Introduction

Have you ever yearned to explore the exhilarating world of options trading but hesitated due to the perceived risks? Simulation option trading presents an ingenious solution, allowing you to delve into market dynamics, refine your strategies, and potentially improve your trading performance – all without risking a dime. Dive into this comprehensive guide to uncover the fascinating realm of simulation option trading and empower yourself with a risk-free path to market mastery.

Image: github.com

Understanding Simulation Option Trading

Simulation option trading mimics real-world option trading environments, providing traders with virtual trading platforms and fictitious funds to execute trades. Unlike live trading, where profit or loss is realized, simulation trading incurs no financial consequences, creating a safe learning environment for aspiring and experienced traders alike.

Benefits of Simulation Option Trading

Enhanced Learning Experience:

Simulation trading serves as an unparalleled learning tool, enabling traders to experiment with different strategies, understand market intricacies, and comprehend the consequences of their decisions in a risk-free environment.

Image: www.optiontradingtips.com

Improved Risk Management:

By practicing option trading in a simulated setting, traders can hone their risk management skills, refine their entry and exit strategies, and develop a better understanding of proper position sizing.

Stress-Free Experimentation:

Simulation trading eliminates the psychological pressure of trading real capital, allowing traders to explore different approaches and techniques without the fear of incurring losses, fostering creativity and innovation.

Choosing a Simulation Platform

Selecting the right simulation trading platform is crucial. Consider the following factors:

- Historical Data: Look for platforms that offer access to historical data, enabling you to backtest strategies and learn from historical market patterns.

- Real-Time Market Data: Real-time data ensures you’re trading in a realistic environment and learning to respond to market fluctuations effectively.

- Variety of Instruments: Consider platforms offering a wide range of options to trade, encompassing various underlying assets, expiration dates, and strike prices.

Essential Concepts for Simulation Option Trading

Call vs. Put Options:

Call options grant the buyer the right to buy an underlying asset at a specified strike price, while put options give the buyer the right to sell. Understanding their differences is crucial for successful option trading.

Premiums and Expiry Dates:

Options premiums represent their purchase price, and expiration dates determine the timelines within which options can be exercised or sold. Traders need to factor in these aspects to optimize their strategy.

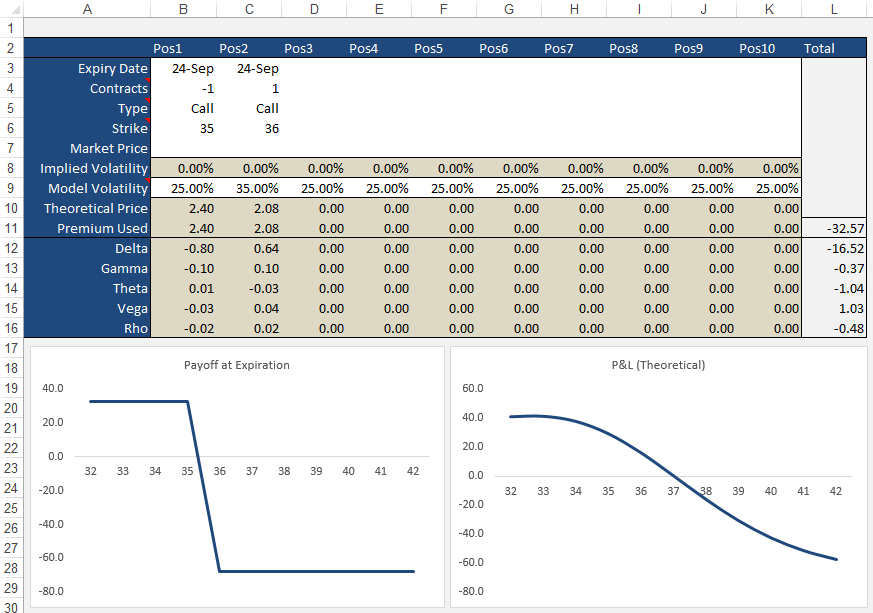

Volatility and Greeks:

Volatility measures the market’s price fluctuations, and Greeks are metrics that gauge an option’s sensitivity to factors like price changes and time decay. Comprehending these concepts is essential for risk management.

Simulation Option Trading

Image: talhaforbes.blogspot.com

Conclusion