Introduction

Options trading is a powerful investment strategy that enables traders to speculate on the value of underlying assets without necessarily owning them. Two of the most fundamental types of options are calls and puts. Understanding these options is crucial for navigating the complexities of the options market.

Image: www.adigitalblogger.com

In this comprehensive guide, we will delve into the world of calls and puts, shedding light on their definitions, functions, and applications. By gaining an in-depth understanding of these options, you can unlock new opportunities and make informed decisions in the options market.

Call and Put Options

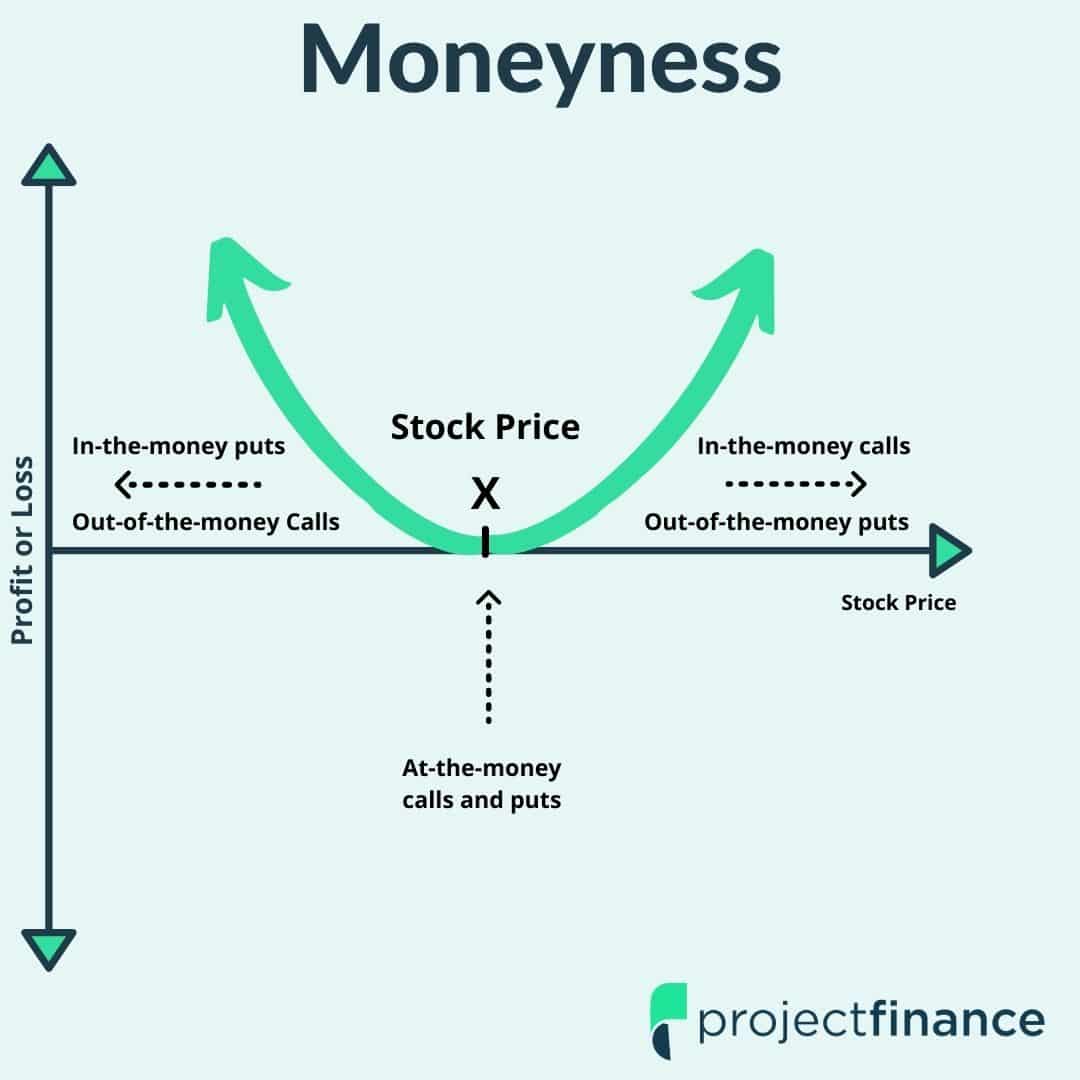

Calls grant the holder the right, but not the obligation, to buy an underlying asset at a predetermined price, known as the strike price, on or before a specific date. When the price of the underlying asset rises above the strike price, the call option becomes lucrative.

Puts, on the other hand, provide the holder with the right, not the obligation, to sell an underlying asset at a specified strike price on or before a certain date. When the price of the underlying asset falls below the strike price, the put option gains value.

How Calls and Puts Work

To illustrate the mechanics of calls and puts, consider the following scenario. A trader believes that the stock of Company XYZ will increase in value over the next month. To capitalize on this expectation, they could purchase a call option with a strike price of $100 and an expiration date of one month from now.

If the stock price rises above $100 during this period, the trader can exercise the call option to buy the stock at the strike price ($100), even if the current market price is higher. Alternatively, they could sell the call option to another trader at a profit.

Contrastingly, if the stock price falls below $100, the call option will expire worthless. The trader will lose the premium paid to acquire the option.

Similarly, a trader anticipating a decline in the stock price of Company XYZ could purchase a put option. If the stock price falls below the strike price, the trader can exercise the put option to sell the stock at the strike price, regardless of the current market price.

It’s important to note that purchasing options does not convey ownership of the underlying asset. Instead, they provide the right to buy or sell the asset at the specified terms.

Latest Trends and Developments

The options market is continuously evolving, with new strategies and products emerging regularly. One notable trend is the rise of exchange-traded funds (ETFs) that track specific options strategies. These ETFs allow investors to access the benefits of options trading without the complexities of managing individual options.

Additionally, technological advancements have made options trading more accessible than ever before. Online platforms and mobile apps provide user-friendly interfaces and real-time data, enabling traders to make informed decisions on the go.

Image: www.projectfinance.com

Tips and Expert Advice

To succeed in options trading, it’s essential to heed the advice of experienced traders. Here are some valuable tips:

- Start by learning the basics of options trading.

- Understand the risks and potential rewards involved.

- Develop a trading plan and stick to it.

- Use limit orders to manage risk.

- Don’t chase losses or trade emotionally.

Remember, options trading involves leverage, which can amplify both profits and losses. It’s crucial to trade within your risk tolerance and seek professional guidance if necessary.

FAQ

- What is the difference between a call and a put option?

A call option gives the holder the right to buy an underlying asset, while a put option provides the right to sell an underlying asset.

- When should I use a call option?

Use a call option when you anticipate an increase in the underlying asset’s price.

- When should I use a put option?

Use a put option when you expect a decline in the underlying asset’s price.

- What factors affect the price of options?

Option prices are influenced by factors such as the underlying asset’s price, time to expiration, volatility, and supply and demand.

- Is options trading profitable?

Options trading can be profitable, but it’s a complex and risky endeavor that requires a sound understanding of the financial markets.

What Is A Call And Put In Options Trading

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Image: adrissevet.com.br

Conclusion

Calls and puts are foundational concepts in options trading, offering traders the flexibility to speculate on the direction of asset prices without the need for direct ownership. By comprehending the intricacies of these options, you can harness their power to enhance your investment strategies.

So, are you ready to venture into the exciting realm of calls and puts? Remember to approach options trading with caution and seek guidance from experts to minimize risks and maximize success.