Introduction:

In the realm of agricultural economics, soybean options trading has emerged as a potent tool for managing risk and capitalizing on market opportunities. As a crucial component of the global food system, soybeans command significant economic importance. Embark on this comprehensive guide to unravel the nuances of soybean options trading, empowering you to navigate the agricultural markets with confidence.

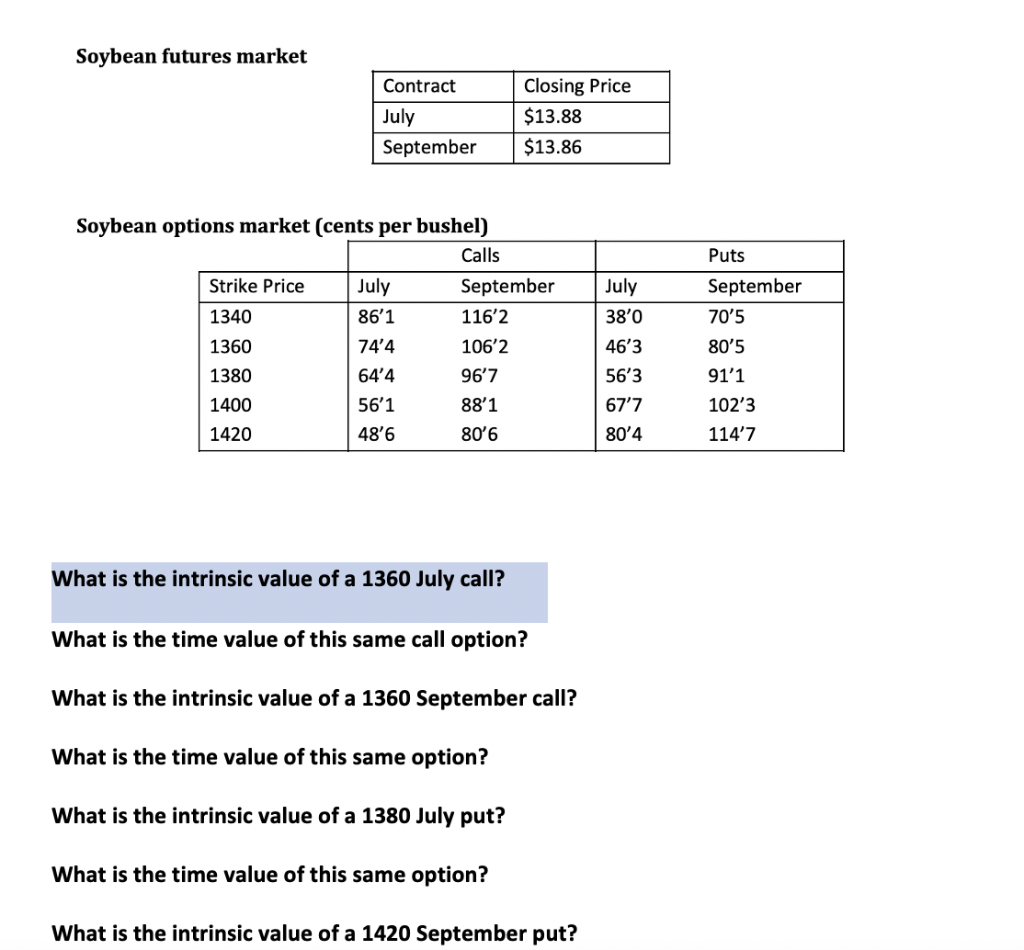

Image: www.chegg.com

Understanding Soybean Options:

Soybean options contracts offer agricultural market participants the right, but not the obligation, to buy (call option) or sell (put option) a predetermined quantity of soybeans at a specific price on or before an established expiration date. These contracts are standardized instruments traded on commodity exchanges, ensuring transparency and liquidity.

Benefits of Soybean Options Trading:

The allure of soybean options trading lies in its versatility, catering to a diverse range of market strategies. These include:

-

Hedging against Price Risk: Farmers, processors, and other market participants can utilize soybean options to mitigate financial losses caused by unfavorable price fluctuations.

-

Profiting from Market Volatility: Soybean options provide opportunities to capitalize on market volatility by speculating on price movements.

-

Enhancing Return Strategies: Combining soybean options trading with other financial instruments can enhance the overall return of an investment portfolio.

Essential Elements of Soybean Options Contracts:

-

Underlying Asset: Soybeans

-

Contract Size: Typically 5,000 bushels of soybeans

-

Expiration Date: The date on which the option contract expires

-

Strike Price: The specified price at which soybeans can be bought (call option) or sold (put option)

-

Option Premium: The price paid for acquiring an options contract, reflecting the market’s assessment of its value

