Have you considered venturing into the realm of options trading, but the concept of options contracts leaves you perplexed? Fear not, as this comprehensive guide will delve into the intricacies of option contracts, equipping you with a newfound clarity. Welcome to the world of options trading, where understanding option contracts is paramount.

Image: financecracker.com

Options Contracts: A Conceptual Overview

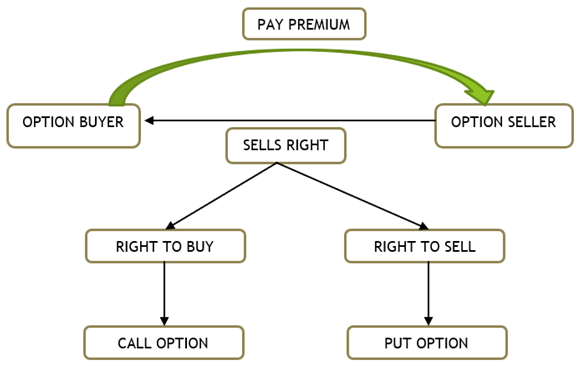

An option contract, simply put, is a financial instrument that provides its holder with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. This right carries an additional cost in the form of a premium, which the contract buyer pays upfront.

Options contracts are a highly versatile tool, offering traders a wide range of possibilities. They can be used for various purposes, such as hedging against price fluctuations, speculating on market movements, and generating income through premium collection.

A Zoom into the Different Types of Options

Navigating the world of options trading requires an understanding of the two main types of options: calls and puts. Calls grant the holder the right to buy an asset, while puts provide the right to sell. Each type holds its unique appeal, making them suitable for different trading strategies.

Call options are ideal for those who anticipate an upward price movement in the underlying asset. By purchasing a call option, the holder secures the privilege of purchasing the asset at a beneficial price, irrespective of its actual market value at the option’s expiration date. Conversely, puts are preferred when a trader anticipates a downturn in the asset’s price. If the asset’s value decreases, the put option grants the holder the right to sell the asset at a price advantageous to them.

The Strategic Significance of Strike Price

In the world of options, the strike price is a pivotal parameter that defines the predetermined price at which an underlying asset can be bought or sold. Options contracts are available in a range of strike prices, each catering to the trader’s expectations of the asset’s future price direction.

The choice of strike price is crucial as it influences both the cost of the option premium and the potential reward. A higher strike price will usually result in a lower premium but limit the potential profit. On the other hand, a lower strike price implies a higher premium but also offers a greater upside if the asset’s price moves favorably.

Image: www.fool.com

Tips and Expert Advice for Success

Seasoned traders in the options market often emphasize the significance of implementing particular strategies to maximize returns and minimize risks. Among these tactics, two stand out for their effectiveness:

- Educate yourself consistently: The world of options trading is an ever-evolving landscape, brimming with complexities and intricacies. Continuous learning and knowledge expansion are the cornerstones of success in this domain.

- Prudent risk management: Options trading involves inherent risks that must be carefully managed. Determine a risk tolerance level that aligns with your financial situation and implement strategies to mitigate potential losses.

A Comprehensive Q&A for Clarity

- Q: What is the essence of an option contract?

- A: An option contract bestows upon its holder the right, but not the obligation, to buy or sell an underlying asset at a certain price on a predefined date.

- Q: Elaborate on the distinction between call and put options.

- A: Call options provide the right to purchase an asset, while put options empower the holder with the right to sell an asset, with both contingent upon reaching a specific strike price.

Options Trading Option Is A Contract

Image: speedtrader.com

Conclusion – A Call to Action

Delving into the world of options trading demands a thorough understanding of the underlying concepts and strategies. Options contracts present a powerful tool for savvy investors, opening doors to diverse trading opportunities. The first step toward success is to equip yourself with knowledge, research the market, and seek expert guidance.

We encourage you to explore the wealth of information available on reputable platforms, engage in insightful discussions with experienced traders, and cultivate a deep understanding of the intricacies of options trading. Understand that investing in options carries inherent risks, and your financial well-being should always take precedence.

Join the vibrant community of traders, delve into the world of options contracts, and embark on a journey toward financial success. We invite you to embrace the excitement of options trading while prioritizing responsible risk management.