Unlocking Market Opportunities: A Comprehensive Guide

The allure of option trading lies in its potential for lucrative returns. With the right stocks, traders can tap into substantial price movements and navigate market fluctuations to their advantage. In this detailed guide, we delve into the world of option trading, identifying the most promising stocks for maximizing your investment opportunities.

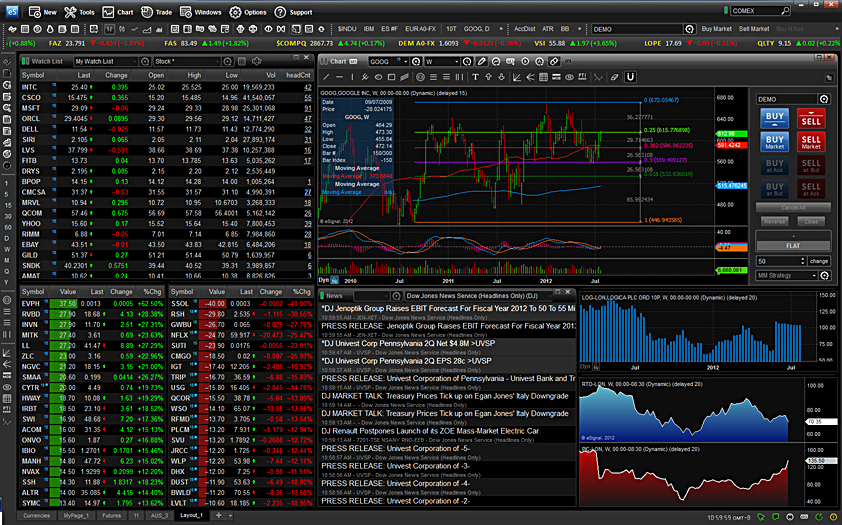

Image: niyudideh.web.fc2.com

Defining Option Trading: A Strategy for Risk and Reward

Option trading involves the buying and selling of contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. Options provide traders with a flexible instrument to capitalize on market trends, hedge against potential losses, and generate income through premiums. Understanding the fundamentals of option trading empowers investors to navigate the complexities of the market and make informed decisions.

Navigating Market Trends: Identifying Strong Stocks for Options Trading

Selecting the right stocks for option trading is crucial for success. Traders should focus on companies with strong fundamentals, high liquidity, and predictable price movements. Stocks with a proven track record of profitability, consistent earnings, and a solid management team offer a solid foundation for option trading strategies.

Market volatility can also influence option pricing, making it essential to monitor news, economic data, and industry trends. Understanding the factors that drive market fluctuations helps traders identify opportunities and mitigate risks.

- Company Fundamentals: Scrutinize the company’s financial statements, earnings reports, and management team to assess its financial health and growth prospects.

- Liquidity: High liquidity ensures that options on the stock can be easily bought and sold at fair market prices, reducing the risk of slippage and market impact.

- Price Volatility: Volatility creates opportunities for profitable options trading. Stocks with consistent price movements within a predictable range are ideal for strategies like covered calls and put selling.

Expert Advice and Strategies for Maximizing Profits

Seasoned traders have honed their skills over years of experience, developing valuable insights and strategies for successful option trading. By tapping into their knowledge, aspiring traders can gain a competitive edge in the market.

Image: www.investors.com

Risk Management Techniques: Preserving Capital and Mitigating Losses

Effective risk management is paramount in option trading. Understanding different risk management techniques, such as hedging, diversification, and position sizing, helps traders protect their capital and limit potential losses. Proper risk management practices allow traders to navigate market fluctuations with confidence, preserving their hard-earned investments.

Option Greeks: Unlocking the Secrets of Options Pricing

Delving into the intricacies of option pricing requires an understanding of option Greeks. These Greeks, including Delta, Theta, Gamma, and Vega, measure the sensitivity of an option’s price to changes in underlying asset price, time, volatility, and interest rates. By mastering the concepts of option Greeks, traders gain a deeper comprehension of option pricing dynamics and can make informed decisions.

Frequently Asked Questions: Demystifying Option Trading

Q: What is the difference between a call and a put option?

A: A call option gives the holder the right to buy an underlying asset at a specified price on a future date, while a put option grants the right to sell the asset at that price.

Q: How do I choose the right strike price for an option?

A: The strike price should be carefully selected based on the trader’s market outlook and risk tolerance. In-the-money options offer higher potential returns but also carry greater risk, while out-of-the-money options provide lower returns with lower risk.

Q: What is the role of liquidity in option trading?

A: Liquidity is crucial as it ensures that options can be bought and sold at fair market prices, reducing slippage and minimizing the risk of getting trapped in illiquid markets.

Today Best Stock For Option Trading

Conclusion

Option trading presents an unparalleled opportunity for investors to capitalize on market trends and generate substantial returns. By understanding the fundamentals of option trading, identifying the best stocks for this strategy, and implementing effective risk management techniques, traders can unlock the potential of the market and achieve their financial goals. As you embark on this journey, remember that knowledge, patience, and a disciplined approach are your guiding lights.

Are you ready to delve into the world of option trading and embrace the thrill of unlocking market opportunities? Join us as we explore the intricacies of this dynamic investment technique and guide you towards informed decisions and profitable outcomes.