Tracking unusual option activity can provide traders with valuable insights into market sentiment and potential trading opportunities.

Image: www.youtube.com

Option trading involves buying and selling contracts that give the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specific price on a specified date. Market participants use options for various purposes, including hedging, speculation, and income generation. By monitoring unusual option activity, traders can identify instances where large volumes of options contracts are being traded in a non-standard manner, suggesting that something is brewing in the underlying market.

Why is Unusual Option Activity Important?

Unusual option activity can be an indicator of several scenarios that can influence the underlying asset’s price movement. It could suggest that:

- Institutional investors are positioning themselves for an anticipated market move.

- Speculators are betting on a specific outcome and trying to influence others to follow suit.

- Traders are hedging against potential risks or uncovering attractive trading opportunities.

By understanding the rationale behind unusual option activity, traders can anticipate potential price movements and make informed trading decisions.

Types of Unusual Option Activity

There are various types of unusual option activity that traders should monitor:

- Large options trades: When unusually large option contracts are traded, often in single or concentrated tranches, it can signify a significant market sentiment shift.

- Out-of-the-money options trading: Buying or selling call or put options that are far out-of-the-money (OTM) may indicate a potential move or volatility in the underlying asset.

- Sudden price spike in option premiums: When option premiums experience a sudden surge in price in a short period, it can suggest anticipations of a significant event or market move.

- High implied volatility: Elevated implied volatility (IV) in options pricing can indicate market uncertainty, volatility expectations, or a possible upcoming event that could impact the underlying asset.

How to Use Unusual Option Activity in Trading

Traders can incorporate unusual option activity into their trading strategies in the following ways:

- Gauge market sentiment: Monitor large option trades and the premiums being paid to understand market sentiment and expectations for the underlying asset.

- Identify trading opportunities: Out-of-the-money options activity and discrepancies between implied and historical volatility can create potential trading opportunities.

- Confirm trading decisions: Unusual option activity can provide supporting confirmation for trades based on other technical or fundamental analysis.

- Exercise caution: Abnormal option activity can also be misleading. It’s essential to research and consider other factors before making trading decisions.

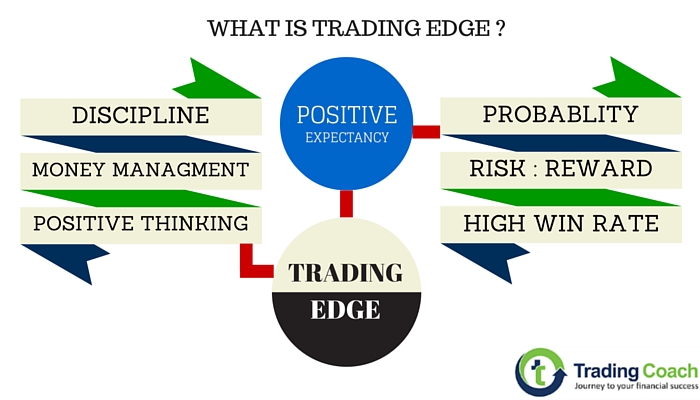

Image: tradingcoach.co.in

Unusual Option Activity Edge In Trading

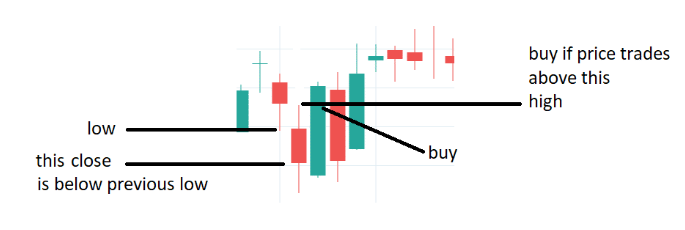

Image: optionstradingiq.com

Conclusion

Monitoring unusual option activity can provide edge in trading by revealing hidden market sentiment, potential price movements, and trading opportunities. By understanding the different types of unusual activity and their implications, traders can make informed decisions, enhance their trading strategies, and potentially increase their returns. However, it’s important to exercise caution and consider other factors to minimize risks and maximize profits when leveraging unusual option activity in trading.