As a seasoned investor, I’ve always believed in the power of compounding returns. When I first opened my Roth IRA, I had high hopes of building a substantial nest egg for retirement. But I also knew that simply holding onto stocks and bonds would not suffice. I needed to be able to actively trade within my Roth IRA if I wanted to maximize its potential.

Image: www.brightscope.com

Unveiling the Options

Researching the topic of Roth IRA trading options, I discovered a wealth of opportunities. First and foremost, I could trade stocks and exchange-traded funds (ETFs) within my account. This meant I could buy and sell individual companies or baskets of assets, allowing me to tailor my portfolio to specific goals and risk tolerance.

Invest in Fractional Shares

One particularly intriguing option was the ability to invest in fractional shares. This meant that even with a limited investment amount, I could gain exposure to high-value companies that I couldn’t otherwise afford to invest in. Fractional shares allowed me to diversify my portfolio and access the growth potential of even the most exclusive stocks.

Options Trading within Roth IRA

Delving deeper, I discovered that options trading was also permissible within Roth IRAs. Options contracts gave me the right to buy or sell an underlying asset at a predetermined price and date. This advanced strategy allowed me to enhance my returns or hedge against potential losses, adding an extra layer of sophistication to my portfolio management.

Image: www.thetechedvocate.org

Exploring the Trading Landscape

To navigate the complexities of Roth IRA trading, I sought guidance from expert sources. I consulted with financial advisors, read industry publications, and engaged in online forums. Through these channels, I gained a comprehensive understanding of the various trading options available to me and the best practices for implementing them.

Navigating the Regulatory Framework

It’s important to note that Roth IRA trading options are subject to certain regulations and restrictions. The Internal Revenue Service (IRS) imposes limitations on the types of investments that can be held within a Roth IRA. Additionally, some brokers may have their own trading rules and fees associated with Roth IRA trading.

Complying with the IRS

To ensure compliance with IRS regulations, I familiarized myself with the rules and consulted with a tax professional. I made sure to avoid prohibited transactions, such as trading with disqualified persons or borrowing from my Roth IRA. By adhering to these guidelines, I protected my account from potential penalties.

Simplifying the Trading Process

Selecting a broker that aligns with your trading needs is crucial. Some brokers offer specialized Roth IRA trading platforms that streamline the process and provide educational resources. By choosing a reputable and user-friendly broker, I simplified my trading experience and gained access to a wide range of trading tools.

Whether you’re a seasoned trader or a novice investor, Roth IRA trading options offer a powerful means of growing your retirement savings. By understanding the different options available, navigating the regulatory framework, and selecting the right broker, you can unlock the full potential of your Roth IRA.

Frequently Asked Questions

Q: Can I trade all stocks and ETFs within my Roth IRA?

A: Yes, you can trade most publicly traded stocks and ETFs within your Roth IRA.

Q: What are the advantages of trading fractional shares?

A: Fractional shares allow you to invest in high-value companies with smaller investment amounts, increasing portfolio diversification and potential growth.

Q: Is options trading permitted within Roth IRAs?

A: Yes, options trading is allowed within Roth IRAs, offering advanced strategies for enhancing returns or hedging against losses.

Q: What regulations apply to Roth IRA trading?

A: Roth IRA trading options are subject to IRS regulations, such as limitations on investments and prohibited transactions. Brokers may also have their own trading rules and fees.

Roth Ira Trading Options

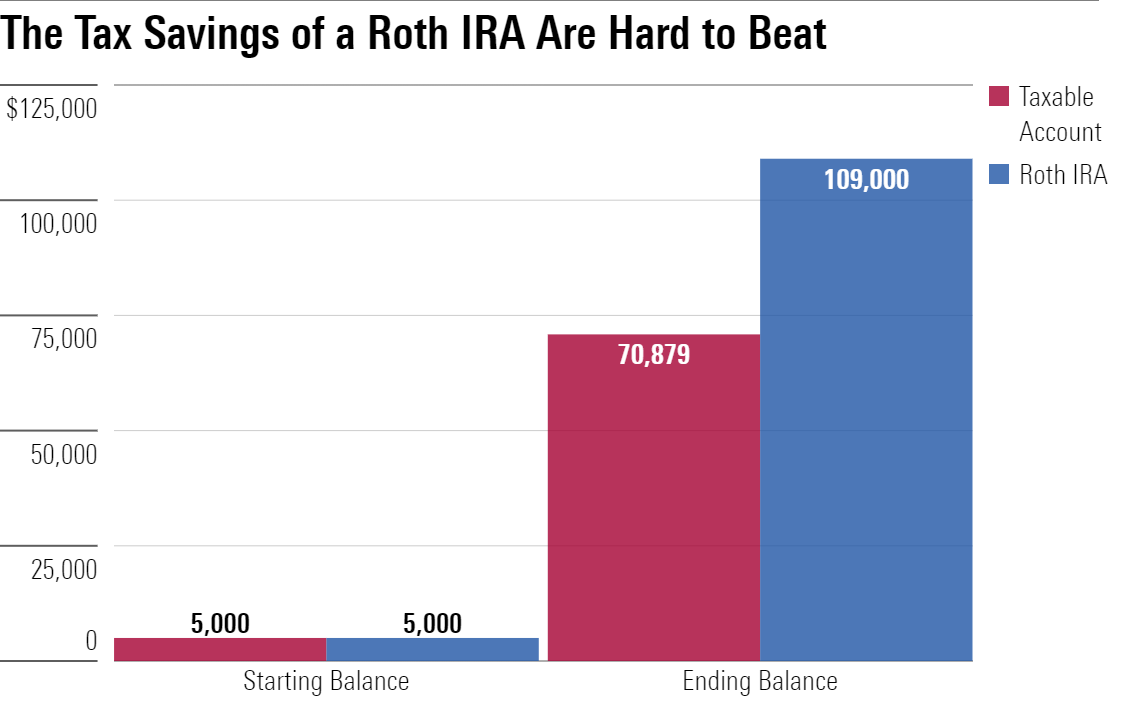

Image: www.morningstar.com

Conclusion

Unlocking the power of Roth IRA trading options can empower you to take control of your retirement savings. With careful planning and a thorough understanding of the available options, you can maximize the growth potential of your investments and secure a financially secure future. Are you ready to explore the exciting world of Roth IRA trading?