Hesitant to venture into the world of options trading? Enter the triangle options strategy – a beginner-friendly technique that can boost your portfolio’s potential. Imagine this: you’re at a casino, playing a game of chance. You can bet on a single outcome or spread your bets across multiple possibilities. Triangle options trading follows a similar concept, enabling you to mitigate risk while maximizing returns.

Image: www.reddit.com

What is Triangle Options Trading?

Triangle options trading is a strategy that involves buying or selling three options simultaneously – a bull call spread, a bear call spread, and a bear put spread – arranged in a triangular formation. The combination creates a neutral position, as the potential losses are capped while the potential profit is uncapped.

The goal of triangle options trading is to take advantage of market volatility. When prices move in a certain direction, one or more legs of the triangle will profit, while the others offset potential losses.

Decoding the Triangle Options Strategy

Bull Call Spread: The bull call spread involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price. If the stock price rises, both options gain value, resulting in profit.

Bear Call Spread: In the bear call spread, you sell a call option at a lower strike price and buy a call option at a higher strike price. This strategy profits when the stock price falls.

Bear Put Spread: The bear put spread entails selling a put option at a higher strike price and buying a put option at a lower strike price. This spread benefits from falling stock prices.

The Latest in Triangle Options Trading

The world of options trading is constantly evolving, and triangle options trading is no exception. Here are some recent trends and developments to watch out for:

- Increased Volatility: Recent market volatility has created opportunities for triangle options traders to capitalize on price fluctuations.

- Advancements in Technology: New trading platforms and tools have made triangle options trading more accessible and efficient.

- Expert Insight: Financial analysts and experienced traders are sharing valuable insights and strategies for successful triangle options trading.

Image: steemit.com

Expert Advice for Triangle Options Trading

Seasoned traders share their wisdom for maximizing your triangle options trading experience:

- Choose the Right Underlying: Select stocks or indices that exhibit high liquidity and volatility.

- Determine Market Conditions: Analyze market trends to identify potential volatility and price movements.

- Manage Risk: Implement stop-loss orders and position sizing strategies to mitigate potential losses.

- Monitor Regularly: Keep track of your options positions and make adjustments as needed.

Remember, options trading involves risk, so it’s crucial to understand the potential for both gains and losses.

FAQs on Triangle Options Trading

- What are the benefits of triangle options trading?

Triangle options trading offers a limited risk and uncapped reward potential, reducing drawdowns compared to single-leg options strategies. - How can I learn more about triangle options trading?

Attend webinars, workshops, or consult with an experienced financial advisor to gain comprehensive knowledge. - What are the risks associated with triangle options trading?

The main risk involves the loss of the premium paid for the options, though the limited risk nature of the strategy reduces potential losses compared to other options strategies.

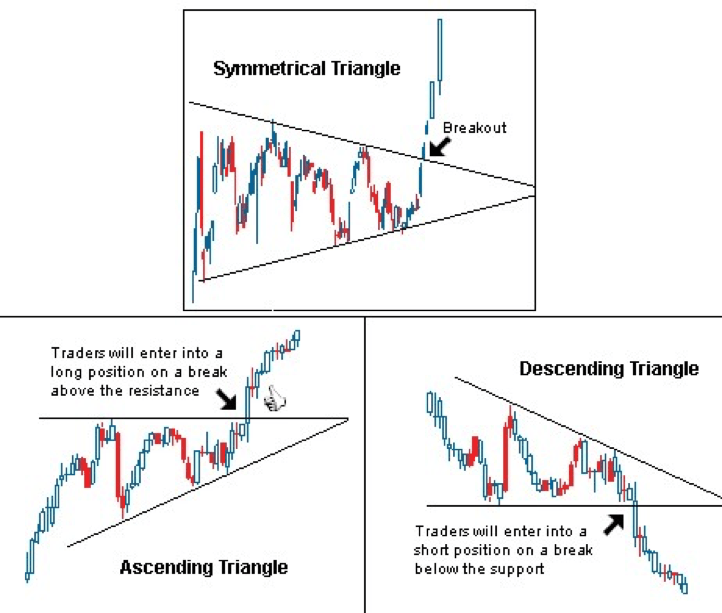

Triangle Options Trading

Image: bloghowtotrade.blogspot.com

Conclusion

Triangle options trading presents a strategic approach to options trading, balancing risk and reward in a dynamic market environment. By employing the knowledge and tips shared in this article, you can unlock the potential of triangle options trading and enhance your portfolio’s growth.

Interested in Triangle Options Trading? Explore our portfolio of financial services today and take your trading strategy to the next level.