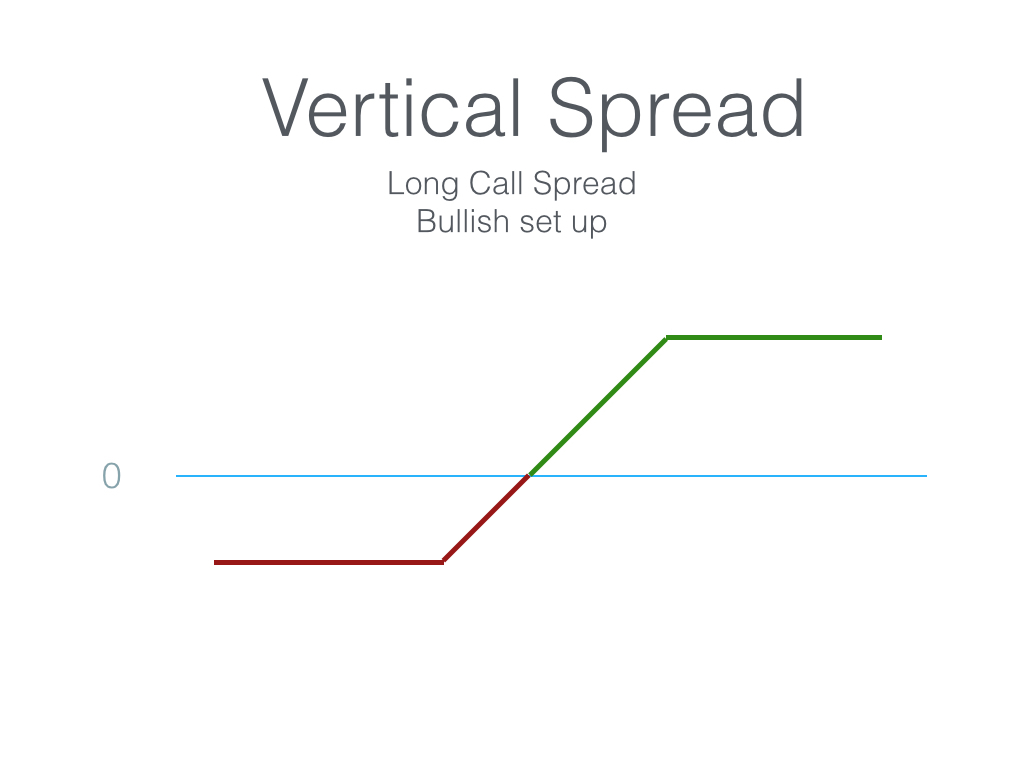

Imagine you’re on a financial expedition, seeking a path to amplify your portfolio’s growth. One captivating avenue is vertical spread option trading. It’s like a balanced dance, where you strategically combine options with varying strike prices to create a customizable profit potential. Thinkorswim, a powerful trading platform, empowers you to harness this technique with ease.

Image: www.randomwalktrading.com

What is Vertical Spread Option Trading?

Vertical spread option trading involves simultaneously buying and selling options with different strike prices but the same expiration date. The difference between these strike prices is known as the spread. By constructing this structure, you gain the flexibility to fine-tune your risk and reward.

Types of Vertical Spreads

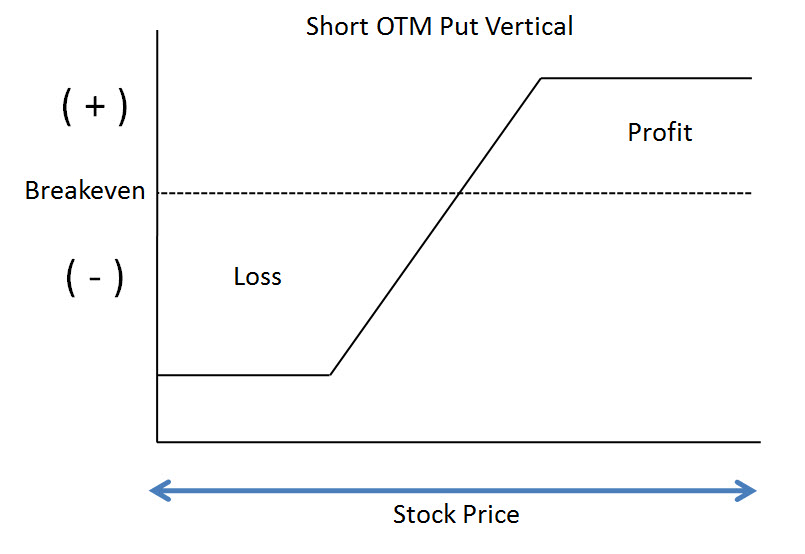

There are two primary types of vertical spreads:

Bull Call Spread: Purchase a lower strike call option and simultaneously sell a higher strike call option at the same time. This strategy is ideally executed when you anticipate a moderate price increase in the underlying asset.

Bear Call Spread: Sell a lower strike call option and purchase a higher strike call option. This spread benefits from a declining or flat market where the underlying asset’s price is expected to remain within a range.

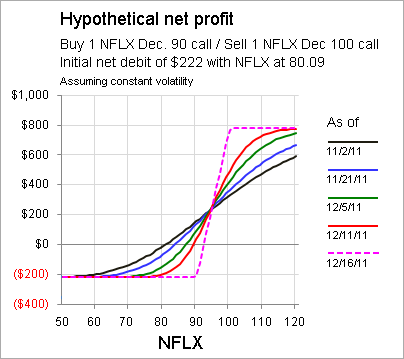

Thinkorswim Platform

Thinkorswim is an intuitive platform that simplifies vertical spread option trading. Its user-friendly interface and robust tools provide a seamless experience for both beginners and experienced traders. Here’s how you can use Thinkorswim for vertical spread trading:

- Create a TOS Account: Begin by opening an account with Thinkorswim.

- Identify Candidates: Analyze the market for potential trading opportunities. Focus on stocks with strong volatility and liquidity.

- Set Up Trade: Use the Option Chain tool to visualize available options for a specific stock. Select options with appropriate strike prices and expiration dates.

- Enter Order: Specify the details of your vertical spread trade, including buy/sell action, quantity, and strike prices. Preview the details before submission.

Benefits of Vertical Spread Option Trading

- Limited Risk: Spreads effectively cap potential losses since they involve simultaneously buying and selling options.

- Tailored Risk and Reward: Traders can customize spreads based on their risk tolerance and profit objectives.

- Enhanced Flexibility: Spreads allow you to adjust your position as market conditions change, giving you greater control.

Cautions

Vertical spread trading is a sophisticated strategy with inherent risks. Consider the following cautions before diving in:

- Knowledge and Experience: It’s essential to possess a thorough understanding of options and spread trading concepts.

- Market Volatility: Spreads can amplify market volatility, so it’s crucial to monitor market conditions closely.

- Time Decay: Options lose value over time, which can impact spreads, particularly during extended market downturns.

Conclusion

Vertical spread option trading with Thinkorswim empowers you to navigate the financial markets with precision and flexibility. Its intuitive platform and comprehensive tools simplify the process, enabling you to explore this powerful strategy. Remember to approach trading with caution, armed with knowledge, experience, and a solid understanding of the risks involved. As you embark on this journey, let Thinkorswim be your guiding star, illuminating the path to calibrated risk and tailored rewards.

Image: thewaverlyfl.com

Vertical Spread Option Trading Think Or Swim

Image: seekingalpha.com