Trading Options on Robinhood Made Easy: A Comprehensive Guide for Beginners

Image: daytradereview.com

Introduction

Have you ever wondered about the world of options trading but felt intimidated by its complexity? Look no further! In this beginner-friendly guide, we’ll demystify the jargon and provide you with everything you need to know to get started with options trading on Robinhood. From understanding the basics to mastering the art of making wise investment decisions, we’re here to help you navigate this thrilling financial landscape.

Unlocking the Basics of Options Trading

Options, simply put, are financial contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a specific price within a predetermined time frame. Unlike stocks, which represent direct ownership of a company, options allow you the flexibility to speculate on the future price movements of assets without actually owning them. This eröffnet endless possibilities for investors to capitalize on market trends or mitigate potential risks.

Getting Your Feet Wet on Robinhood

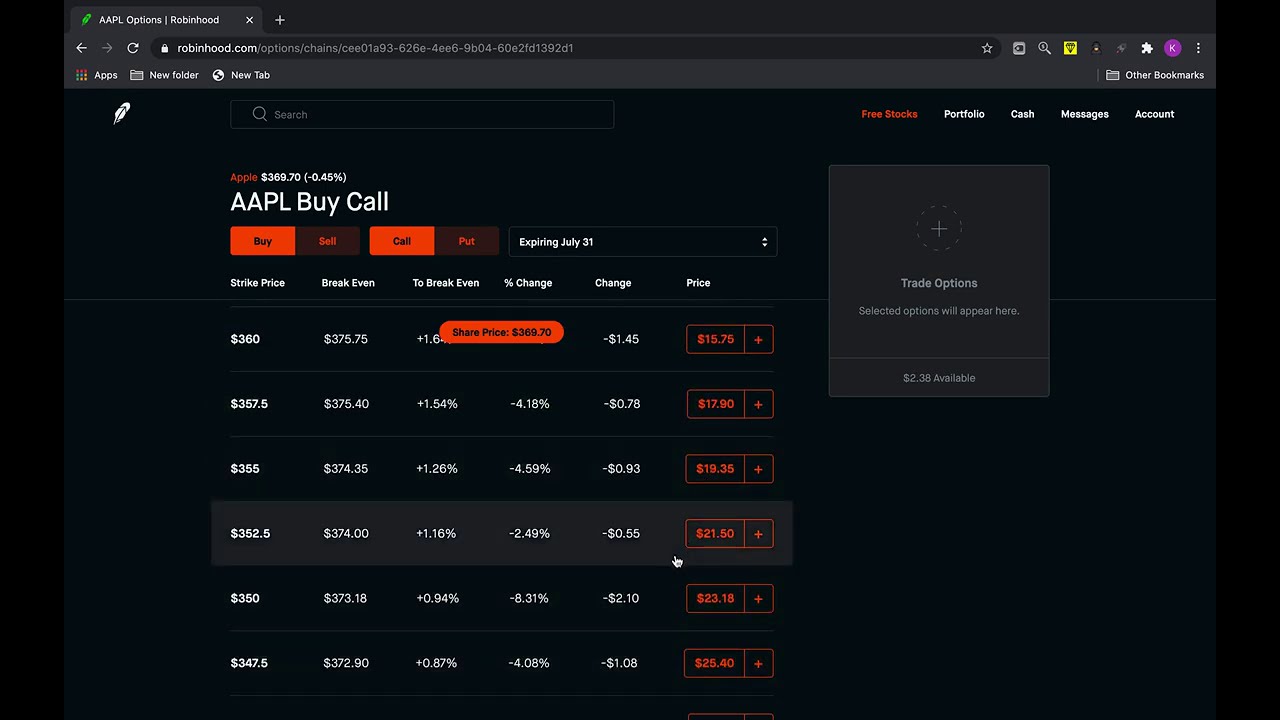

Robinhood has emerged as a popular platform for options trading, thanks to its user-friendly interface and commission-free trading. It provides a seamless experience for both novice and experienced traders. To get started, simply open an account and complete the trading permissions process. Once your account is approved, you can begin exploring the world of options.

Understanding Key Terms and Concepts

A plethora of terms and concepts abound in options trading, but don’t let that deter you. Let’s break down the most fundamental ones:

-

Call options: These options give you the right to buy an asset at the strike price on or before the expiration date.

-

Put options: Conversely, put options give you the right to sell an asset at the strike price on or before the expiration date.

-

Strike price: This is the predetermined price at which you can buy or sell the underlying asset with the option contract.

-

Expiration date: Options have a finite lifespan. The expiration date marks the day the option contract expires.

Crafting Effective Options Strategies

Mastering options trading requires a strategic mindset. You’ll need to determine whether to buy or sell options, and which type of option to use. Let’s explore some common strategies:

-

Covered Call: Sell a call option on an underlying asset you own. This strategy generates income and reduces risk.

-

Put Option Hedging: Buy a put option to offset potential losses in case the price of the underlying asset falls.

-

Straddle: Buy both a call and a put option with the same strike price and expiration date. This strategy provides protection against significant price fluctuations.

Heeding Expert Advice and Tips

Navigating the intricacies of options trading can be daunting, but you don’t have to go it alone. Seeking expert insights and embracing proven tips can significantly enhance your success rate:

-

Stay Informed: Keep your finger on the pulse of the market by reading industry publications, attending webinars, and staying abreast of financial news.

-

Manage Risk: Options trading carries inherent risk. Use stop-loss orders and carefully manage your position size to mitigate potential losses.

-

Practice Discipline: Avoid emotional trading and stick to your investment plan. Consistency is key in achieving long-term success.

Conclusion

Trading options on Robinhood can be a rewarding endeavor when approached with knowledge and strategy. By embracing the principles outlined in this guide, you can confidently navigate the options market, make informed investment decisions, and unlock your financial potential. Remember, this is just the beginning of your journey. Continue to learn, adapt, and evolve as the market presents new opportunities and challenges.

Image: www.youtube.com

Trading Options On Robinhood Made Easy

Image: www.youtube.com