The National Commodity and Derivatives Exchange (NCDEX) offers an advanced module on option trading, designed for experienced traders seeking to enhance their understanding of advanced option strategies. This comprehensive Ncfm option trading advanced module pdf covers a wide range of topics, empowering traders with the knowledge and skills to navigate the complexities of options trading effectively.

Image: tradebrains.in

The Ncfm option trading advanced module pdf delves into the intricacies of advanced option strategies, providing traders with a solid foundation in the concepts of volatility, time decay, and implied volatility. It explores key strategies such as multi-leg options, spread strategies, and synthetic positions, enabling traders to diversify their portfolios and manage risk effectively. The module also addresses the practical aspects of option trading, including order types, margin requirements, and risk management techniques.

Essential Concepts of Advanced Option Trading

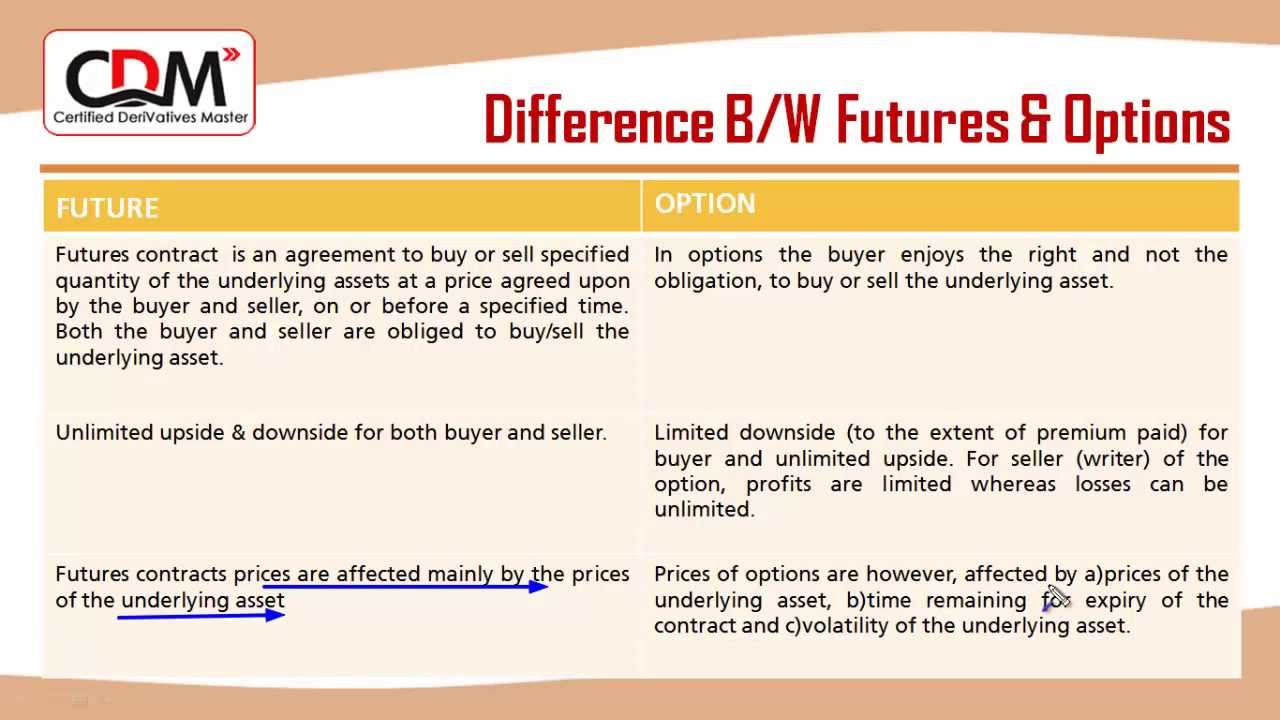

Before delving into advanced option strategies, the Ncfm option trading advanced module pdf establishes a firm grounding in the fundamental concepts of option trading. It clarifies the distinction between calls and puts, explains bid-ask spreads, and discusses the dynamics of option pricing. Moreover, it emphasizes the significance of implied volatility and its impact on option premiums, providing traders with valuable insights into market fluctuations and pricing models.

Multi-Leg Options: Enhancing Profit Potential

The module introduces traders to multi-leg options, highlighting their potential for enhancing profit and managing risk. It explains the mechanics of bull and bear spreads, vertical spreads, and calendar spreads, providing practical examples to illustrate the application of these strategies in different market conditions. Additionally, it discusses the concept of synthetic positions, which involve combining multiple options to create customized exposure, allowing traders to tailor their strategies to specific market views and risk tolerances.

Spread Strategies: Managing Risk and Boosting Returns

Spread strategies play a pivotal role in advanced option trading, and the Ncfm option trading advanced module pdf dedicates significant attention to this topic. It covers vertical spreads, horizontal spreads, and diagonal spreads, exploring their distinct risk-return profiles. The module provides a thorough understanding of the Greeks, including delta, gamma, theta, and vega, and explains how they influence the performance of spread strategies.

Image: tradingtuitions.com

Advanced Risk Management Techniques

Risk management is paramount in option trading, and the Ncfm option trading advanced module pdf emphasizes the importance of implementing robust risk management strategies. It discusses position sizing, stop-loss orders, and hedging techniques, enabling traders to protect their capital and mitigate potential losses. The module also explores the concept of backtesting, which involves testing trading strategies on historical data to assess their performance and optimize parameters.

Practical Applications in Real-World Markets

To bridge the gap between theoretical knowledge and practical implementation, the Ncfm option trading advanced module pdf incorporates real-world market examples. It examines successful trading strategies employed by experienced traders and delves into case studies to illustrate the application of advanced option strategies in diverse market conditions. These case studies provide valuable insights into the decision-making process and risk-reward assessment involved in option trading.

Ncfm Option Trading Advanced Module Pdf

Image: ronoxivipyr.web.fc2.com

Conclusion

The Ncfm option trading advanced module pdf is an invaluable resource for experienced traders seeking to elevate their understanding and proficiency in advanced option trading strategies. Its comprehensive coverage of concepts, practical applications, and risk management techniques empowers traders to navigate the complexities of options trading effectively. By mastering the advanced concepts outlined in this module, traders can enhance their profitability, mitigate risk, and unlock new opportunities in the dynamic world of options trading.