Unleashing the Adventure of Financial Markets with GoPro

As an ardent GoPro enthusiast, I find myself immersed in the adrenaline-pumping realm of adventure. But little did I know that these thrilling experiences could translate into the exciting world of financial markets. GoPro, an innovative company capturing the essence of moment-makers, has entered the captivating arena of options trading. Join me as we embark on an exploration of GoPro options trading, uncovering its complexities and accessing its potential rewards.

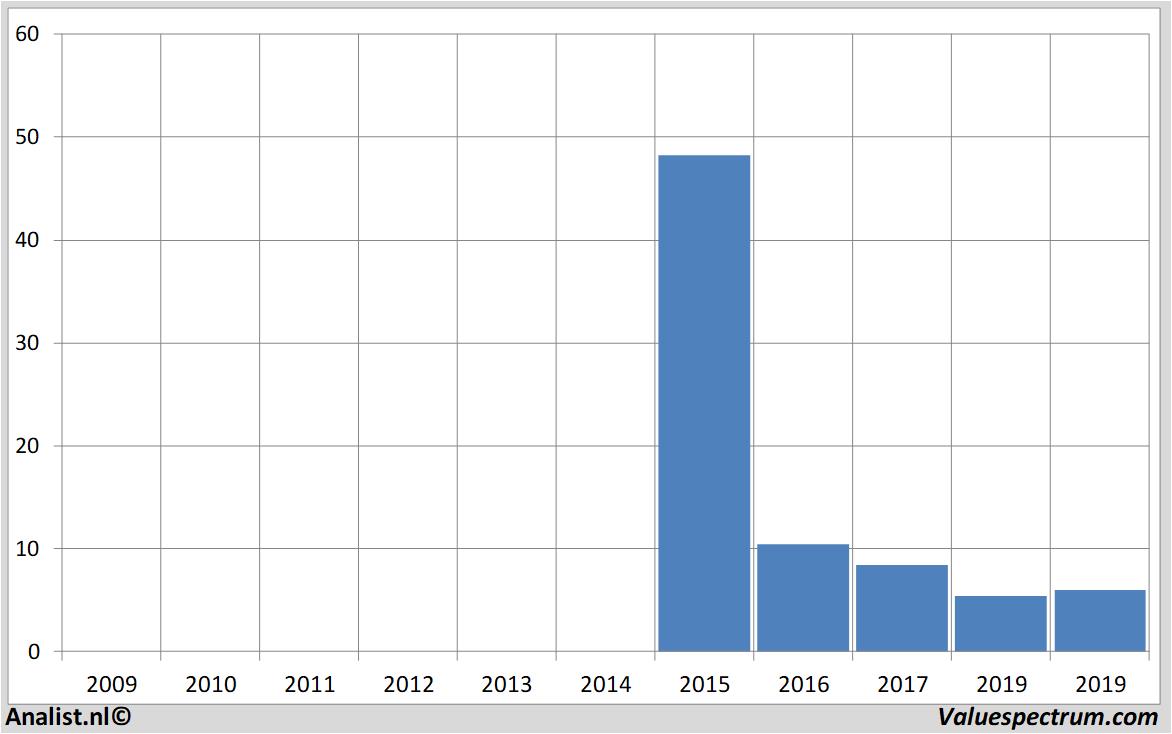

Image: www.valuespectrum.com

Navigating the Options Landscape: Understanding GoPro Options

Options trading entails the buying and selling of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a defined time frame. GoPro options provide investors with the flexibility to capitalize on the price fluctuations of GoPro’s stock, GoPro Inc. (GPRO). These contracts empower traders to make informed decisions based on their market outlook, enabling them to potentially amplify their returns or hedge against risks.

Mastering the GoPro Options Trading Toolkit

- Call Options: These confer the right to buy GoPro shares at the strike price on or before the expiration date. Traders purchase call options when they anticipate a stock price increase.

- Put Options: Conversely, put options provide the right to sell GoPro shares at the strike price on or before the expiration date. Traders buy put options when they foresee a stock price decline.

- Strike Price: This is the price at which the underlying asset can be bought or sold.

- Expiration Date: It marks the end of the contract’s life.

- Premium: This is the price of the option contract, representing the fee paid for this right.

Unveiling the Secrets of GoPro Options Trading Strategies

- Bullish Strategy: Long Call: Buying a call option allows an investor to profit from an anticipated increase in the stock price. This strategy is employed when bullish sentiments prevail.

- Bearish Strategy: Long Put: When an investor anticipates a stock price decline, purchasing a put option grants the right to sell shares at the strike price.

- Neutral Strategy: Covered Call: This involves selling a call option against an existing stock holding. It limits upside potential but generates additional income through the premium received.

Image: storytellertech.com

Expert Insights: Tips and Advice for GoPro Options Trading

- Study market trends and GoPro’s financial performance meticulously.

- Select the appropriate option type based on your trading style and market outlook.

- Choose strike prices and expiration dates that align with your trading goals.

- Exercise caution and manage risk by limiting position sizes.

- Consider different options strategies to enhance returns and hedge against potential losses.

Exploring the Nuances of GoPro Options Trading: FAQ

Q: What are the benefits of trading GoPro options?

A: GoPro options offer potential profit opportunities and allow for tailored risk management strategies.

Q: How do I determine the right GoPro options to trade?

A: Consider your market outlook, trading goals, and risk tolerance to make suitable selections.

Q: What are the risks associated with GoPro options trading?

A: Options trading involves inherent risks, including potential contract expiration without profit and the loss of the premium paid.

Gopro Options Trading

Conclusion: Embracing the GoPro Options Trading Adventure

GoPro options trading presents a captivating opportunity for investors to harness the power of GoPro’s market presence and price movements. By embracing the strategies and advice outlined in this guide, you can unlock the potential of this engaging form of financial engagement. Delving into GoPro options trading is akin to embarking on an adventure, fraught with opportunities and risks. Are you ready to capture the thrill of the market’s ups and downs with GoPro options?