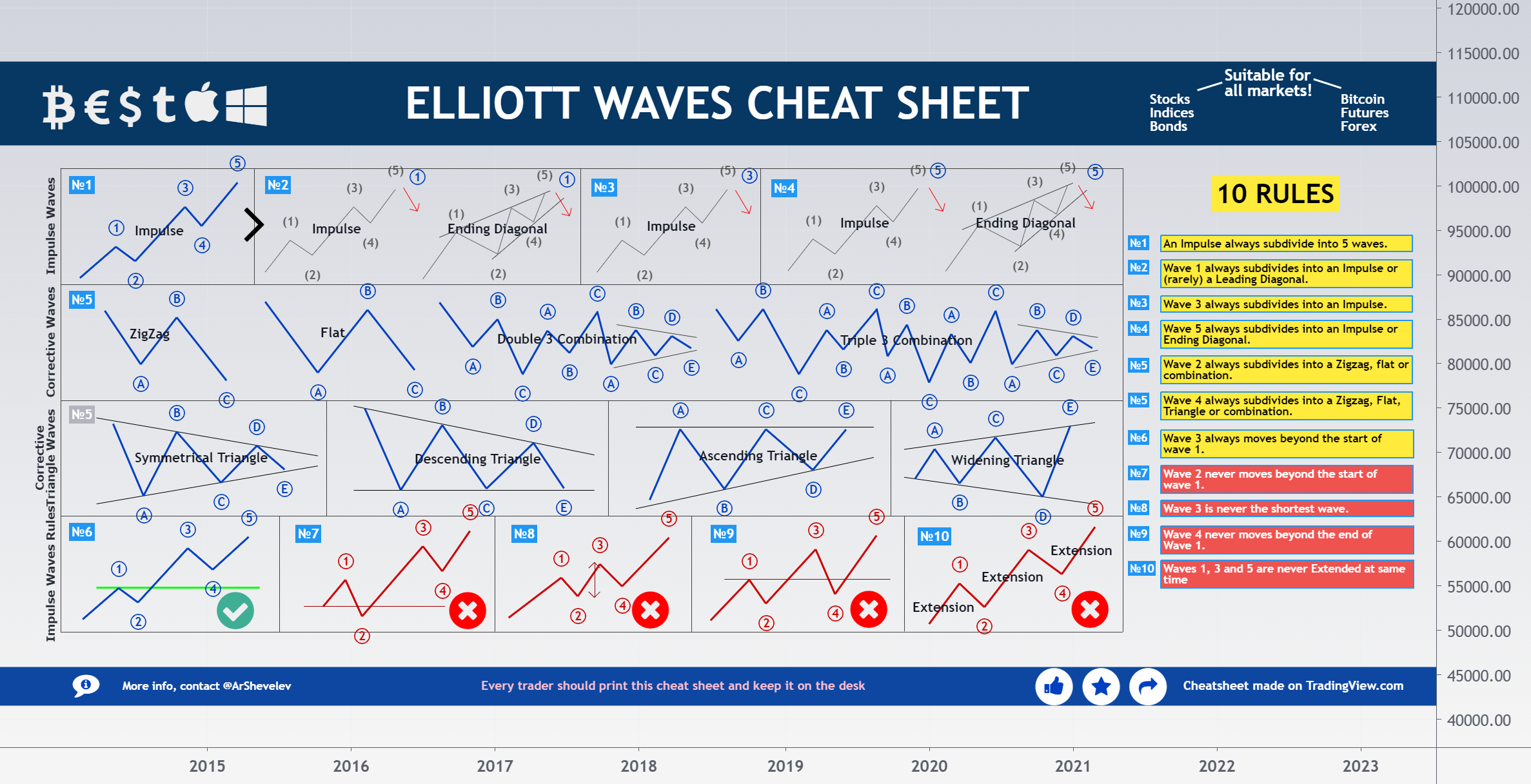

Section 2: Planning and Mapping Out Strategies

Options trading sheets play a crucial role in strategy development and trade execution. Traders can visually map out potential scenarios, evaluate risk-reward ratios, and optimize trade parameters based on their objectives. By plotting option prices on a graph, traders can identify favorable entry and exit points, turning theoretical concepts into actionable plans.

Section 3: Trade Management and Tracking

The options trading sheet transforms into a vital tool for managing open trades. Traders can track crucial metrics such as daily profit/loss, remaining time to expiration, and changes in implied volatility. This real-time monitoring allows for proactive adjustments to strategies, mitigating risks and maximizing gains.

Image: promo.pearlriverresort.com

Section 4: Historical Data and Performance Analysis

Options trading sheets provide a valuable repository for historical trade data. By tracking past performance, traders can identify patterns, optimize trading strategies, and refine their decision-making process over time. This data-driven approach enhances trading discipline and improves overall trading outcomes.

Section 5: Collaboration and Knowledge Sharing

Options trading sheets facilitate collaboration among traders working together or mentoring others. By sharing sheets, traders can exchange ideas, discuss strategies, and gain valuable insights from alternative perspectives. This collaborative learning environment fosters continuous improvement and elevates trading prowess.

Section 6: Adapting to Dynamic Market Conditions

The financial markets are inherently dynamic, and options trading sheets provide the flexibility to adapt to changing market conditions. Traders can quickly update information, incorporate new data, and adjust strategies as the market landscape evolves. This adaptability ensures traders remain agile and responsive to market volatility and macroeconomic shifts.

Section 7: Technology and Automation

Technological advancements have enhanced the capabilities of options trading sheets. Traders can employ specialized software and online platforms that automate calculations, generate interactive charts, and provide real-time alerts. These tools streamline the trading process, saving time and minimizing errors.

Section 8: Psychological Aspects of Trading

Beyond numerical calculations, options trading sheets also serve as a psychological tool. By visualizing trades and tracking progress, traders can manage emotions, maintain discipline, and execute trades with greater confidence and clarity.

Section 9: Emerging Trends and Innovations

The world of options trading is constantly evolving. Traders can stay abreast of the latest trends and innovations by following industry publications, attending conferences, and leveraging social media platforms. By embracing new knowledge and adapting to emerging best practices, traders can continuously enhance their trading skills.

Options Trading Sheets Tmeplate

Image: botswana.desertcart.com

Section 10: Conclusion

Options trading sheets are indispensable tools that empower traders to navigate the complexities of options markets with enhanced precision, efficiency, and psychological fortitude. By understanding the anatomy of options trading sheets, planning strategies, tracking performance, and embracing technological advancements, traders can unlock the full potential of these invaluable resources and elevate their trading journeys to new heights.