Delving into the Power of Interest Rate Sensitivity

In the labyrinthine world of options trading, where strategies intertwine and opportunities abound, there exists a hidden gem known as the Greek letter “rho” (ρ). This enigmatic factor holds the key to unlocking potential profits by exploiting the intricate relationship between interest rates and option premiums. Embark on this journey with us as we unravel the secrets of trading options using rho and unearth its transformative potential for discerning traders.

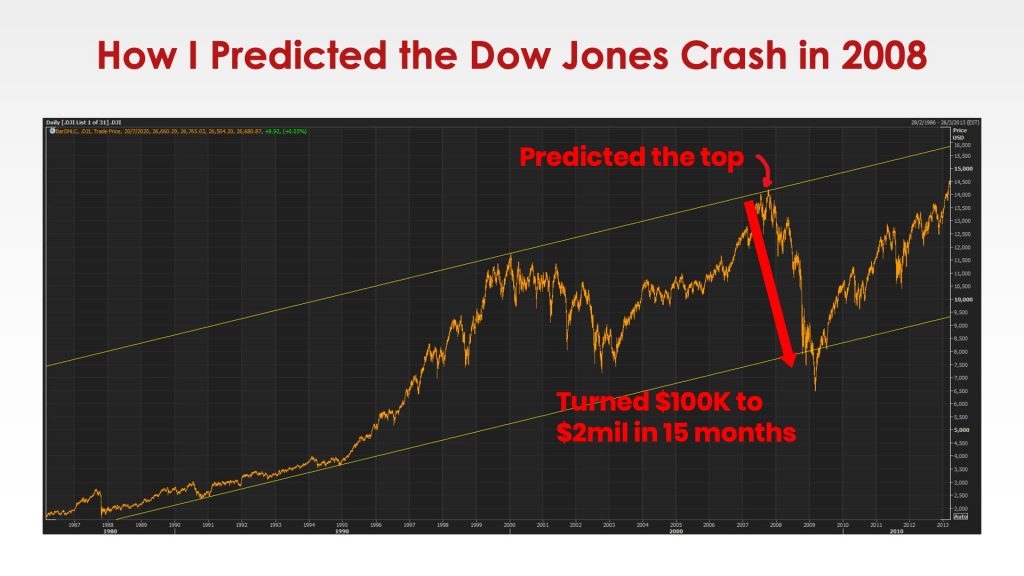

Image: www.tradingkungfu.com

Understanding Rho: The Heart of Interest Rate Sensitivity

Rho measures the sensitivity of an option’s price to changes in the underlying interest rates. As interest rates fluctuate, so too do the premiums of options associated with the underlying asset. Comprehending this dynamic is crucial for crafting profitable trading strategies that capitalize on the interplay between options and interest rates. Higher interest rates generally result in increased premiums for call options (bullish bets) and decreased premiums for put options (bearish bets). Conversely, a drop in interest rates typically engenders the opposite effect.

Applications of Rho in Options Trading

Harnessing the power of rho can empower traders with a diverse array of strategies. One such strategy involves utilizing rho to enhance returns on covered calls. By selling a call option against an underlying stock already owned, traders can generate income through the option premium while also potentially profiting from price appreciation of the stock. As interest rates climb, the premium received for selling the call option increases, boosting overall profitability.

In a different vein, traders can also employ rho to hedge against fluctuations in interest rates. For instance, by purchasing put options on interest rate futures contracts, traders can protect their portfolio from the negative impact of rising rates. This hedging strategy mitigates the risk associated with interest rate volatility, providing a safety net for prudent investors.

Monitoring Interest Rates: A Vital Part of Successful Trading

Keeping a watchful eye on interest rate movements is paramount for successful rho trading. Central bank announcements, economic data releases, and geopolitical events can all exert significant influence on interest rates. Utilizing real-time market data and analytical tools allows traders to stay abreast of the latest developments, enabling them to make informed decisions based on the most up-to-date information.

Image: www.youtube.com

Trading Options Using Rho

Image: redot.com

Conclusion: Unveiling the Potential of Rho

Rho, the often-overlooked Greek letter, holds immense potential for savvy options traders. By understanding its intricacies and incorporating it into their trading strategies, traders can unlock opportunities for enhanced profitability and risk management. Whether it’s generating additional income through covered calls or safeguarding portfolios against interest rate fluctuations, the power of rho should not be underestimated. Embrace this newfound knowledge and venture into the world of rho trading with confidence, unlocking the exceptional rewards that this unique aspect of options trading has to offer.