Trading options can be a daunting endeavor, but when it comes to soybean options, there’s a wealth of opportunities waiting to be explored. As a crucial commodity in global agriculture, soybeans play a pivotal role in food security and provide investors with a compelling asset class. This comprehensive guide will empower you with the knowledge and strategies needed to navigate the world of soybean options trading, unlocking the potential for substantial gains.

Image: www.researchgate.net

Delving into Soybean Options: A Cornerstone of Agricultural Markets

Soybean options are contracts that grant the buyer the right, but not the obligation, to buy or sell a specific quantity of soybeans at a set price on a predetermined date. These contracts offer flexibility, allowing traders to hedge against price fluctuations or speculate on future soybean prices. Understanding the dynamics of soybean production, consumption, and trade flows is essential for successful trading.

Mastering the Mechanics of Soybean Options: From Premiums to Exercise Dates

In the realm of options trading, a premium is the price paid upfront to obtain the right to buy or sell the underlying asset. Soybean options are typically priced in cents per bushel, and the premium fluctuates based on factors such as the stock’s price, time to expiration, and market volatility. Understanding the interplay of these factors is crucial for making informed trading decisions.

Furthermore, options have an expiration date, after which they become worthless if not exercised. Traders must carefully consider the appropriate expiration date based on their investment horizon and market outlook.

Harnessing Market Insights: Unlocking the Secrets of Soybean Options Trading

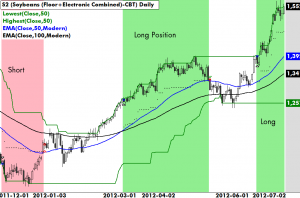

Successful soybean options trading hinges on the ability to analyze market trends and make informed predictions. Technical analysis, fundamental analysis, and sentiment analysis are essential tools in this endeavor.

Technical analysis involves studying historical price data to identify patterns and trends that can indicate future price movements. Fundamental analysis examines factors such as crop yields, global demand, and weather conditions to assess the intrinsic value of soybeans. Sentiment analysis gauges the market’s overall mood towards soybeans, which can influence price movements. By combining these analytical approaches, traders can gain an edge in the soybean options market.

Image: tradingstrategyguides.com

Embracing Strategies for Success: From Hedging to Speculation

The versatility of soybean options allows for a wide range of trading strategies tailored to different risk appetites and investment goals. For risk-averse investors seeking to protect their soybean positions, hedging strategies like buying put options can mitigate potential losses. Alternatively, speculative traders seeking to capitalize on price movements can employ strategies like buying call options or selling put options.

Understanding these strategies and matching them with your investment objectives is paramount for maximizing returns.

Trading Soybean Options

Image: www.followingthetrend.com

Conclusion: Embarking on the Soybean Options Odyssey

Trading soybean options is a complex yet rewarding endeavor that requires a thorough understanding of market dynamics, options mechanics, and trading strategies. By embracing the knowledge and insights provided in this comprehensive guide, you’ll be well-equipped to embark on the soybean options odyssey, unlocking the potential for substantial gains in this dynamic agricultural market.