In the dynamic realm of options trading, Greeks play a pivotal role in deciphering market intricacies. Among these Greeks, theta occupies a unique position, representing the relentless march of time and its profound impact on option value.

Image: globaltradingsoftware.com

Understanding Theta: The Essence of Time Decay

Theta, denoted by the Greek letter θ, quantifies the rate at which an option’s value diminishes as time elapses. This phenomenon, known as time decay, is essentially the erosion of option value due to the passage of time. As the expiration date approaches, theta exerts a progressively stronger force, eroding the premium paid for the option.

Implications for Traders: Timing Matters

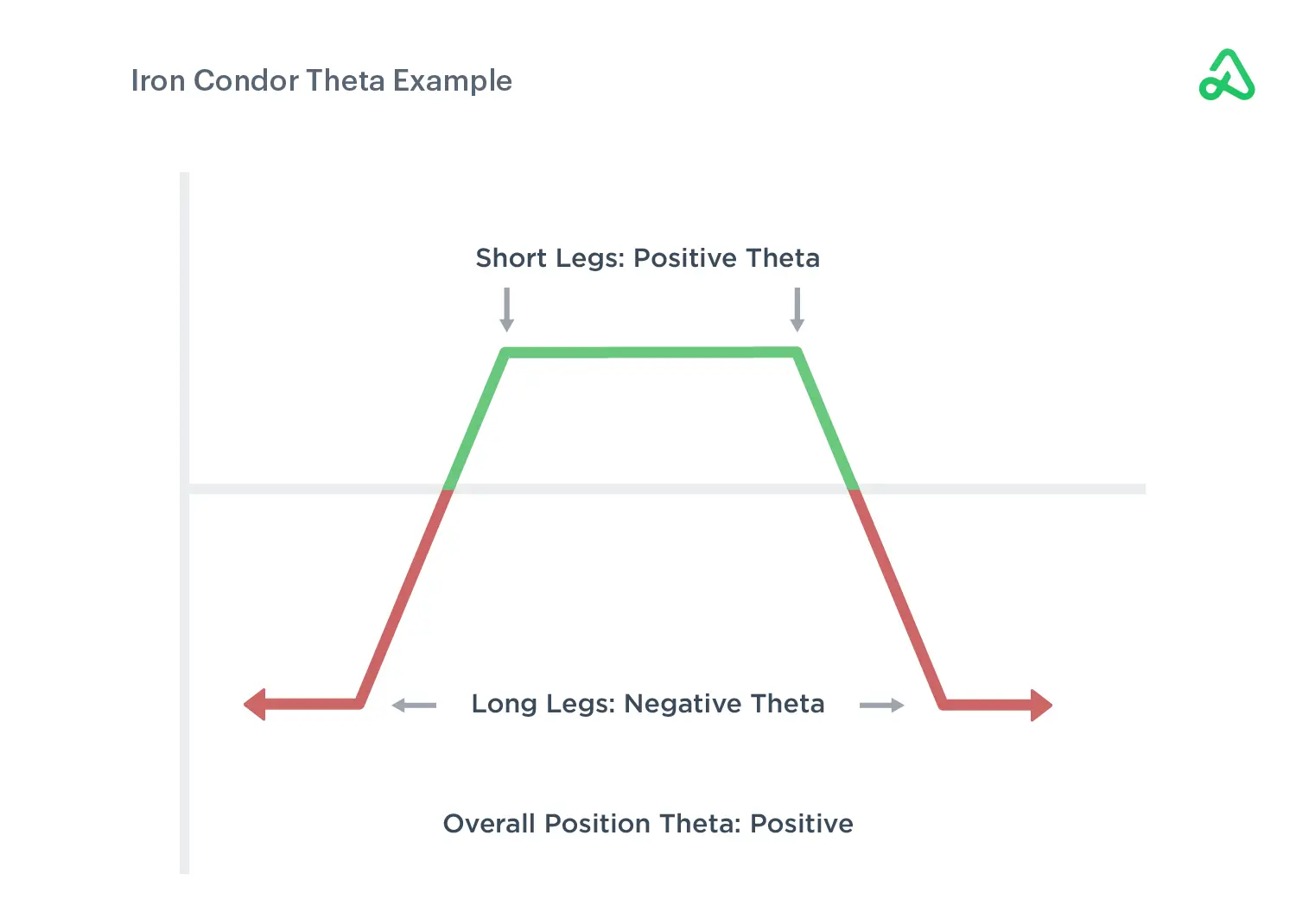

Theta’s significance lies in its implications for traders who must carefully consider the time factor when buying or selling options. For instance, buyers of call or put options should be cognizant that theta will work against them as time progresses. Conversely, sellers of options benefit from theta’s time decay effect, as it reduces the potential payout they may owe.

Factors Influencing Theta

The magnitude of theta is influenced by several factors, including:

- Time to Expiration: Theta’s impact intensifies as the expiration date draws near.

- Option Type: Call and put options experience theta decay at different rates.

- Underlying Price: Theta is inversely proportional to the underlying asset’s price.

- Interest Rates: Rising interest rates can increase theta decay.

- Volatility: Higher volatility levels tend to reduce theta’s effect.

Practical Applications of Theta

Understanding theta empowers traders to make informed decisions, such as:

- Optimizing Trade Entry and Exit: Theta can guide traders on the ideal time to enter or exit option trades based on their time horizons.

- Managing Risk: Theta plays a crucial role in risk management, as traders can monitor option decay to adjust positions accordingly.

- Sentiment Analysis: Theta’s behavior can provide insights into market sentiment and expectations about future price movements.

Expert Insights and Actionable Tips

“Effectively managing theta is essential for options traders,” says Dr. Mark Sebastian, a renowned options expert. “Traders should closely monitor theta decay and incorporate it into their trading strategies.”

To harness the power of theta, traders can consider the following tips:

- For short-term trades, prioritize options with shorter expirations to minimize theta decay.

- If expecting a significant price move, consider purchasing options with longer expirations to reduce the impact of theta.

- Sell options when theta is working in your favor to capture potential profits from time decay.

- Use theta to identify trading opportunities by analyzing the relationship between option premiums and time to expiration.

Conclusion

Theta occupies a prominent place in options trading, embodying the inexorable force of time decay. By comprehending theta’s implications and applying expert insights, traders can refine their decision-making, optimize risk management, and navigate the complexities of the options market with greater precision. As traders navigate the ever-evolving landscape of options trading, a thorough understanding of theta becomes an indispensable tool in their arsenal.

Image: redot.com

What Does Theta Mean In Trading Options

Image: web.quantsapp.com