An Introduction to Option Contracts

Have you ever wondered how speculators bet on the future direction of an asset without actually owning it? Options trading, a unique and fascinating segment of the financial markets, offers a path to do just that. Understanding the cornerstone of options trading – contracts – is paramount to grasping this complex yet captivating domain.

Image: speedtrader.com

Defining an Options Contract

An options contract, in its essence, is an agreement between two parties that grants the holder the right, but not the obligation, to buy or sell a specific asset at a predetermined price during a specified period. This flexibility is what distinguishes options from traditional stock or bond contracts, where buyers and sellers are obligated to complete transactions.

In the realm of options, the buyer of the contract acquires the right to exercise the option as per the agreed-upon terms, while the seller of the contract incurs the obligation to fulfill the contract if the buyer chooses to exercise it.

Types of Options Contracts

There are two main types of options contracts:

- Call Options: Grant the buyer the right to buy an underlying asset at a strike price (predefined price) by the expiration date.

- Put Options: Provide the buyer the right to sell an underlying asset at a strike price by the expiration date.

Components of an Options Contract

Several critical components make up an options contract:

- Underlying asset: The asset (stock, commodity, currency) to which the option pertains.

- Strike price: The predetermined price at which the underlying asset can be bought or sold.

- Expiration date: The specific date by which the option can be exercised.

- Premium: The non-refundable fee paid by the buyer to the seller for the option contract.

Image: www.youtube.com

Advantages of Options Contracts

Options contracts offer several unique advantages that make them attractive to a wide range of traders:

- Flexibility: Options grant the holder the right, not the obligation, to exercise the contract.

- Leverage: Options offer leverage, allowing traders to control significant underlying assets with relatively small investments.

- Risk Management: Options can be used for risk management strategies, such as hedging and income generation.

Latest Trends and Developments

The world of options trading is dynamic and constantly evolving; here are some recent trends:

- Rise of Exchange-Traded Options (ETOs): ETOs provide more transparency and liquidity in options trading.

- Growth of Binary Options: Binary options, with their all-or-nothing payouts, have gained popularity.

- Technological Advancements: Trading platforms have introduced advanced features like algorithmic trading and automated execution.

Expert Tips for Options Trading

Seasoned traders recommend the following tips for options trading:

- Understand the Risks: Options carry significant risk; it’s crucial to comprehend potential losses before engaging.

- Proper Research: Research the underlying asset and the options market to make informed decisions.

- Risk Management: Implement risk management strategies to mitigate potential losses.

Frequently Asked Questions

Q: Who are the parties involved in an options contract?

A: Buyer (who acquires the right to exercise the option) and Seller (who has the obligation to fulfill the contract).

Q: What is the difference between a call and a put option?

A: Call options give the right to buy, while put options confer the right to sell.

Q: What happens if the option is not exercised?

A: The option expires worthless, and the premium paid goes to the seller.

What Is A Contract In Options Trading

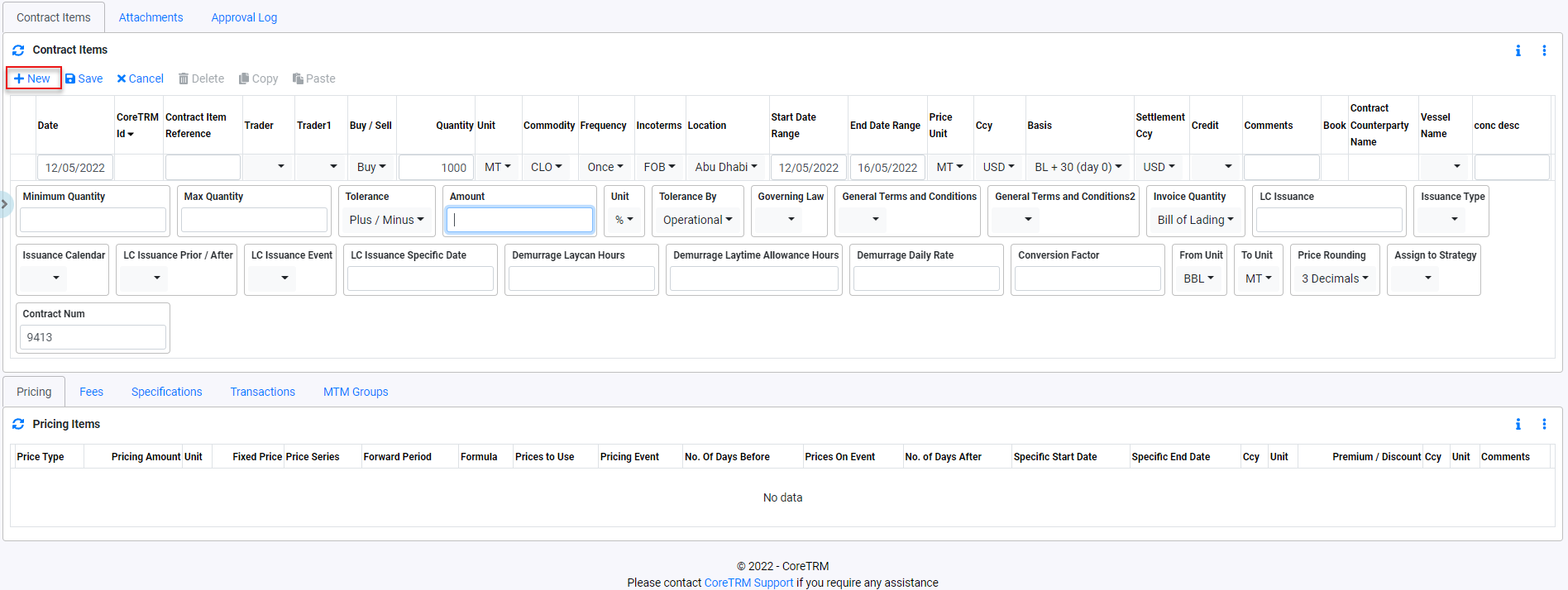

Image: coretrm.com

Conclusion

An options contract is the building block of options trading, providing flexibility, leverage, and risk management capabilities. By understanding their key aspects, investors can harness the power of options to navigate the dynamic financial markets. Whether you are a seasoned trader or just starting in options, stay updated with the latest trends and incorporate expert advice to maximize your trading outcomes.

We hope this article has clarified your understanding of options contracts. If you have any further questions or would like to delve deeper into this intriguing realm, feel free to engage with us in the comments section below.