In today’s fast-paced financial markets, identifying trading opportunities that offer a high probability of success is paramount. Moving averages, a technical analysis tool that tracks a stock’s or option’s price over time, have proven invaluable for traders seeking to navigate market fluctuations and make informed decisions.

Image: iitiantrader.in

This comprehensive guide will provide you with an in-depth understanding of trading options using moving averages. We’ll explore the basics of moving averages, dissect various types, and discuss how to incorporate them into your trading strategy. Whether you’re a seasoned trader or embarking on a new investment journey, this guide will equip you with the knowledge and insights necessary to leverage moving averages effectively.

What are Moving Averages?

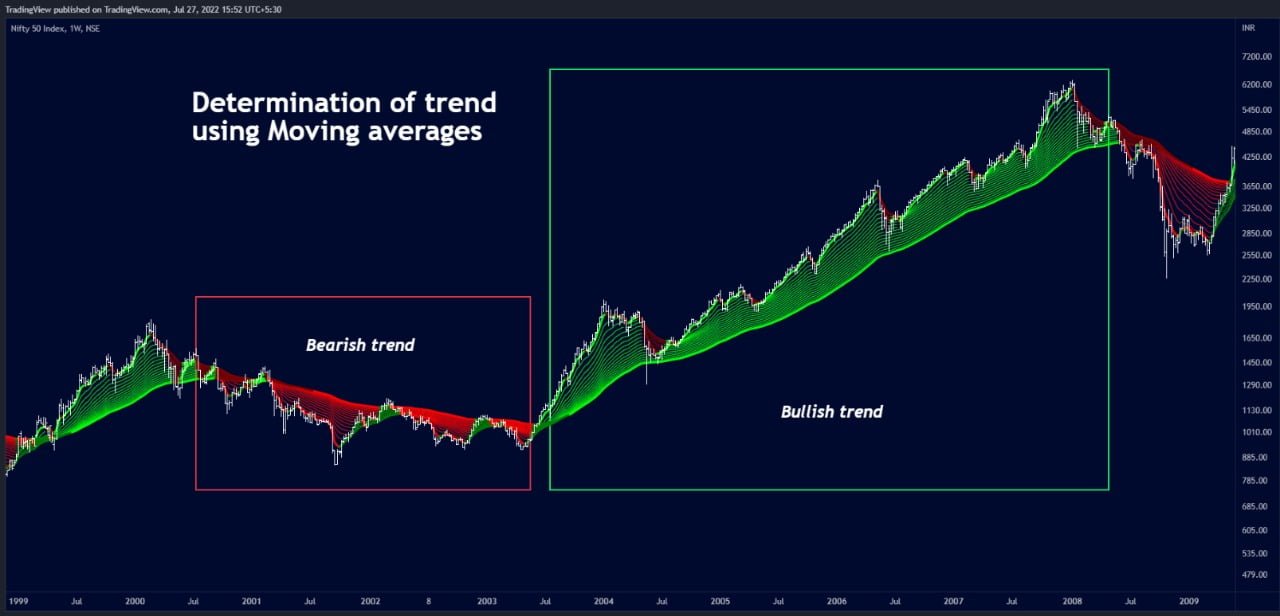

Moving averages are technical indicators that calculate the average price of a stock or option over a specified period. They are plotted on a price chart and act as a smoothing mechanism, filtering out short-term price fluctuations and providing a clearer trend.

