Introduction

The realm of options trading opens up a myriad of opportunities for savvy investors seeking to harness the power of leverage and mitigate risk. Among the key concepts underpinning this fascinating market is the “time value” of options – a crucial factor that can significantly impact trading strategies. In this comprehensive guide, we delve into the intricacies of time value options trading, exploring its history, foundational principles, and practical applications.

Image: danilacalise.blogspot.com

The Essence of Time Value

An option contract grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (e.g., stock, currency, commodity) at a specified strike price on or before a certain date. The time remaining until this expiration date represents the option’s time value, which gradually decays as the clock ticks down.

Historic Genesis and Evolution

The concept of time value options trading emerged in the late 1600s with the development of put and call options on stocks. However, it gained prominence with the establishment of the Chicago Board Options Exchange (CBOE) in 1973, creating a standardized marketplace for options contracts. Over the years, the understanding and utilization of time value have revolutionized options trading, enabling investors to design sophisticated strategies that exploit its impact on option prices.

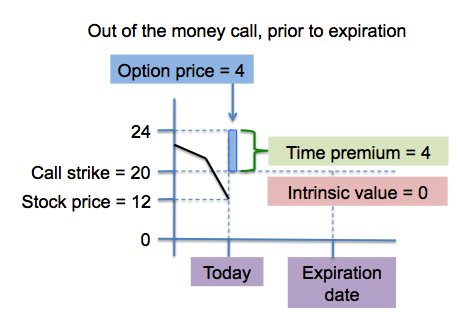

Intrinsic vs. Extrinsic Value

Options contracts possess two distinct components: intrinsic value and extrinsic value. Intrinsic value refers to the difference between the underlying asset’s current market price and the option’s strike price. Extrinsic value, on the other hand, represents all other factors influencing the option’s price, primarily time value and implied volatility.

Image: www.youtube.com

Factors Influencing Time Value

Several factors play a pivotal role in determining the time value of an option:

-

Time to Expiration: As expiration approaches, the time value gradually decreases, as the probability of the option expiring out-of-the-money increases.

-

Volatility: Implied volatility, or the market’s expectations for future price fluctuations, significantly impacts time value. Higher volatility leads to higher time value.

-

Interest Rates: Higher interest rates generally increase time value for call options and decrease it for put options.

-

Dividend Yield: Options on stocks that pay dividends experience a slight reduction in time value as the ex-dividend date approaches.

Real-World Applications

Understanding the nuances of time value empowers traders to devise tactical strategies that maximize profit potential while mitigating risk:

-

Time Spreading: This strategy involves buying and selling options with different expiration dates to capitalize on shifts in the underlying asset’s price while preserving time value.

-

Straddle: This bullish strategy involves simultaneously buying a call and a put option with the same strike price and expiration date, betting on a significant price movement in either direction.

-

Strangle: Similar to a straddle, but with different strike prices, a strangle exploits larger price movements while sacrificing some time value.

Current Trends and Developments

The options trading landscape is constantly evolving, with new trends and developments emerging:

-

Long-Dated Options: Investors are showing a growing appetite for options with longer time to expiration, considering the current low volatility environment.

-

Algorithmic Trading: Advanced trading algorithms are increasingly used to monitor and exploit time value opportunities in real-time.

Time Value Options Trading

Image: www.youtube.com

Conclusion

The time value of options trading represents a pivotal concept that profoundly influences trading strategies. By comprehending the interplay between intrinsic and extrinsic value, as well as the factors governing time value decay, investors can harness its power to optimize their investment outcomes. Remember, the realm of options trading is complex and requires diligent research and responsible execution. As always, consult with a qualified financial advisor before making investment decisions.