Introduction

Have you ever heard of options trading but felt intimidated by the jargon and overwhelming information? In this blog post, I will break down everything you need to know about options trading, from the basics to the latest trends and expert advice. I’ll simplify complex concepts and provide practical tips to help you understand and potentially profit from this fascinating market.

Image: www.youtube.com

What is Options Trading?

Options trading is a versatile strategy that allows you to speculate on the price movements of an underlying asset (e.g., a stock, index, or commodity). Unlike traditional stock trading, options provide you with the right, not the obligation, to buy (call) or sell (put) the asset at a specific price (strike price) on or before a certain date (expiration date). This flexibility gives you unique opportunities to manage risk and potentially generate substantial returns.

Types of Options

There are two main types of options contracts:

- Call Options: Give you the right to buy the underlying asset at the strike price, regardless of its current market value.

- Put Options: Give you the right to sell the underlying asset at the strike price, regardless of its current market value.

Key Terms and Definitions

- Options Premium: The price you pay to purchase an options contract.

- Intrinsic Value: The difference between the strike price and the current market price of the underlying asset (positive for in-the-money options and negative for out-of-the-money options).

- Time Value: The value associated with holding an options contract until its expiration date.

- Implied Volatility: The market’s expectation of future price volatility of the underlying asset, reflected in the option’s premium.

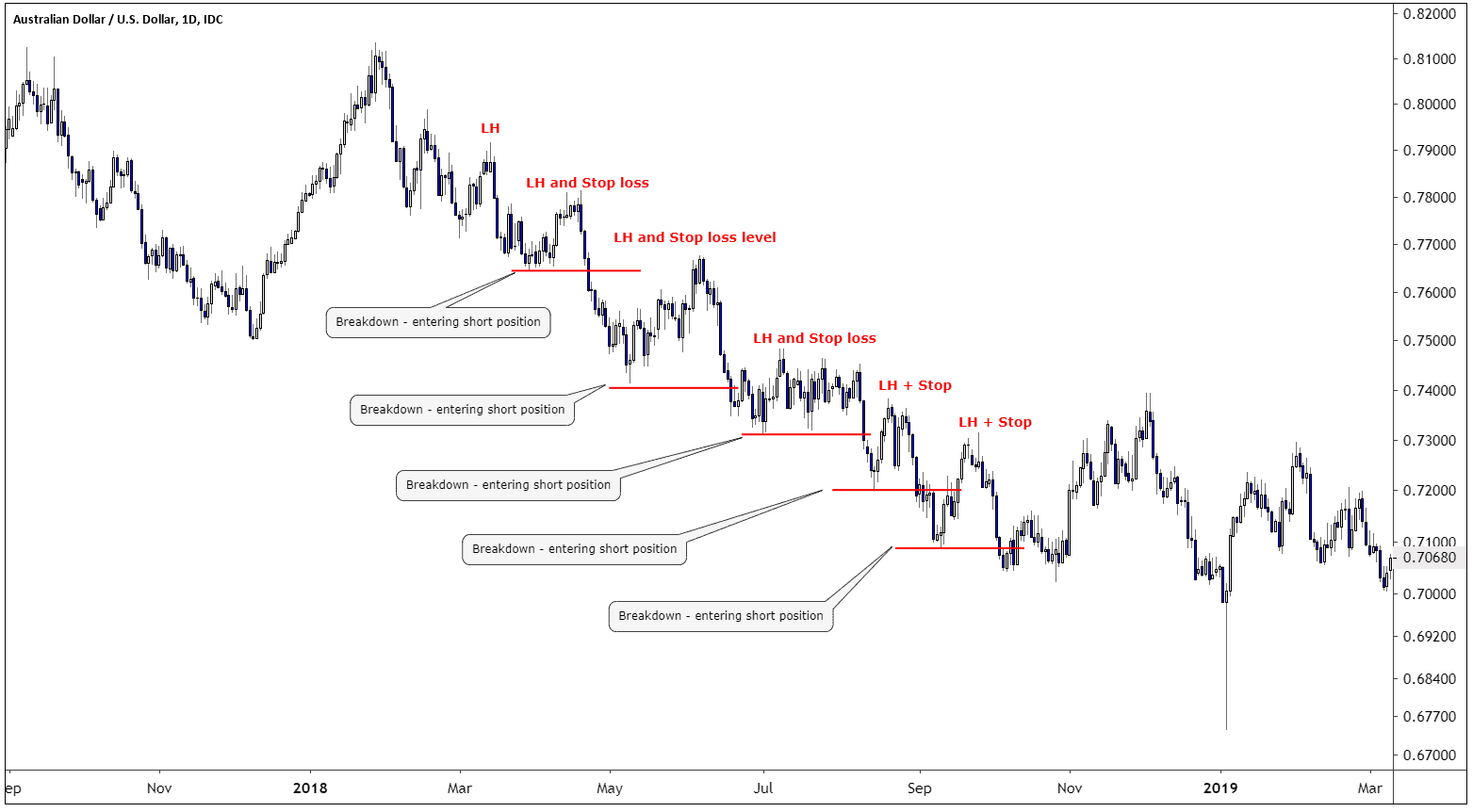

Image: www.investingcube.com

Strategies and Techniques

Options offer a wide range of strategies and techniques to suit different investment goals and risk tolerances. Some popular options strategies include:

- Covered Calls: Using long stock positions to cover short call options, generating income and hedging potential losses.

- Cash-Secured Puts: Using short put options to ensure the potential purchase of an underlying asset at a favorable price.

- Iron Condor: Trading a combination of call and put options at different strike prices and expiration dates, creating a neutral market position.

Tips and Expert Advice

Options trading can be both rewarding and challenging. Here are some tips from the experts:

- Understand the Risks: Options involve significant financial risk and are not suitable for all investors.

- Educate Yourself: Thoroughly research and study options trading principles, strategies, and risk management techniques.

- Use a Broker with Options Capabilities: Choose a reputable broker who offers options trading platforms and support services.

- Trade Within Your Means: Only invest what you can afford to lose and consider your risk tolerance.

- Monitor Your Positions: Track the performance of your options contracts regularly and adjust your strategies as needed.

FAQs

Q: What are some of the advantages of options trading?

A: Flexibility, risk management, income generation, potential for high returns.

Q: What are some of the disadvantages of options trading?

A: High risk, complex strategies, potential for losses.

Q: Is options trading suitable for beginners?

A: While it’s technically possible, beginners should proceed with caution and seek guidance from experienced traders or professionals.

Options Trading Breakdown

Image: www.pinterest.com

Conclusion

Options trading opens up a world of financial opportunities, but it requires a thorough understanding of the concepts and risks involved. By taking the time to educate yourself and applying the tips and strategies discussed in this article, you can harness the potential of options and potentially enhance your investment portfolio.

Call to Action: Are you ready to explore the exciting world of options trading? Connect with a qualified financial advisor or broker today to learn more and start your options trading journey.