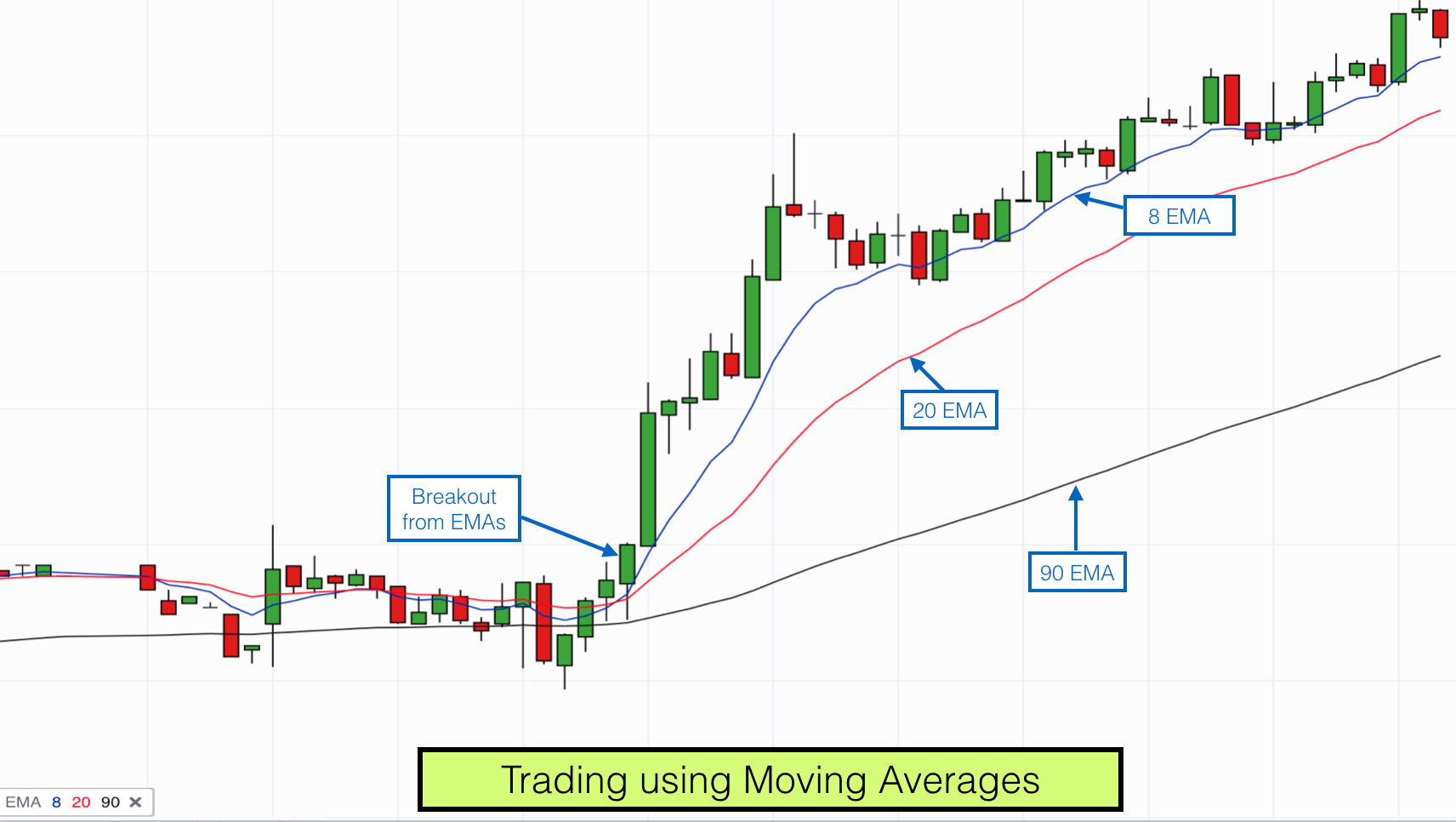

Moving averages can be categorized based on the period over which the average is calculated. Common types include Simple Moving Averages (SMAs), Exponential Moving Averages (EMAs), and Weighted Moving Averages (WMAs). SMAs assign equal weight to all data points, while EMAs put more emphasis on recent price action and WMAs weight higher prices more than lower prices.

Trading Options with Moving Averages

Moving averages are commonly utilized to identify trading opportunities in options trading. Options contracts allow traders to buy or sell an underlying asset at a predefined price within a specified time frame.

By analyzing the relationship between an option’s price and its moving average, traders can identify potential trading opportunities. For example, when an option’s price crosses above a moving average (in the case of a call option) or below a moving average (in the case of a put option), it can signal a potential buy or sell signal, respectively.

Tips for Trading Options Using Moving Averages

Integrating moving averages into your options trading strategy requires careful consideration. Here are a few expert tips to guide you:

- Choose the Right Moving Average: Experiment with different moving average types and periods to determine which works best for your trading strategy.

- Consider Multiple Moving Averages: Using multiple moving averages with varying periods can provide a more comprehensive view of price trends and enhance signal accuracy.

- Combine Moving Averages with Other Indicators: Moving averages should be used in conjunction with other technical indicators, such as support and resistance levels or candlestick patterns, for a more robust trading strategy.

It’s important to remember that trading options using moving averages, like any trading strategy, involves risk. Always conduct thorough research, understand the risks involved, and consider your investment goals and risk tolerance before executing any trades.

Image: excellenceassured.com

Frequently Asked Questions

Q: What is the most effective moving average for options trading?

A: The effectiveness of moving averages varies depending on the underlying asset, market conditions, and individual trading style. Experimentation is key to identifying the best moving average for your strategy.

Q: Can moving averages predict future price movements?

A: Moving averages do not provide definitive predictions but rather offer insights into market trends and potential trading opportunities. They are not a foolproof method, and risk management is crucial.

Trading Options Using Moving Averages

Image: www.tradingwithrayner.com

Conclusion

Trading options using moving averages is a powerful technique that can enhance your trading strategy. By understanding the basics, applying expert tips, and incorporating risk management practices, you can effectively leverage this indicator to identify potential trading opportunities and navigate market fluctuations. Remember, continuous learning, research, and adaptation are essential to maximize your trading acumen and strive for success in the dynamic world of options trading.

Are you interested in trading options using moving averages and further exploring this versatile tool? Share your thoughts and experiences in the comment section below or reach out to us for personalized guidance. Let’s collectively navigate the markets and pursue profitable trading opportunities!