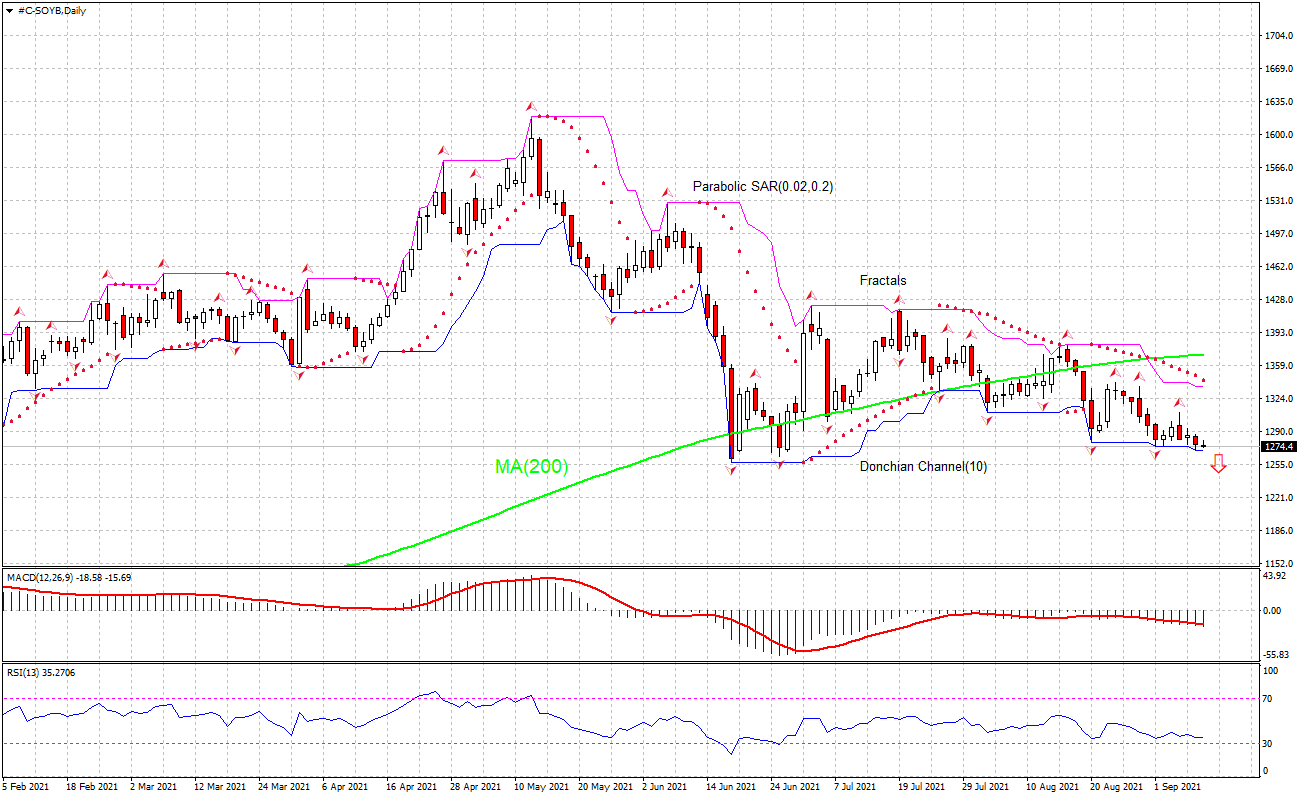

Image: www.ifcmarkets.com

Understanding Call and Put Options:

-

Call Options: Grant the holder the right to buy soybeans at the strike price, regardless of the prevailing market price. They are used to speculate on potential price increases or hedge against price declines.

-

Put Options: Confer the right to sell soybeans at the strike price, regardless of the prevailing market price. They are employed to speculate on potential price decreases or hedge against price increases.

Trading Soybean Options on Commodity Exchanges:

Soybean options are traded on designated contract markets, such as the Chicago Board of Trade (CBOT). Market participants can buy or sell soybean options contracts directly or through intermediaries like brokers.

Factors Influencing Soybean Option Prices:

Numerous factors impact soybean option prices, including:

-

Supply and Demand Dynamics: Soybean production levels, global demand, and inventory levels influence soybean prices and, consequently, option prices.

-

Economic Conditions: Economic growth and inflation rates impact the overall demand for soybeans, affecting option prices.

-

Weather Conditions: Adverse weather conditions can affect soybean production and, subsequently, option prices.

-

Government Policies: Government programs and regulations can influence soybean production and trade, impacting option prices.

Risk Management in Soybean Options Trading:

Like any financial instrument, soybean options trading involves inherent risks. Prudent trading practices include:

-

Understanding the Risks: Traders should thoroughly comprehend the potential risks and rewards of soybean options trading.

-

Managing Financial Exposure: Setting appropriate trading limits and utilizing stop-loss orders can mitigate financial losses.

-

Hedging Positions: Utilizing a combination of soybean futures and options contracts can hedge risk and reduce potential downside exposure.

Soybean Options Trading

Image: set-and-forget.com

Conclusion:

Soybean options trading presents a myriad of opportunities and challenges within the agricultural markets. By grasping the intricacies of this trading vehicle, market participants can effectively mitigate risks and seize market opportunities. Thorough research, prudent risk management, and a keen understanding of market dynamics empower traders to navigate the soybean options market with confidence. Embark on the journey of soybean options trading today, unlocking the potential of this powerful financial instrument in the world of agricultural commodities.