Introduction

Have you ever wondered about the world of options trading, but found the concept too daunting to approach? Fear not, for this comprehensive guide will demystify options trading and unveil its accessible nature. By unraveling the basics, exploring real-world applications, and breaking down complex terms, you’ll discover that option trading is not as intimidating as it initially may seem.

Image: tradewithmarketmoves.com

In the vast financial landscape, options trading offers a versatile tool that can enhance your investment strategy. Options contracts grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. With their inherent flexibility, options provide a valuable mechanism to manage risk, speculate on price movements, and generate additional income.

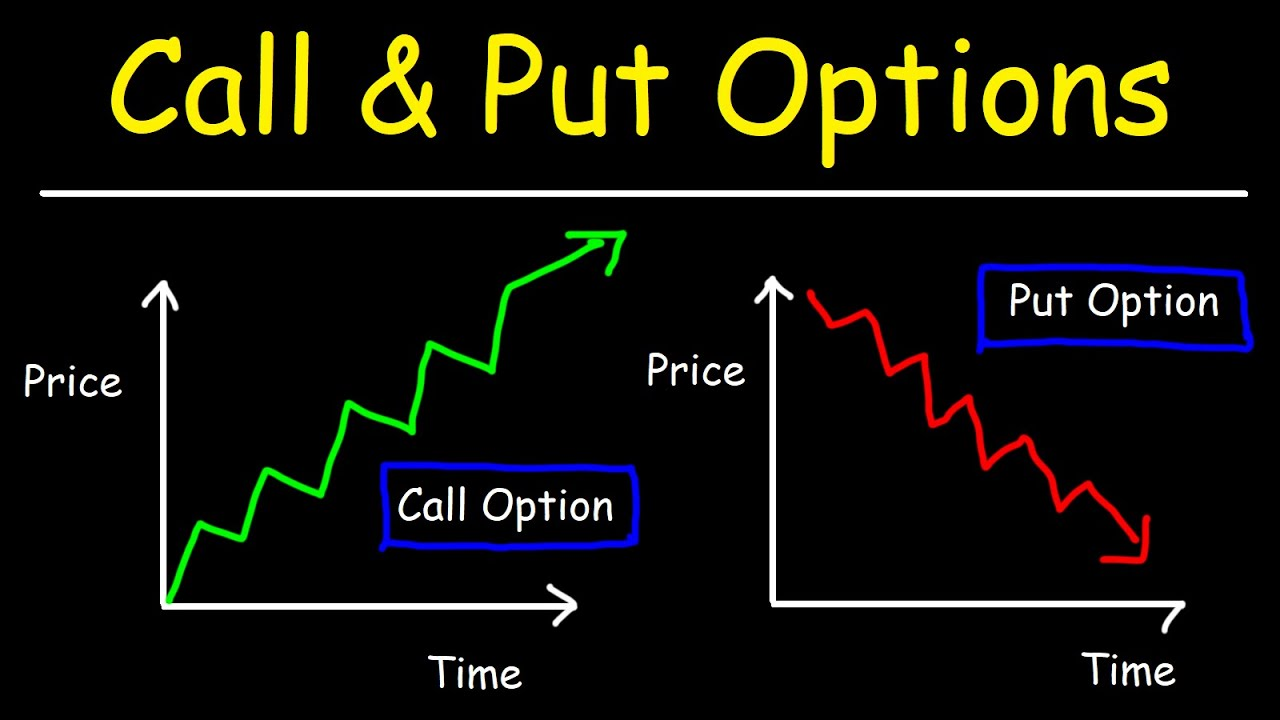

Types of Option Contracts

When venturing into the world of options trading, understanding the two main types of contracts is crucial: calls and puts. Call options赋予您在未来以特定价格购买标的资产的权利,而put options赋予您在未来以特定价格出售标的资产的权利。根据您的投资目标,您可以在到期前任何时候行使这些权利,但您没有义务这样做。

Key Concepts in Options Trading

To fully grasp the intricacies of options trading, a firm understanding of several key concepts is essential:

- **Premium:** The price you pay to acquire an option contract.

- **Strike Price:** The predetermined price at which you can buy or sell the underlying asset using the option.

- **Expiration Date:** The date on which the option contract expires, rendering it worthless if not exercised before this date.

- **In-the-Money:** An option is considered in-the-money if its strike price is favorable compared to the current market price of the underlying asset.

- **Out-of-the-Money:** An option is considered out-of-the-money if its strike price is unfavorable compared to the current market price of the underlying asset.

Real-World Applications of Option Trading

The versatility of option contracts extends to a wide range of investment strategies. Here are some practical examples:

- **Hedging Risk:** Options can act as insurance against unfavorable price movements in the underlying asset.

- **Income Generation:** By selling options, you can collect premiums and potentially generate regular income.

- **Speculation:** Options allow you to speculate on the future price direction of an underlying asset, potentially amplifying your returns.

Image: thebrownreport.com

Getting Started with Option Trading

Before embarking on your options trading journey, it’s imperative to lay a solid foundation. Here are some preliminary steps to take:

- **Education:** Familiarize yourself with the basics of options trading through books, online courses, or seminars.

- **Practice:** Start with paper trading or simulated platforms to practice option strategies without risking real capital.

- **Choose a Broker:** Select a reputable broker that offers options trading services and aligns with your investment goals.

- **Understand Your Risk Tolerance:** Determine your comfort level with risk and allocate funds accordingly.

Option Trading Is Easy

![Options Strategies Cheat Sheet [FREE Download] - How to Trade](https://howtotrade.com/wp-content/uploads/2023/02/options-strategy-cheat-sheet-2048x1448.png)

Image: howtotrade.com

Conclusion

Unveiling the secrets of option trading, this beginner’s guide has paved the way for you to embark on a fulfilling investment journey. By comprehending the different types of contracts, grasping key concepts, and exploring real-world applications, you’ve gained a foundational understanding of this powerful financial tool. Remember, practice, patience, and a prudent risk management approach are key to success in the dynamic world of options trading.