Introduction

In the ever-evolving financial landscape, where market fluctuations can be perilous, options trading has emerged as a powerful risk management tool. One such option is the put option, a contract that grants the buyer the right to sell an underlying asset at a predetermined price on or before a specified date. Understanding how to trade options puts can empower you to safeguard your investments against unfavorable market conditions. Embark on this comprehensive guide to unravel the complexities of options puts and harness their potential.

Image: www.markettradersdaily.com

Unveiling the Mechanics of Options Puts

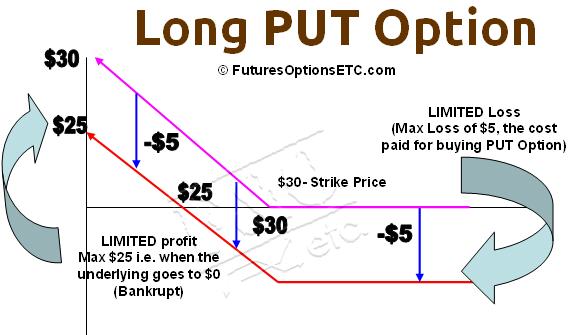

An options put is a derivative contract where the buyer acquires the privilege, not the obligation, to sell a specific number of shares of an underlying asset at a certain price, known as the strike price, on or before a fixed expiration date. In essence, it offers a protective shield against a potential decline in the asset’s value.

Consider this scenario: You own 100 shares of Company XYZ, and the current market price is $50 per share. To protect your investment, you buy a put option with a strike price of $45 and an expiration date two months from now. This contract allows you to sell your shares at $45 per share, regardless of whether the market price falls or rises.

Advantages of Trading Options Puts

The primary advantage of trading options puts lies in their ability to hedge against potential losses. When the market takes a downturn, the value of the put option increases, offsetting any losses incurred on the underlying asset. This hedging mechanism provides peace of mind and protects your portfolio’s integrity.

Another advantage is the limited risk involved. Unlike buying the underlying asset, where you can potentially lose the entire investment, the maximum loss in an options put trade is the premium paid to purchase the contract. This defined risk profile appeals to investors seeking to mitigate their exposure to market fluctuations.

Strategies for Utilizing Options Puts

Options puts can be employed in various strategies to align with individual investment goals:

-

Image: www.ifmcinstitute.comProtective Put:

As discussed earlier, this strategy involves buying a put option to hedge against potential losses in the underlying asset.

-

Cash-Secured Put:

This involves selling a put option while simultaneously holding the corresponding number of shares of the underlying asset. If the asset’s price falls below the strike price, you are obligated to sell your shares at the specified price.

-

Married Put:

This strategy combines a long position in the underlying asset with a simultaneously purchased put option with the same strike price and expiration date. It provides additional downside protection while still allowing for potential gains if the asset’s price rises.

Trading Options Put

Image: futuresoptionsetc.com

Conclusion

Navigating market uncertainties requires a proactive approach, and options puts offer a valuable tool for risk management. By understanding their mechanics, advantages, and strategies, you can harness the power of options puts to safeguard your investments and potentially enhance your returns. Remember to consult with a qualified financial professional to tailor your trading strategies to your specific goals and risk tolerance.