Introduction

Options trading, an intriguing realm of financial markets, has captivated investors with its tantalizing promise of profit. Like a poker game played with market assets, it requires astute strategy alongside an understanding of its nuances to come out on top. Allow me to take you on a journey that unravels this venerable trading arena, equipping you with the wisdom to navigate its intricate paths.

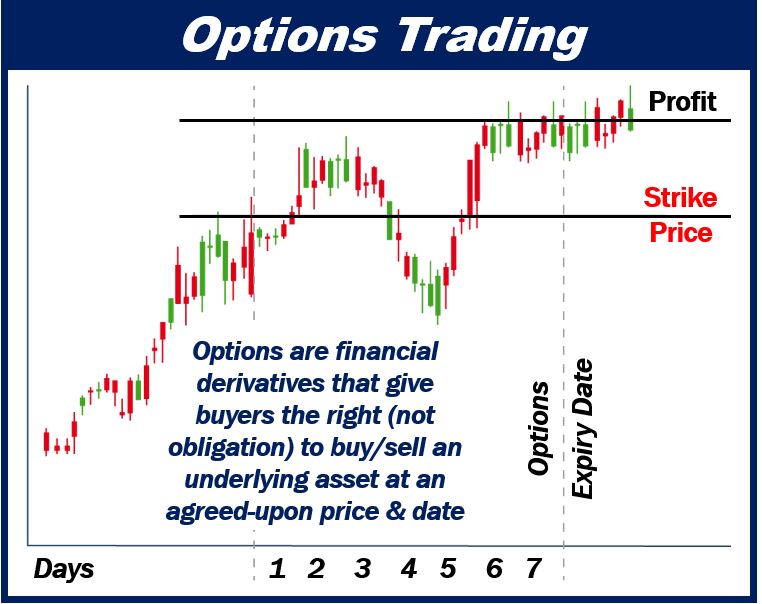

Image: marketbusinessnews.com

For ages, options have served as a cornerstone of financial instruments, empowering investors with the flexibility to capitalize on market predictions. It’s a fascinating dance between risk and reward, where traders wager on the future price movements of underlying assets like stocks or indices.

Types of Options: Calls and Puts

In the options trading arena, two gladiators reign supreme: call options and put options. Call options grant the holder the right, not the obligation, to acquire an underlying asset at a predetermined price (the strike price) on or before a designated date (the expiration date). When the market smiles upon you and the asset’s price ascends beyond the strike price, call options become champions, granting you the potential for substantial gains.

Put options, on the other hand, offer the right (once again, not the duty) to sell an underlying asset at a predetermined price before the expiration date. These options blossom when market conditions turn stormy, causing the asset’s price to fall below the strike price. It’s an opportunity for traders to hedge against potential losses or speculate on a downward market trajectory.

Anatomy of an Options Contract

To decipher the secret language of options, understanding the components of an options contract is paramount. The strike price, as mentioned earlier, signifies the price at which you can execute your right to buy (for call options) or sell (for put options) the underlying asset. The expiration date determines the deadline for exercising this right, while the premium represents the price you pay upfront to acquire an options contract.

Delta measures the sensitivity of the option’s price to changes in the underlying asset’s price. Theta, on the other hand, quantifies the impact of time decay on the option’s value, ticking away as the expiration date approaches.

Trading Strategies: Unlocking the Power of Options

Options trading unlocks a world of strategic possibilities, empowering you to tailor your approach to market conditions and risk tolerance. Armed with an arsenal of strategies, traders navigate the market landscape, seeking to optimize their gains and mitigate potential losses.

Covered calls and secured puts involve selling premium while maintaining ownership of the underlying asset, generating income and capitalizing on market stability. Bullish and bearish strategies are designed to profit from anticipated price movements, with the former employed in uptrending markets and the latter flourishing in downtrends. Option spreads, employing combinations of calls and puts, offer sophisticated traders the ability to customize risk-reward profiles and respond to volatile market conditions.

Image: jeka-vagan.blogspot.com

Tips to Enhance Your Trading Prowess

Mastering options trading requires a blend of knowledge, experience, and cunning strategy. Here are a few expert tips to help you elevate your trading prowess:

- Begin by comprehending the basics thoroughly to lay a solid foundation.

- Practice diligently using paper trading or simulated platforms before venturing into the live market arena.

- Monitor market trends, news events, and company-specific developments to stay abreast of market dynamics.

- Manage your risk vigilantly by understanding the potential losses associated with each trade.

- Seek guidance from seasoned traders or consider enrolling in educational programs to hone your skills.

Frequently Asked Questions

- Q: Is options trading suitable for beginners?

A: While options trading offers immense potential, it’s not recommended for absolute beginners due to its inherent complexity and risk. Gaining a comprehensive understanding and developing a strong foundation in financial markets is prudent before embarking on options trading.

- Q: How do I get started with options trading?

A: Educate yourself through books, online resources, and courses to grasp the fundamentals. Practice with paper trading or simulators to gain practical experience. Open a brokerage account that supports options trading and begin with small trades to manage risk.

- Q: What are the risks involved in options trading?

A: Options trading involves substantial risk, including the potential loss of the entire investment. It’s crucial to understand the mechanics of options contracts and manage risk by employing proper trading stratégies and position sizing.

Trading Options Business

Image: wislibrary.net

Conclusion

The enigmatic world of options trading beckons with its promise of lucrative returns. By comprehending the intricacies of this financial instrument, grasping the nuances of trading stratégies, and embracing expert tips, you embark on a path towards mastering this exhilarating arena. Remember, knowledge, patience, and risk management are your steadfast companions on this financial odyssey. As you delve deeper into the realm of options trading, discover its complexities and embrace the opportunities it presents. The pursuit of financial success through this dynamic market awaits your exploration.

Is options trading a topic that sparks your curiosity? Share your thoughts and delve into the captivating world of options further.