In the ever-evolving world of finance, option trading has emerged as a game-changer, offering investors a powerful tool to mitigate risks, enhance returns, and navigate the complexities of the stock market. In India, option trading has gained significant traction in recent years, unlocking new possibilities for investors seeking to harness the market’s potential. This article delves into the fascinating realm of option trading in the Indian market, exploring its fundamentals, strategies, and applications, empowering you with the knowledge to unlock its vast array of opportunities.

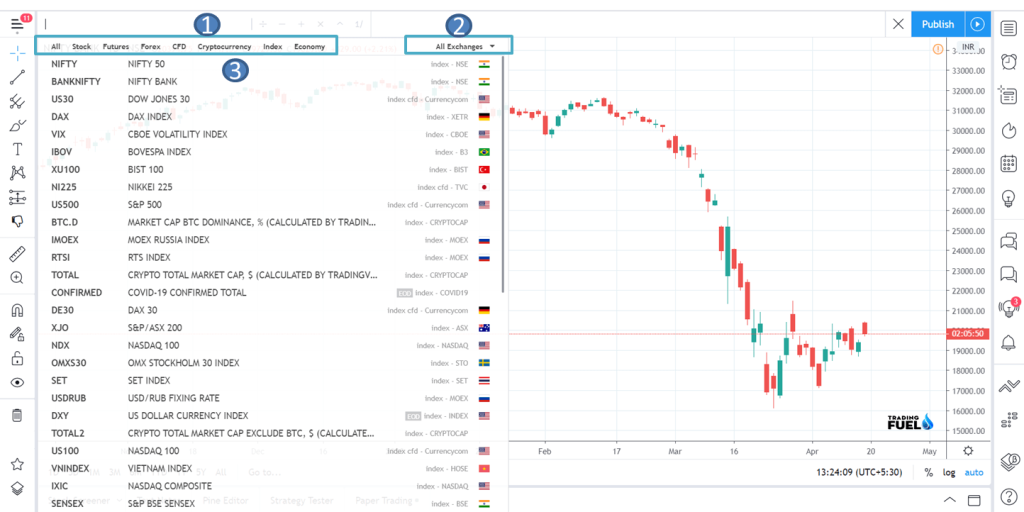

Image: www.tradingfuel.com

Understanding Option Trading: A Gateway to Market Opportunities

An option, in the financial context, is a contract that grants the holder the right, but not the obligation, to buy (call option) or sell (put option) a specific asset at a predefined price (strike price) within a specified timeframe (expiry date). In essence, it offers the holder a choice to exercise the option or not, providing flexibility and risk management options.

Option trading in India is predominantly executed on the NSE’s (National Stock Exchange) derivative segment, where traders can access a wide range of underlying assets, including stocks, indices, and commodities. This diversity allows investors to tailor their strategies to specific sectors or market trends, catering to varying risk appetites and investment goals.

Keys to Success: Unraveling Option Trading Strategies

Harnessing the power of option trading lies in understanding and implementing effective strategies. One of the most prevalent approaches is covered calls, where an investor sells (writes) a call option while holding the underlying asset. This strategy enables the collection of premiums upfront, potentially offsetting potential losses in the event of a price decline.

For those seeking to take advantage of anticipated price movements, buying call (for bullish expectations) or put options (for bearish outlooks) offers significant potential returns. However, it’s essential to note that while option premiums are attractive, they carry the risk of losing the entire premium paid if the option expires worthless.

Navigating Market Dynamics: Tips for Informed Decision-Making

Navigating the complexities of option trading requires a combination of technical expertise and market understanding. Keep a keen eye on underlying asset prices, closely monitoring news, company announcements, and economic indicators that may influence price fluctuations. Additionally, a thorough understanding of option pricing models, such as the Black-Scholes model, can aid in determining fair prices and evaluating potential risks and rewards.

Image: www.youtube.com

Beyond the Basics: Advanced Option Trading Strategies

As you gain experience, you may wish to explore more advanced option trading strategies, such as combinations of calls and puts (spreads) or using options to hedge existing positions. These strategies offer greater flexibility, but they also come with increased complexity and risk. It’s crucial to approach these advanced techniques with ample knowledge, research, and prudent risk management practices.

Option Trading In Indian Market

Conclusion: Unleashing the Potential of Option Trading

Option trading in the Indian market can be a powerful instrument for investors seeking to augment their portfolio performance, mitigate risk, and seize market opportunities. However, it’s imperative to approach this sphere with a well-rounded understanding of the associated risks. By embracing the strategies and principles outlined above, investors can navigate the complexities of option trading with confidence, unlocking the full potential of this fascinating financial instrument.