Equity options offer a versatile tool for investors seeking to amplify returns or hedge against risk. Understanding the intricacies of equity option trading times is paramount to seize optimal trading opportunities and minimize losses. This comprehensive guide delves into the dynamics of equity option trading times, empowering you with actionable insights.

Image: www.cxoadvisory.com

Definition and Importance of Equity Option Trading Hours

Equity options trade within specific time frames determined by the underlying stock market. Options on stocks listed on U.S. exchanges, such as the New York Stock Exchange (NYSE) and Nasdaq, generally trade between 9:30 AM and 4:00 PM Eastern Standard Time (EST), coinciding with the underlying stock market hours. These time limits ensure orderly trading and liquidity during peak market activity.

Understanding equity option trading times is crucial for effective execution. Trading outside these hours may result in limited liquidity and unfavorable prices. Additionally, certain options strategies, such as multi-leg options and options spreads, require specific execution windows, making it imperative to adhere to trading times.

Pre-Market and After-Hours Option Trading: Extended Trading Opportunities

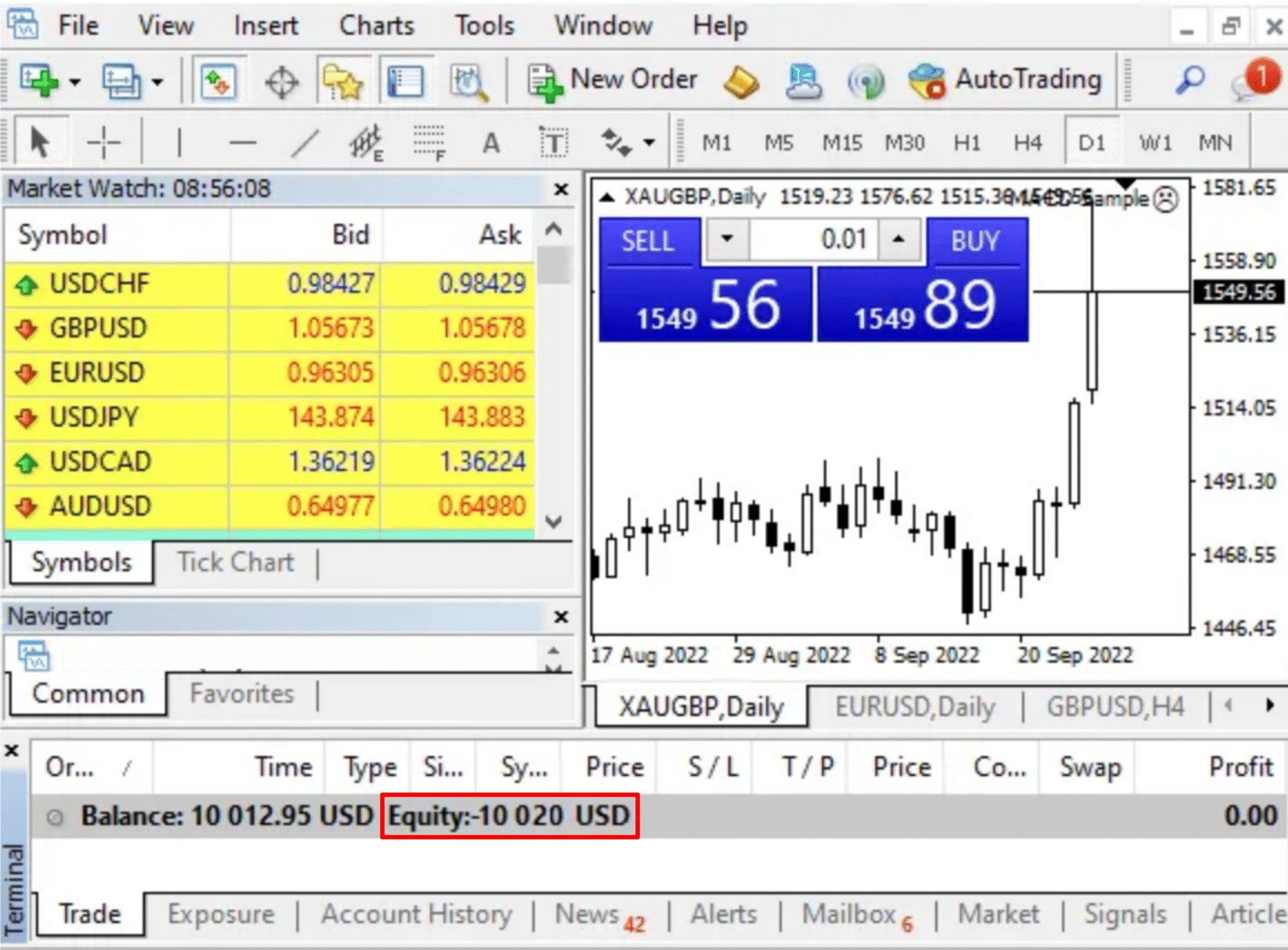

While equity option trading hours primarily align with the underlying stock market, pre-market and after-hours trading extends these timeframes. Pre-market trading, typically commencing at 8:00 AM EST, and after-hours trading, continuing until 8:00 PM EST, offer traders additional flexibility and potential opportunities.

Pre-market trading allows investors to adjust positions before the market opens, reacting to overnight news and market movements. After-hours trading enables traders to capitalize on post-market news and volatility, providing an avenue for nimble trade execution. However, liquidity during pre-market and after-hours trading may be limited compared to regular market hours.

Expiration Times: Understanding the Options’ Lifecycle

