An Introduction to the Thrilling World of Options Trading

Prepare yourself to delve into the adrenaline-pumping realm of options trading, where possibilities and risks coexist in a captivating dance. Like a poker game with the market as your opponent, options empower you to bet on the future direction of stocks, indices, or even currencies. The potential for exponential gains beckons, but so does the inherent risk that makes this arena a thrilling playground.

Image: thewaverlyfl.com

Unveiling the Fundamentals of Options Trading

Options, financial instruments derived from underlying assets, grant you the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specified price (strike price) within a defined time frame (expiration date). This flexibility offers a spectrum of strategies, from hedging against potential losses to speculating on market movements for substantial profits.

Understanding the intricate nuances of options trading is paramount. Delta, gamma, theta, and vega – these Greek letters quantify the complex relationship between an option’s price and various market factors. Mastering these concepts enables you to navigate the options market with greater precision and finesse.

Exploring the Strategies for Options Trading Success

In the vast landscape of options trading, countless strategies await your discovery. From simple buy-and-hold positions to complex multi-leg spreads, the options market offers a diverse toolkit for tailoring your approach to specific market conditions.

Covered calls, for instance, involve selling call options against an underlying stock you own. This strategy generates premium income while limiting your potential upside. Conversely, cash-secured puts allow you to sell put options with the cash to purchase the underlying asset available. This approach yields premium income while positioning you for potential stock ownership if the market declines.

The Iron Condor, a neutral strategy, involves selling both call and put options at different strike prices with the goal of profiting from a market moving within a specific range. However, the risk of loss is capped at the premium received.

For the more adventurous, vertical spreads combine the purchase and sale of options with different strike prices and expiration dates. The Bull Call Spread, a bullish strategy, involves buying a call option at a lower strike price while simultaneously selling a call option at a higher strike price. This limits your potential profit but reduces your risk compared to buying a single call option.

Harnessing the Power of Options Trading: Expert Insights

Before venturing into the options market, arm yourself with the wisdom of experienced traders. Seasoned professionals emphasize the importance of thorough research and understanding your risk tolerance. Options trading is a high-stakes game, and it’s crucial to define your financial boundaries and manage your emotions.

Active participation in online forums and social media platforms can provide invaluable insights into market trends and trading strategies. Forums like Investopedia, Reddit’s WallStreetBets, and Twitter offer a wealth of knowledge and perspectives. Engage with other traders, ask questions, and absorb the collective wisdom of the community.

Image: petrikgolowin.blogspot.com

Frequently Asked Questions on Options Trading:

Q: What is the difference between a call and a put option?

A: While a call option grants you the right to buy an underlying asset, a put option gives you the right to sell an underlying asset.

Q: Can I lose more money than I invest in options trading?

A: Options trading involves significant risk. If the underlying asset moves against your predicted direction, you could lose your entire investment plus any additional premium paid for the option.

Q: What is the best way to learn about options trading?

A: Seek knowledge through books, online courses, and webinars. Engage with experienced traders in forums and on social media platforms. Practice using paper trading accounts until you develop confidence in your strategies.

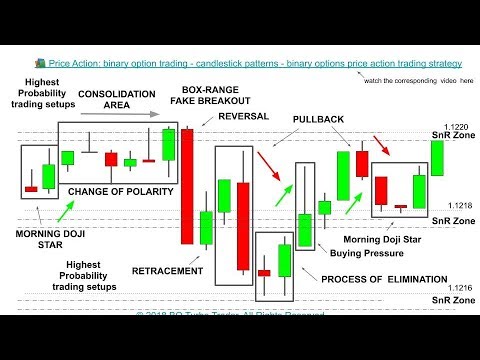

Options Trading Action

Image: www.ig.com

Conclusion: Embracing the Options Trading Frontier

Options trading is a thrilling and potentially lucrative avenue for investors seeking high-growth opportunities. However, it demands a thorough grasp of the concepts, strategies, and risks involved. By educating yourself, seeking expert guidance, and actively managing your portfolio, you can harness the power of options to amplify your returns while navigating the inherent risks.

Are you ready to embrace the exhilarating challenges and immense rewards of options trading? Join the league of investors who have embraced this high-growth, high-risk realm and unlock the full potential of your financial strategies.