Introduction

Step into the exhilarating world of option trading, where the dance of stock movements can be deciphered through the enigmatic language of chart patterns. These patterns, like footprints in the financial wilderness, guide traders towards informed decisions, potentially leading to profitable outcomes. Join us as we embark on a journey to unravel the complexities of option trading chart patterns, empowering you to navigate the markets with confidence and skill.

Image: bullsarenatrading.com

Understanding Option Trading Chart Patterns

Option trading chart patterns are formations created by the price action of an underlying asset over time. These patterns can be categorized into two main types: reversal patterns and continuation patterns. Reversal patterns indicate a potential change in the current trend, while continuation patterns suggest the trend is likely to continue.

Reversal patterns include:

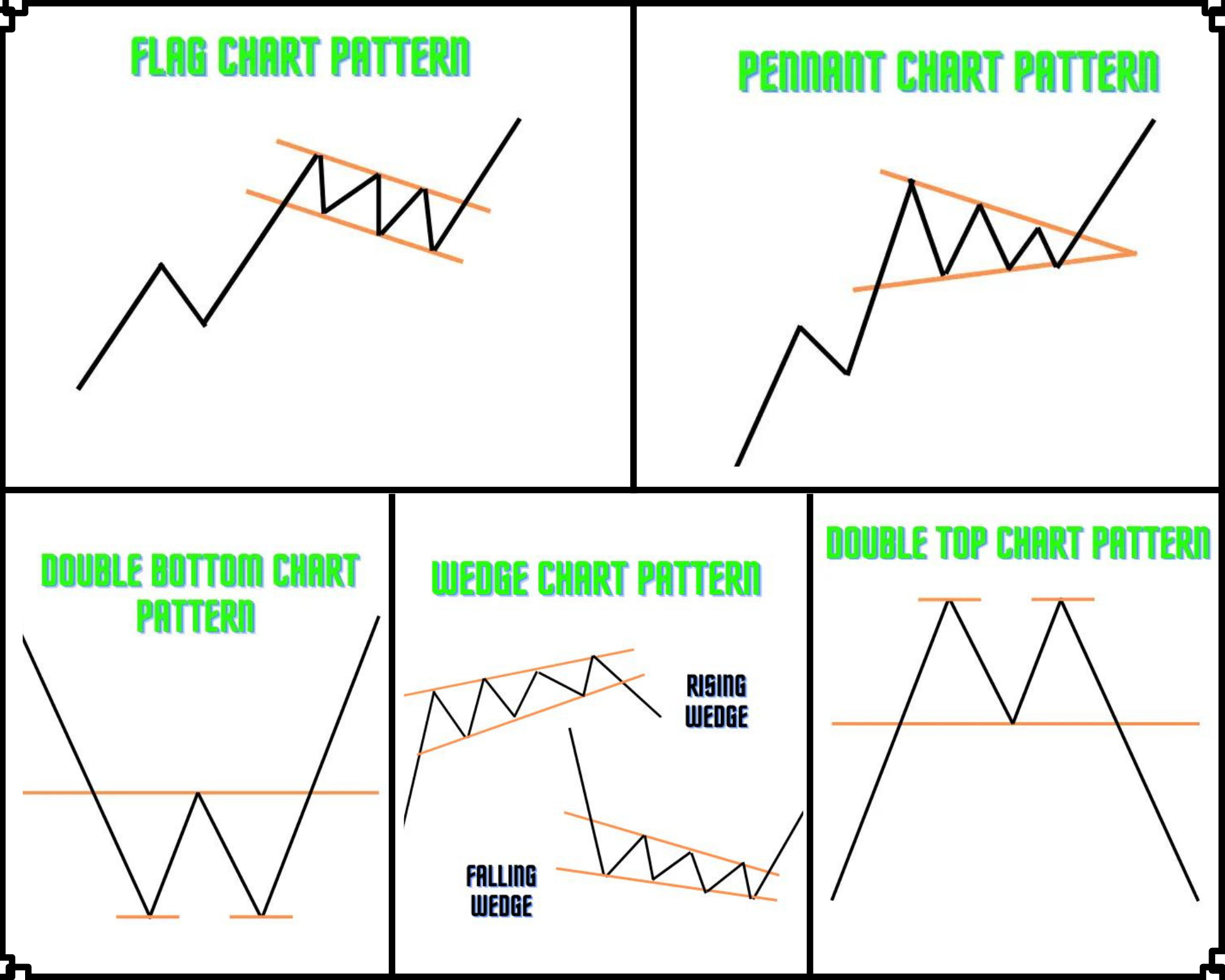

- Double Tops and Bottoms: These patterns form when the price forms two consecutive peaks (tops) or troughs (bottoms) at roughly the same level. They indicate a potential reversal of the current trend.

- Head and Shoulders: This pattern resembles a person’s head and shoulders, with the central “head” rising higher than the flanking “shoulders.” It signals a potential trend reversal from bullish to bearish.

- Inverse Head and Shoulders: The inverse pattern resembles the head and shoulders pattern but flipped upside down. It suggests a potential trend reversal from bearish to bullish.

Continuation patterns, on the other hand, indicate that the current trend is likely to persist:

- Triangle: This pattern forms when the price action creates a series of lower highs and higher lows within a triangle-shaped formation. It can indicate a continuation of the current trend or a period of consolidation before a breakout.

- Flag and Pennant: These patterns are created when the price action moves sideways within a narrow channel, forming a flag or pennant shape. They often signal a continuation of the prior trend.

- Wedge: Similar to the triangle, a wedge pattern forms when the price action creates a series of higher highs and lower lows, but with the trendlines converging. It can indicate a continuation or a reversal, depending on the context.

Expert Insights: Decoding the Patterns

“Chart patterns are not mere indicators; they are the materialized footprints of market sentiment,” says renowned trader and analyst, Nicholas Darvas. “By understanding these patterns, traders can anticipate potential moves and position themselves accordingly.”

Another expert, Peter Lynch, emphasizes the importance of context when assessing chart patterns. “No pattern exists in isolation; it must be interpreted within the broader market landscape,” he advises.

Actionable Tips: Harnessing the Power of Patterns

- Combine multiple patterns: Don’t rely solely on a single pattern. Look for corroboration among different chart patterns to enhance your trading confidence.

- Consider market context: Analyze chart patterns in conjunction with other market indicators, such as moving averages, technical oscillators, and market news.

- Manage your risk: Always implement a sound risk management strategy, such as setting stop-loss and take-profit orders.

- Practice and patience: Mastery of option trading chart patterns requires practice and patience. Study historical charts, simulate trades, and gradually increase your trading size as your confidence grows.

Image: www.pinterest.com.mx

Option Trading Chart Patterns

https://youtube.com/watch?v=xvouqLOoN8k

Conclusion

Option trading chart patterns are invaluable tools that can empower traders to navigate the markets with greater precision and potential profitability. By understanding the different types of patterns and their implications, you can develop a discerning eye and make informed trading decisions. Remember to approach trading with a measured mind, manage risks diligently, and continuously seek knowledge to enhance your skills. Embrace the challenge, uncover the secrets of option trading chart patterns, and embark on a rewarding trading journey.