Equity options have a finite lifespan, expiring on a specified date. The expiration time is typically the last trading day of the underlying stock’s expiration month, although weekly and monthly expiration options are also available. Understanding expiration times is critical for managing positions and realizing gains or losses.

Options expiring “in-the-money” (ITM), meaning the strike price is favorable, will be assigned if not closed beforehand. In contrast, options expiring “out-of-the-money” (OTM), where the strike price is unfavorable, will expire worthless, resulting in a loss of premium paid. Monitoring expiration times allows traders to adjust positions or close out contracts to optimize returns.

Image: www.keenbase-trading.com

Timing Strategies for Enhanced Option Trading

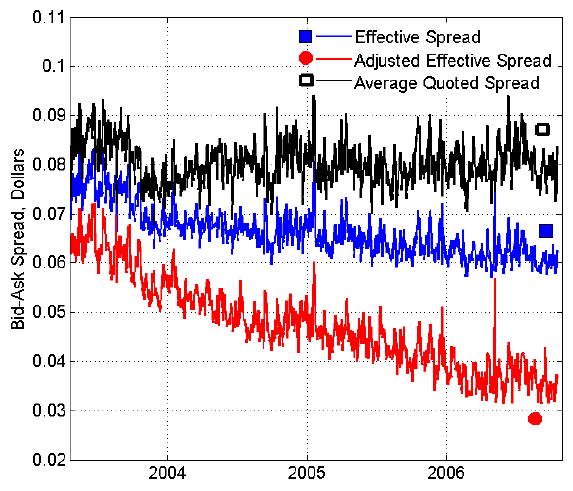

Equity option trading times present strategic opportunities for investors. Time decay, a gradual erosion of option value as expiration approaches, can be both an ally and an adversary. Options with shorter time to expiration experience time decay more rapidly, offering a potential decay premium for traders. Conversely, options with longer expiration times may allow for more favorable entry and exit points.

Trader risk tolerance and market conditions influence optimal trading times. For aggressive traders, pre-market and after-hours trading provide additional opportunities with potentially higher volatility and wider bid-ask spreads. Conservative traders may prefer to trade during regular market hours with higher liquidity and less volatility.

Equity Option Trading Times

Image: www.keenbase-trading.com

Conclusion

Equity option trading times play a pivotal role in optimizing returns and managing risk. By understanding the trading hours, pre-market and after-hours opportunities, expiration times, and timing strategies, investors can navigate the complexities of equity option trading with increased confidence. This comprehensive guide equips traders with the knowledge and insights to maximize their equity option trading endeavors.