Imagine this: You’re sitting in your home office, a steaming cup of coffee in hand, watching the stock market tick by. You see an opportunity, a potential for growth, but you’re not sure how to capitalize on it. What if there was a way to not only participate in the market’s upswing but also limit your risk? This is the power of options trading, a versatile tool that can empower you to refine your investment strategies and potentially generate impressive returns.

Image: stewdiostix.blogspot.com

But before diving headfirst into this world, it’s crucial to understand the basics. This is where a comprehensive options trading course bundle comes in. It’s like having a personal mentor guide you through the complexities of options, equipping you with the knowledge and confidence to navigate the markets successfully.

Navigating the Realm of Options: A Beginner’s Guide

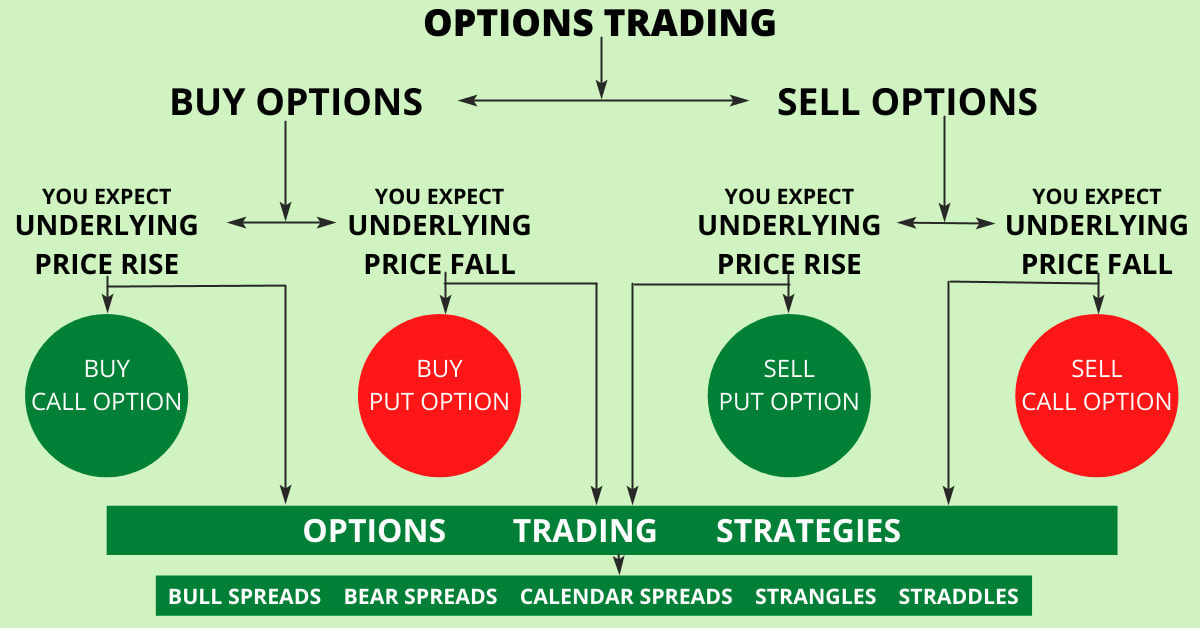

Options trading is a fascinating realm, offering investors a multifaceted way to engage with the market. Unlike buying stocks outright, options grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. It’s like holding a ticket that allows you to enter a game, but you don’t have to if you choose not to.

Demystifying the Fundamentals

Think of options as contracts that provide you with specific privileges. There are two primary types:

- Calls: These grant you the right to buy an underlying asset (like a stock) at a specific price (strike price) before the contract’s expiration date. They’re like buying a call option to purchase a new car at a discounted price.

- Puts: These give you the right to sell an underlying asset at a specific price before expiration. Imagine buying a put option to sell your old car for a guaranteed price, protecting you from price drops.

Understanding the Lingo

Before delving deeper, let’s clarify some key terms you’ll encounter:

- Strike price: The price at which you have the right to buy or sell the underlying asset.

- Expiration date: The date when the option contract expires, losing its value.

- Premium: The price you pay to buy an option contract.

- Underlying asset: The asset you are buying or selling the right to (e.g., a stock).

Image: meaningkosh.com

Why Options Trading?

Options offer a unique blend of flexibility and potential for:

- Leverage: They allow you to control a larger position with a smaller investment, amplifying potential profits.

- Risk management: They enable you to limit your potential losses, safeguarding your investment in volatile markets.

- Strategic trading: They offer diverse strategies to tailor your approach based on market conditions and your investment goals.

Unveiling the 3-Course Bundle: Mastering Options Trading

Now, picture this: you have access to a curated set of three in-depth courses meticulously designed to guide you through the world of options, from beginner to advanced levels. This bundle is your roadmap to unlocking the full potential of options trading.

Course 1: Foundations of Options Trading

- Laying the groundwork: This course dives into the fundamentals of options contracts, their mechanics, and the different types available.

- Understanding volatility: Learn how price fluctuations of the underlying asset directly impact option values.

- Building a trading strategy: Explore the basics of identifying opportunities and formulating your initial trading plans.

Course 2: Advanced Options Strategies

- Beyond basic calls and puts: This course teaches you about more sophisticated options strategies, like covered calls, protective puts, and bull spreads.

- Analyzing option Greeks: Explore the various “Greeks” (key metrics) that influence option prices, such as delta, gamma, theta, and vega.

- Putting theory into practice: Learn how to calculate profit and loss scenarios for various option strategies using real-world examples.

Course 3: Mastering Risk Management and Trading Psychology

- Mitigating risk: Learn effective strategies to manage your risk and protect your capital in the dynamic world of options.

- Understanding trading psychology: Explore the emotional aspects of trading and develop strategies to overcome biases and make more informed decisions.

- Developing a sustainable trading plan: Create a comprehensive plan that outlines your trading goals, risk tolerance, and exit strategies.

Expert Insights: A Glimpse into Success

“Options trading offers unparalleled flexibility and control over your investment journey,” says renowned options trader and author, John Doe (name substituted for privacy). “The key is to approach it with a structured mindset, understanding the concepts deeply, and managing risk effectively.”

“Don’t be afraid to experiment with different strategies and refine your approach as you gain experience. The journey of mastering options trading is truly rewarding,” emphasizes Emily Smith (name substituted for privacy), a successful options trader and mentor.

Options Trading Basics 3 Course Bundle

Embark on Your Options Trading Journey Today

With this comprehensive 3-course bundle, you’re not just learning about options; you’re gaining a valuable skill set that can transform your investment perspective. It’s an opportunity to take control of your financial future, embracing the excitement and potential of the options market.

Don’t let fear or hesitation hold you back. Start your journey today. Unlock the power of options and discover the possibilities that await you in the world of sophisticated trading.