Embarking on the Enigmatic World of Option Trading: A Guide to Selling Puts

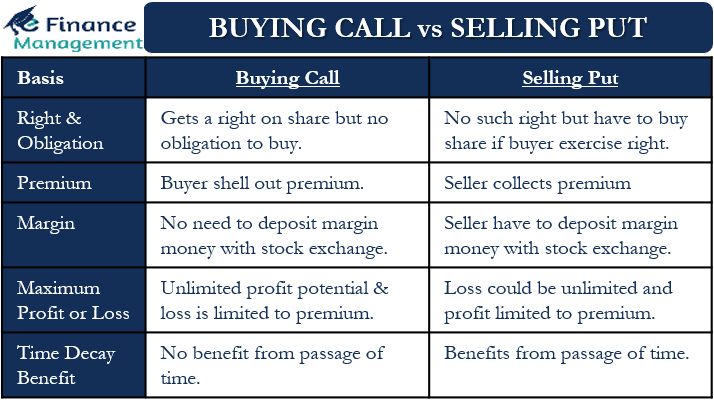

Image: efinancemanagement.com

The labyrinthine world of option trading can be both alluring and intimidating for those eager to venture beyond traditional investment realms. Among the myriad strategies this realm offers, selling puts stands out as a viable option for prudent investors seeking income generation potential and exposure to underlying assets. But before you dive headfirst into the put-selling plunge, it’s imperative to arm yourself with a thorough understanding of this strategy, its nuances, and potential ramifications.

