Options trading, a complex financial venture involving the buying and selling of contracts that derive their value from underlying assets, can be a lucrative avenue for savvy investors. However, the tax implications of these transactions often prove equally intricate, demanding a comprehensive understanding to avoid costly mistakes. This article aims to delve into the taxation of options trading losses, equipping you with the knowledge necessary to navigate the tax landscape effectively.

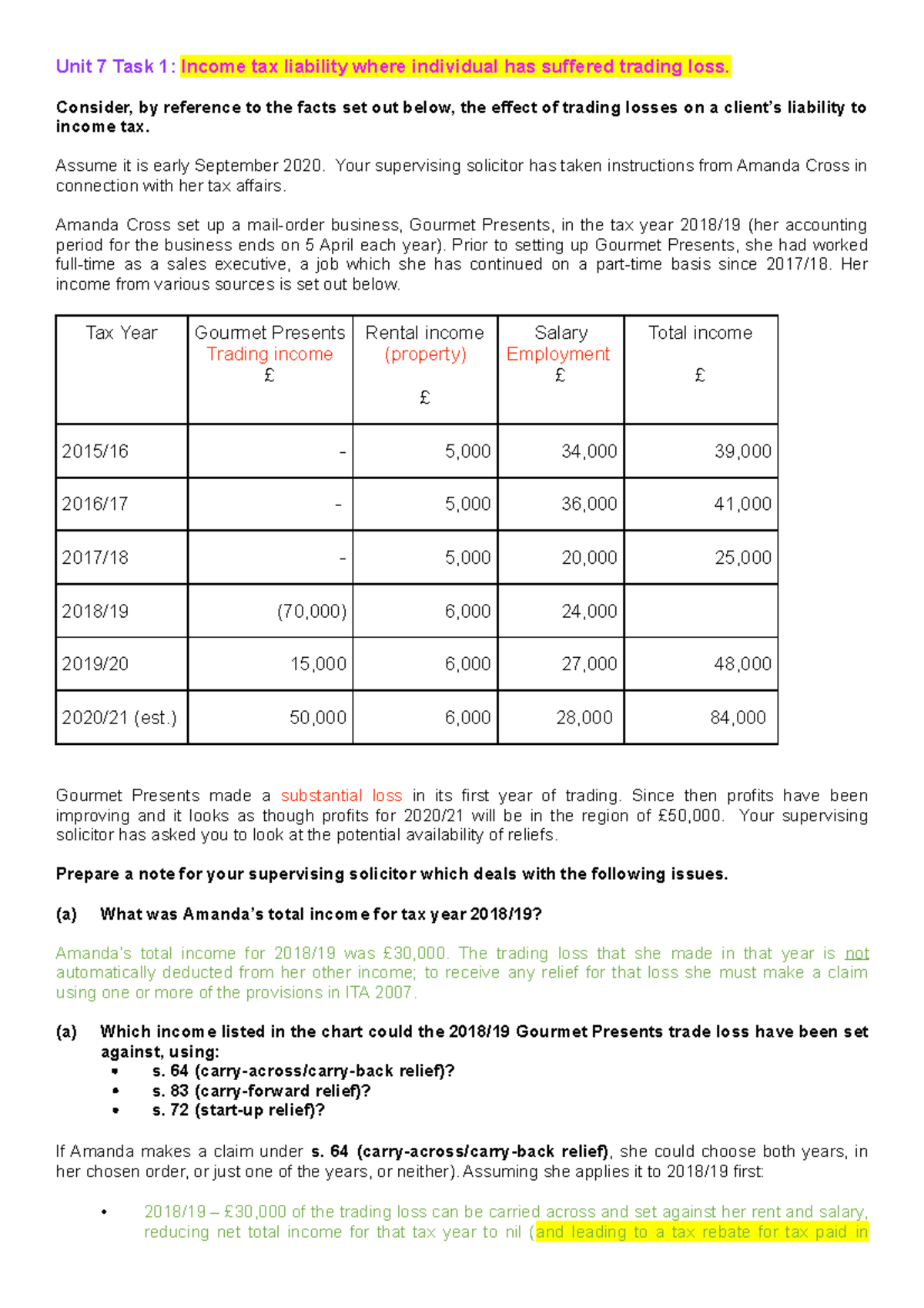

Image: www.studocu.com

Understanding the Mechanics of Loss Taxation

When an option trade incurs a loss, the amount incurred is considered a deduction against your taxable income. This deduction, however, is not a dollar-for-dollar reduction. Here’s how it works:

- For short-term losses (those realized within one year of acquiring the option): Short-term losses can offset up to $3,000 of your ordinary income, including wages, interest, and dividends. If your losses exceed this amount, the remaining loss can be carried forward to subsequent tax years.

- For long-term losses (those held for over one year): Long-term losses are taxed at a more favorable rate, offsetting capital gains or up to $3,000 of ordinary income. Any excess loss can also be carried forward.

Specific Examples for Clarity

- Example 1: Short-Term Loss

You purchase 100 shares of XYZ stock for $50 per share. To protect your investment, you purchase a short-term (less than one year) call option for $1 per share, representing a total investment of $100. The stock price falls, and you sell the call option for $0.25 per share, resulting in a loss of $0.75 per share. This loss of $75 can be deducted from your ordinary income, up to the limit of $3,000.

- Example 2: Long-Term Loss

You invest in a long-term (over one year) put option for $500. After a year, the underlying asset price rises, and you sell the option for $100, resulting in a long-term loss of $400. This loss can be deducted from your capital gains (if any) or up to $3,000 of your ordinary income. Any excess loss can be carried forward to future years.

Strategies for Minimizing Tax Impact

- Offset Gains and Losses: One strategy is to pair your losses with gains realized from other options trades. This strategy reduces your overall taxable income, as gains and losses from options trading are netted against each other.

- Limit Short-Term Trades: To avoid the less favorable tax treatment of short-term losses, consider holding your options for longer periods to qualify for long-term capital gains treatment.

- Consider Hedging Strategies: Employing hedging strategies, such as selling call options against your long stock positions or buying put options against your short stock positions, can help manage risk while potentially creating tax-advantaged outcomes.

Image: www.hotzxgirl.com

Loss On Options Trading Taxes

Image: www.the-pool.com

Conclusion

Navigating the tax labyrinth of loss on options trading requires a thorough understanding of the rules and strategies involved. By recognizing the nuances of short-term and long-term loss deductions, and employing smart tax planning techniques, you can minimize the impact of losses while maximizing the potential returns from your options trading endeavors. Remember, the information provided here is for general knowledge purposes only; consult a tax professional for personalized advice tailored to your specific circumstances.