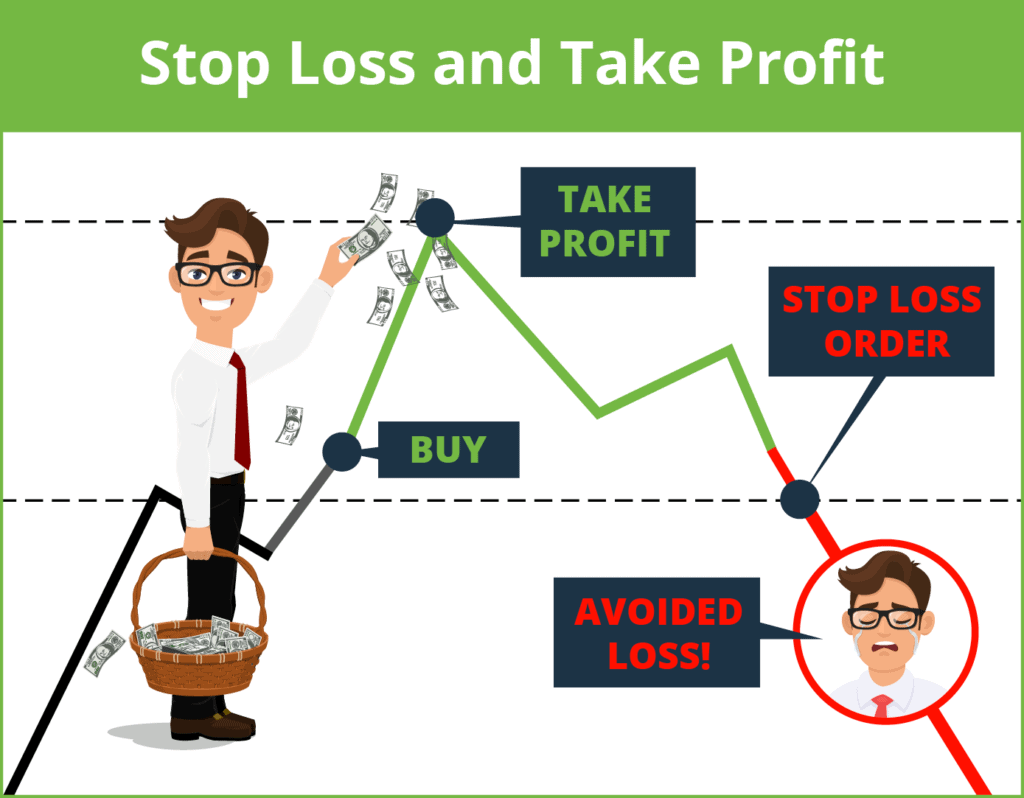

In the realm of option trading, stop-loss orders act as a crucial risk management tool, helping traders limit potential losses and preserve their capital. Determining an effective stop-loss level requires careful consideration, and several factors play a pivotal role in this decision.

Image: tradingforexcoid.blogspot.com

Factors Influencing Stop-Loss Placement

1. Risk Tolerance: A trader’s individual risk tolerance should profoundly influence stop-loss placement. Those with a lower tolerance may prefer tighter stop-loss levels, while more risk-tolerant traders may allow for more room for market fluctuations.

2. Market Volatility: Market volatility measures the magnitude of price movements over a defined period. Higher volatility warrants wider stop-loss levels to accommodate potential price swings, while less volatile markets may allow for more precise stop orders.

Understanding Option Greeks

Option Greeks are key metrics that quantify option behavior and provide insights into their price sensitivity. Two crucial Greeks for stop-loss decisions are Delta and Volatility:

Delta: Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. Higher Delta options (e.g., near-the-money or at-the-money) exhibit a more significant price movement for each point change in the underlying, necessitating tighter stop-loss levels.

Volatility: Implied Volatility (IV) reflects market expectations of future price fluctuations. Higher IV implies greater uncertainty, and stop-loss levels should be adjusted accordingly to accommodate potential price movements.

Tips for Efficient Stop-Loss Placement

Consider these expert tips to enhance stop-loss effectiveness:

1. Support and Resistance Levels: Identify key support and resistance levels in the underlying chart. Placing stop-loss orders close to these levels can mitigate losses if the market reverses course.

2. Technical Analysis: Utilize technical indicators (e.g., moving averages, trendlines) to identify potential trend reversals or support and resistance zones, which can serve as ideal stop-loss locations.

3. Historical Volatility Analysis: Study historical volatility data to gauge the magnitude of price fluctuations that the underlying asset has experienced in the past, which can inform stop-loss placement decisions.

Image: www.youtube.com

Frequently Asked Questions (FAQs)

Q: Should stop-loss levels be absolute?

A: Not necessarily. Traders may consider trailing stop-loss orders that adjust dynamically with market movements, allowing for some profit protection while accommodating potential trend reversals.

Q: How often should I adjust my stop-loss levels?

A: Stop-loss orders should be reviewed and adjusted periodically, especially when market conditions change significantly or when new technical or fundamental information emerges.

What Should Be The Stop Loss In Option Trading

Conclusion

Establishing an optimal stop-loss level in option trading is a multifaceted process that requires a thorough understanding of market dynamics, risk tolerance, and option Greeks. By adhering to the guidelines and expert advice outlined in this article, traders can enhance their risk management strategy and increase the likelihood of preserving capital while pursuing profit opportunities in the options market.

If you found this article informative and would like to further explore the topic of stop-loss placement in option trading, consider visiting reputable financial websites or consulting with a qualified financial advisor for tailored guidance.