Title: Unlocking the Secrets of Greek Symbols for Option Trading: A Journey to Empowerment

Image: www.slideshare.net

Introduction:

In the perilous waters of the financial markets, where decisions can shape destinies, the enigmatic Greek symbols emerge as beacons of guidance. These symbols, borne out of ancient Grecian mathematics, hold the power to unravel the complexities of option trading, empowering traders to navigate the treacherous terrain with confidence and precision.

My journey into the world of Greek symbols began with a curiosity sparked by the transformative potential they held. I embarked on a quest to decipher their significance, seeking a deeper understanding of how they could elevate my trading strategies. Join me on this journey as I unravel the hidden meanings behind each symbol, unlocking the secrets that lie within.

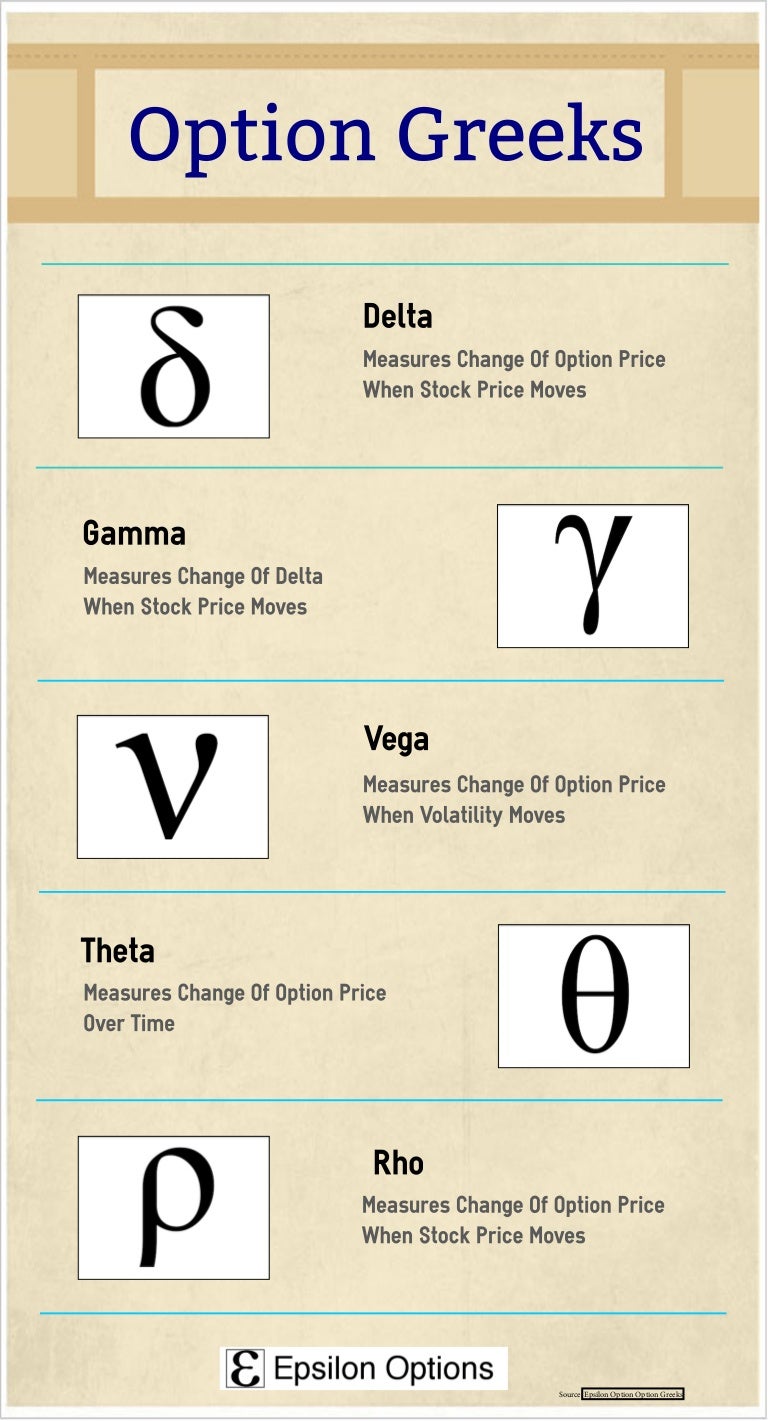

Delta: The ‘Direction’ Detective

Delta, the symbol of change, captures the sensitivity of an option’s price to fluctuations in the underlying asset. This metric serves as a compass, indicating the direction in which the option’s value will shift with every incremental move of the asset. Armed with this knowledge, traders can gauge the potential impact of market movements on their positions, equipping them to make informed adjustments.

Gamma: The ‘Acceleration’ Amplifier

Gamma, the symbol of acceleration, measures the rate of change in an option’s Delta in response to shifts in the underlying asset’s price. It serves as a magnifying glass, amplifying the sensitivity and highlighting the potential for exponential gains or losses. Understanding Gamma empowers traders to stay ahead of the curve, anticipating and capitalizing on market momentum shifts.

Theta: The ‘Time’ Deceiver

Theta, the symbol of time, captures the insidious nature of time decay in options. As the relentless march of time unfolds, Theta relentlessly erodes the value of options, particularly out-of-the-money options. This knowledge becomes a valuable tool, helping traders optimize their entries and exits, maximizing profits and minimizing losses.

Vega: The ‘Volatility’ Whisperer

Vega, the symbol of volatility, unveils the relationship between an option’s value and implied volatility. It acts as a seismograph, measuring the impact of volatility fluctuations on an option’s price. By understanding Vega, traders can anticipate how changes in volatility will influence their positions, allowing them to navigate the choppy waters of the markets with greater finesse.

Rho: The ‘Interest Rate’ Indicator

Rho, the symbol of interest rates, reveals how changes in interest rates affect an option’s price. This subtle yet significant factor can have a profound impact on the value of long or short positions. Traders who harness Rho’s power can gain a competitive edge by predicting and exploiting interest rate movements, optimizing their returns.

Conclusion:

The Greek symbols for option trading are not mere mathematical abstractions; they are the keys to unlocking the hidden dynamics of the markets. By mastering these symbols and incorporating them into their trading strategies, traders can elevate their game, reaping the rewards of informed decision-making.

May this journey into the world of Greek symbols serve as a beacon of empowerment for fellow traders. Armed with this newfound knowledge, we can unlock the full potential of option trading and confidently traverse the unpredictable landscapes of the financial markets. Let us embrace the challenges and grasp the opportunities that these symbols hold, soaring to greater heights of trading success.

Image: yoyofabol.web.fc2.com

Greek Symbols For Option Trading

Image: www.fidelity.com