Introduction

Have you ever wondered if it’s possible to profit from the stock market without actually buying stocks? The answer lies in the realm of options trading, a versatile strategy that allows you to tap into the stock market’s ups and downs without the need for direct ownership. In this in-depth guide, we’ll delve into the intricacies of options trading without owning stock, empowering you to navigate this complex yet rewarding financial landscape.

![[100% OFF] Trading options is WAY BETTER than trading stocks! with ...](https://www.tutorialbar.com/wp-content/uploads/4809218_a327_3-749x421-2.jpg)

Image: www.tutorialbar.com

What is Options Trading Without Owning Stock?

Options trading involves buying or selling contracts that grant you the right, but not the obligation, to buy or sell an underlying security (such as a stock or ETF) at a predetermined price within a specified timeframe. This allows traders to speculate on the direction of the underlying asset’s price without the need for full ownership, significantly reducing their capital requirements.

Types of Options and Their Uses

There are two main types of options: calls and puts. Call options give you the right to buy the underlying asset, while put options give you the right to sell. Traders can use calls to bet on an asset’s rise in value, while puts are suitable for speculating on a decline.

Call Options:

- Profit potential: Unlimited

- Maximum loss: Premium paid

- When to use: When you expect an asset to increase in value.

Image: www.financialtechwiz.com

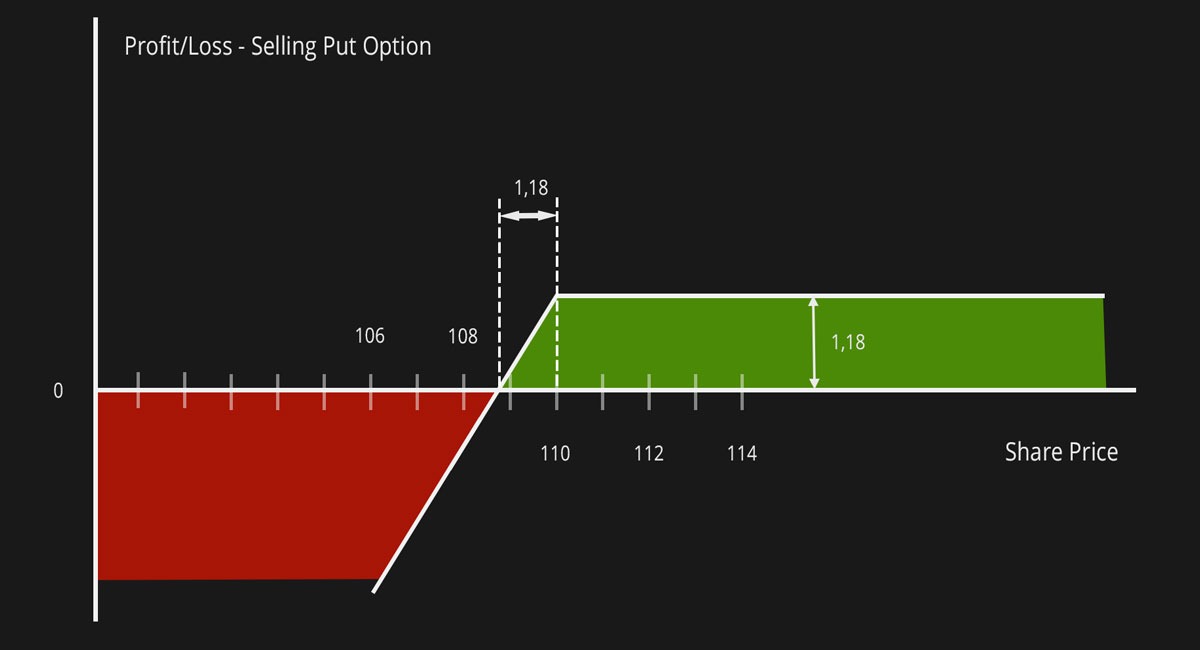

Put Options:

- Profit potential: Unlimited

- Maximum loss: Premium paid

- When to use: When you expect an asset to decrease in value.

Benefits of Options Trading Without Owning Stock

-

Flexibility:

Options provide traders with a high degree of flexibility, allowing them to adjust their positions based on market conditions.

-

Leverage:

Options utilize leverage, giving traders the opportunity to control a large position with a relatively small investment.

-

Risk Management:

Options can be used as a risk management tool to hedge against potential losses in other investments or to limit the potential loss on an options position itself.

-

Income Generation:

Option selling strategies can generate income, even in sideways or volatile markets, by collecting premiums from option buyers.

Strategies for Options Trading Without Owning Stock

There are numerous options trading strategies, each with its own risks and potential rewards. Here are a few popular strategies to consider:

-

Bull Call Spread:

This strategy involves buying a call option at a lower strike price and selling a call option at a higher strike price.

-

Bear Put Spread:

This strategy involves selling a put option at a higher strike price and buying a put option at a lower strike price.

-

Covered Call:

This strategy involves selling a call option against an existing stock position, generating income and limiting potential upside.

-

Married Put:

This strategy involves buying a put option against an existing stock position to protect against a decline in value.

Options Trading Without Owning Stock

Image: www.tradingoptionscashflow.com

Conclusion

Options trading without owning stock offers a powerful tool for investors looking to profit from market fluctuations while mitigating risk. By understanding the basics of options trading, identifying suitable strategies, and managing risk effectively, you can harness the potential of this versatile market. It’s important to remember that options trading carries significant risks and should only be undertaken with proper research and a well-defined trading plan. Embrace the learning journey, stay informed, and the world of options trading can unlock a world of possibilities.