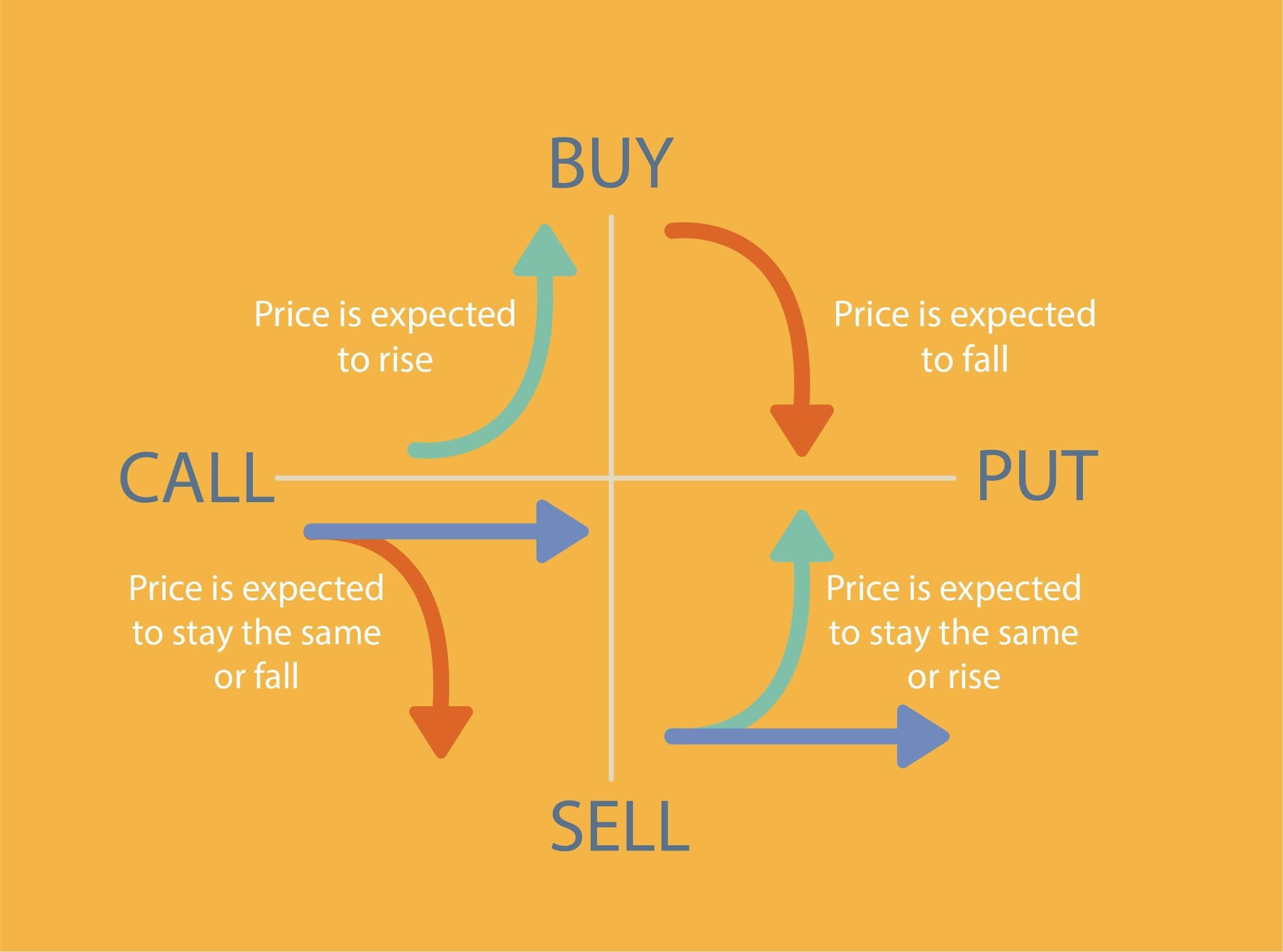

To elucidate the intricacies of put selling, we must first unravel the very essence of options. Options, financial instruments embodying both rights and obligations, grant the holder the privilege, not the obligation, to buy (call options) or sell (put options) an underlying asset at a predetermined price (strike price) by a specified date (expiration date). As we focus on put selling, let’s delve into the specifics of this strategy.

Selling a put option involves granting another party the right to sell you a specified number of shares of a particular stock at a fixed price on or before a set date. In essence, you’re assuming the obligation to purchase those shares if the option is exercised – which could occur if the stock price declines below the strike price. For this service, you receive a premium, representing the price paid by the option buyer for the right to sell you the shares.

The decision of whether to sell a put as an initial foray into option trading hinges on a careful assessment of several factors, including:

-

Risk tolerance: Put selling carries inherent risk, particularly in scenarios where the underlying stock price plummets. Thus, it’s crucial to meticulously evaluate your risk appetite before embarking on this strategy.

-

Market outlook: A rudimentary understanding of market trends and the trajectory of the underlying asset is indispensable. If you anticipate a bullish or neutral market, selling puts might prove advantageous.

-

Investment horizon: Put selling generally aligns with short-term to medium-term investment horizons, as the options typically expire within a year.

If these factors align with your financial goals and risk tolerance, selling puts can provide a gateway into option trading. However, it’s paramount to acknowledge that options trading, including put selling, is a complex endeavor that merits thorough research, prudent risk management, and a measured approach.

Demystifying the Mechanics of Put Selling

To further unravel the intricacies of put selling, let’s examine a hypothetical scenario. Suppose you believe the stock price of Company XYZ is poised to remain stable or potentially appreciate in the coming months. You could sell a one-month put option with a strike price of $50 for a premium of $3.

Here’s how this transaction unfolds:

-

You receive a $3 premium for granting the option buyer the right to sell you 100 shares of XYZ at $50 per share on or before the expiration date.

-

If the stock price remains above $50 by expiration, the option will expire worthless, and you retain both the premium and the obligation to buy the shares.

-

Conversely, if the stock price drops below $50, the option holder may exercise their right to sell you 100 shares at $50 per share. In this case, you’re obligated to purchase those shares at the agreed-upon strike price, regardless of the prevailing market price.

The profit or loss potential in selling puts is directly tied to the movement of the underlying stock price relative to the strike price. Understanding these dynamics and meticulously managing risk are essential for successful put selling.

Harnessing Put Selling for Income Generation

One of the primary motivations for selling puts is the potential for income generation. By collecting premiums for granting the option to sell, you can generate a steady stream of income, regardless of whether the option is ultimately exercised.

However, it’s imperative to recognize that this income is not risk-free. If the underlying stock price plummets, you may be obligated to purchase shares at a price higher than the prevailing market value, potentially incurring losses that offset or exceed the premiums you’ve collected.

Put Selling: Embracing the Role of a Market Maker

When you sell a put option, you effectively become a market maker for that specific option contract. As the grantor of the option, you’re providing liquidity to the market and facilitating trades between buyers and sellers.

This role carries inherent responsibilities, including the obligation to fulfill your commitment to buy the underlying shares if the option is exercised. It’s crucial to approach this responsibility with prudence and a thorough understanding of the risks involved.

Image: www.youtube.com

Risk Management Considerations in Put Selling

As previously mentioned, put selling involves inherent risks, primarily associated with the potential for significant losses if the underlying stock price undergoes a precipitous decline. To mitigate these risks effectively, several measures are essential:

-

Selecting appropriate strike prices: Choosing strike prices that align with your risk tolerance and market outlook is paramount. Avoid overly ambitious strike prices that expose you to excessive risk.

-

Monitoring market conditions: Vigilant monitoring of market conditions and the performance of the underlying asset is crucial. If market conditions change drastically, you may need to adjust your strategy or exit the trade promptly to limit potential losses.

Do I Sell A Put To Begin Option Trading

Image: wallpaperide24107.blogspot.com

Conclusion

Selling puts can serve as a viable entry point into option trading for risk-tolerant investors seeking income generation potential. By granting the right to sell shares at a predetermined price, put sellers can collect premiums while assuming the obligation to purchase those shares if the option is exercised.

However, thorough research, prudent risk management, and a clear understanding of the mechanics and potential pitfalls of put selling are essential for success. By adhering to these principles and approaching this strategy with a measured and responsible mindset, you can harness the potential benefits of put selling while navigating the inherent risks associated with this intricate financial instrument.