Harnessing the Potential of Options Contracts

In the realm of financial markets, there exists a potent tool that empowers investors with the opportunity to navigate volatility and enhance returns: options trading. Among the most prevalent options strategies are calls and puts, which grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. Understanding the intricacies of these contracts is crucial for unlocking the potential that options trading holds.

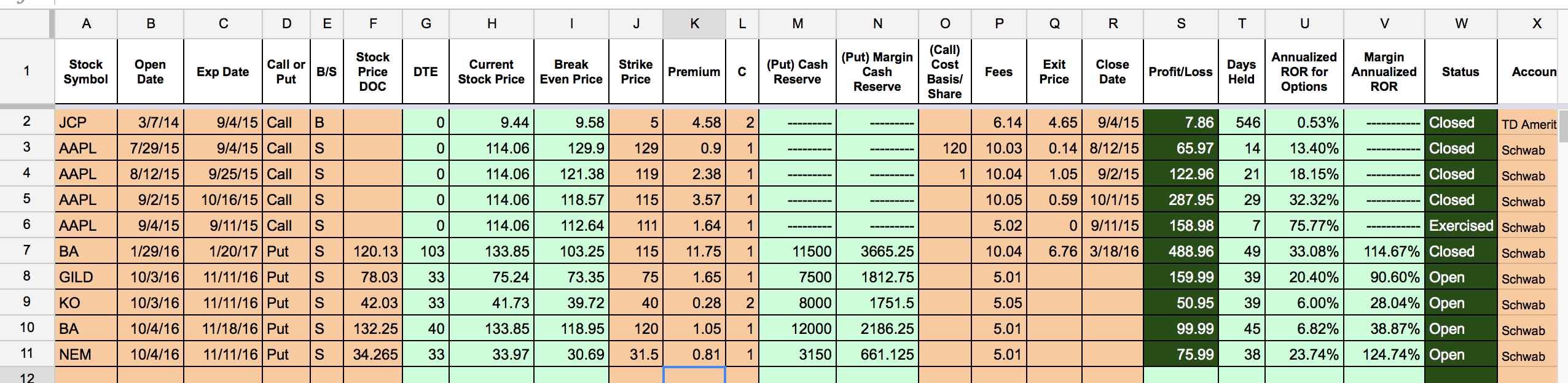

Image: www.toptradingdirectory.com

Embarking on the Journey of Options Trading

Before delving into the mechanics of calls and puts, it’s imperative to establish a strong foundation in options trading concepts. An option contract represents an agreement between two parties, the buyer and the seller, where the buyer has the right but not the obligation to exercise the option at a later date. The terms of the contract stipulate the underlying asset, the strike price (the price at which the buyer can buy or sell), and the expiration date.

A Deeper Dive into Calls and Puts

Calls: A call option grants the buyer the right to purchase an underlying asset at a specified strike price before or on the contract’s expiration date. By acquiring a call option, the buyer has the expectation that the asset’s price will rise above the strike price, allowing them to exercise the option profitably.

Puts: Conversely, a put option provides the buyer with the right to sell an underlying asset at a specified strike price before or on the contract’s expiration date. Investors typically purchase put options when they anticipate the asset’s price to decline, enabling them to sell the asset at the higher strike price before it loses significant value.

The Appeal of Options Trading

Options trading offers a myriad of benefits that contribute to its popularity among investors:

-

Flexibility: Options provide traders with the flexibility to speculate on the direction of an asset’s price without actually owning the underlying asset.

-

Leverage: Options contracts often require a lower up-front investment compared to purchasing the underlying asset directly, providing investors with significant leverage potential.

-

Managing Risk: Options strategies can be employed to hedge against potential losses, allowing investors to manage risk more effectively.

Image: www.twoinvesting.com

Navigating the Complexities of Options Trading

While options trading presents ample opportunities, it’s crucial to proceed with caution and a thorough understanding of the risks involved. Here are some key considerations for aspiring options traders:

-

Expiration Date: Options contracts have a finite lifespan, and the value of the option decays as the expiration date approaches. Choosing an appropriate expiration date is crucial for maximizing profitability and mitigating losses.

-

Volatility: Options premiums are directly influenced by the volatility of the underlying asset. Traders should carefully assess the market’s expected volatility before entering an options position.

-

Commission: Trading options incurs commissions, which can eat into profits if not factored into the trading strategy.

The Path to Options Trading Success

Mastering options trading requires dedication, knowledge, and a disciplined approach. Aspiring traders should embark on a journey of learning, studying reputable sources, and seeking guidance from experienced investors or professional brokers. By embracing a thirst for knowledge and prudent risk management, traders can unlock the transformative power of options trading.

Options Trading Call & Puts

Image: www.hashtaginvesting.com

Conclusion

Options trading, with its array of strategies such as calls and puts, offers investors a potent tool to navigate financial markets. By equipping themselves with knowledge, implementing sound risk management practices, and seeking expert guidance when necessary, traders can harness the potential of options contracts to achieve their financial goals. Remember, the journey to options trading mastery is an ongoing pursuit that requires dedication and a passion for financial acumen.