Imagine the transformative power of growing your retirement savings tax-free with the flexibility to trade options. Enter the world of Roth IRA options trading with Vanguard, a financial powerhouse that empowers investors to navigate the complexities of the stock market while maximizing their investment returns.

Image: www.youtube.com

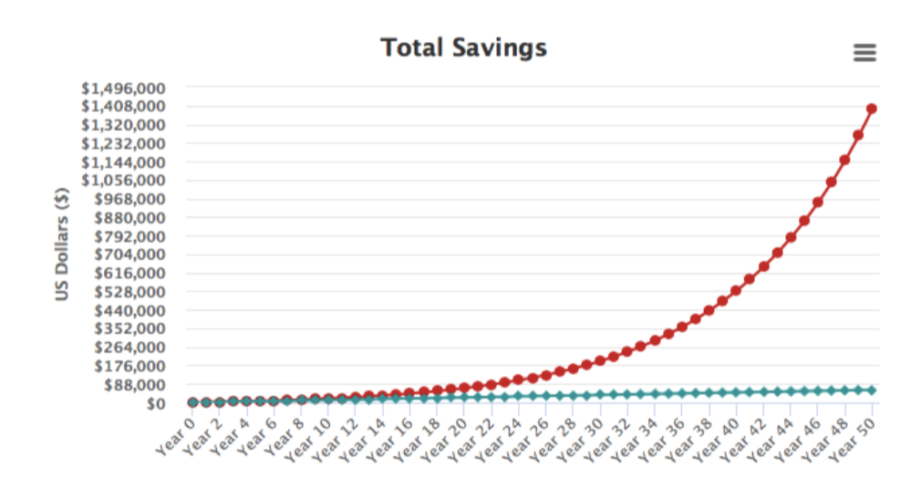

Leveraging Options for Accelerated Growth

Options trading within a Roth IRA offers an innovative strategy to amplify potential gains without sacrificing the tax benefits associated with this retirement account. Options are contracts that convey the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a predetermined price on or before a specific date. This flexibility allows investors to enhance returns or hedge against market risks.

Vanguard, renowned for its low-cost index funds and unwavering commitment to investor education, provides a highly accessible platform for Roth IRA options trading. Through their Options Select program, investors gain access to a range of options strategies tailored to their risk tolerance and financial goals.

Getting Started with Roth IRA Options Trading

Embarking on Roth IRA options trading requires a fundamental understanding of options trading concepts and the underlying risks involved. Vanguard’s educational resources offer a wealth of information, enabling you to develop a comprehensive strategy before initiating any trades.

To qualify for Roth IRA options trading with Vanguard, you must maintain an active IRA account. Once your account is approved for options trading, you will have access to a dedicated trading platform that seamlessly integrates with your existing IRA portfolio.

Navigating Options Strategies

Options strategies encompass a spectrum of techniques employed to harness the potential of options trading within a Roth IRA. Covered calls, for instance, involve selling call options against stocks already owned within your IRA, potentially generating additional income while limiting the upside potential of those stocks.

Cash-secured puts, on the other hand, involve selling put options against cash, obligating you to buy the underlying asset if the option is exercised. This strategy may generate income if the stock price remains above the strike price while providing downside protection.

Image: www.youtube.com

Maximizing Returns, Mitigating Risks

Roth IRA options trading offers the potential for significant returns, but it also carries inherent risks. Careful consideration of your investment goals, risk tolerance, and time horizon is paramount before implementing any options strategies. By diligently managing risk, investors can seek to maximize returns while safeguarding their long-term financial aspirations.

Vanguard’s Options Select program includes advanced risk management tools that empower investors to monitor their portfolios closely, adjust strategies as needed, and minimize losses in volatile market conditions.

Roth Ira Options Trading Vanguard

Image: bhsowl.org

Conclusion: Unveiling Limitless Potential

Roth IRA options trading with Vanguard opens a world of possibilities for investors seeking to accelerate their retirement savings growth. Armed with a comprehensive understanding of options strategies and prudent risk management practices, you can harness the transformative power of options trading to unlock the full potential of your tax-free retirement nest egg.

Embark on this transformative journey with Vanguard today and experience the empowerment of advanced investing strategies, maximizing your financial well-being for a secure and thriving retirement.