In the fast-paced world of finance, options trading has emerged as a dynamic and potentially lucrative investment strategy. And with the advent of user-friendly platforms like Robinhood, options trading has become accessible to a wider audience than ever before.

Image: www.youtube.com

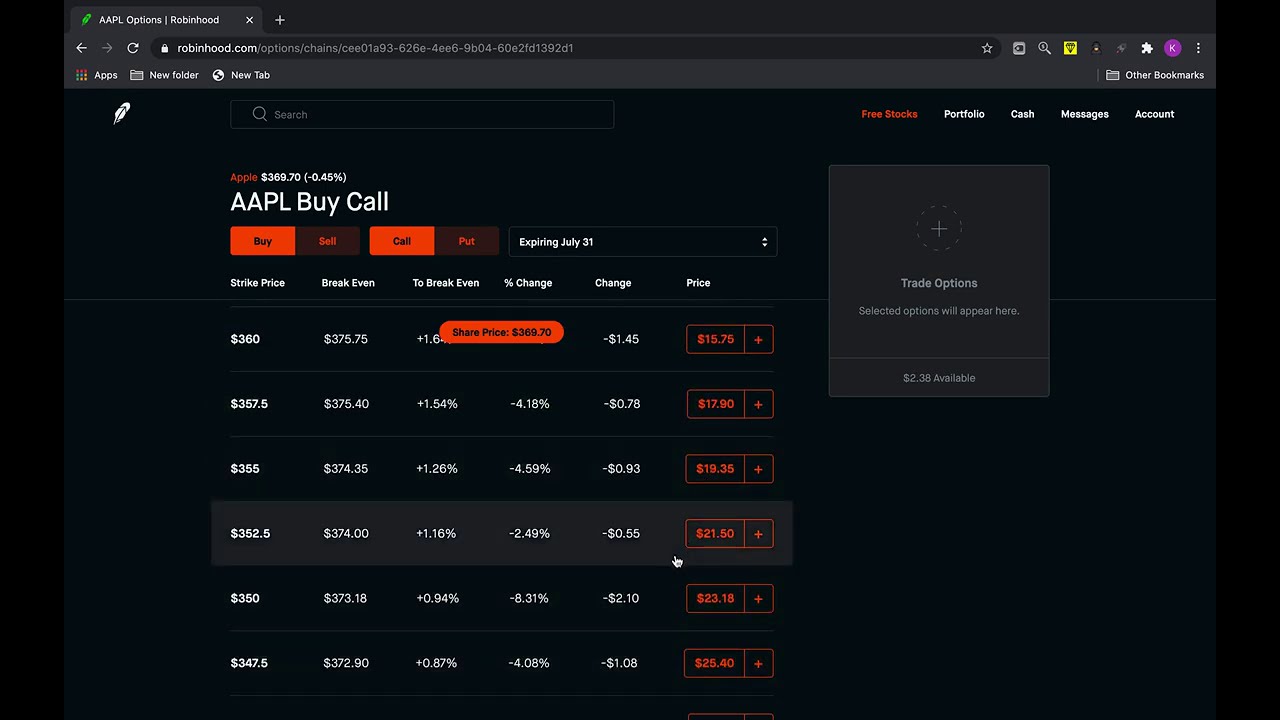

Welcome to our comprehensive guide to trading options on Robinhood via YouTube. In this article, we embark on a journey to unlock the intricacies of options trading, providing you with essential knowledge and actionable insights to navigate this multifaceted market effectively.

What is Options Trading?

Options trading involves the buying and selling of financial contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a preset price on or before a specific date.

There are two primary types of options: calls and puts. A call option grants you the right to buy the underlying asset, while a put option provides the right to sell it. The price at which you can exercise this right is known as the strike price, and the date on which the option expires is known as the expiration date.

Why Trade Options on Robinhood?

Robinhood offers several advantages for options traders, particularly those who are new to the market.

- Low trading fees: Robinhood charges $0 commissions on options trades, making it a cost-effective platform for frequent trading.

- Ease of use: Robinhood’s user-friendly interface and intuitive mobile app simplify the options trading process, even for beginners.

- Educational resources: Robinhood provides access to a wealth of educational materials, including videos, tutorials, and webinars, to help you enhance your trading knowledge.

Latest Trends in Options Trading

The options trading landscape is constantly evolving, driven by advancements in technology and changes in the global economy.

Image: www.youtube.com

Tips and Expert Advice for Options Trading

Seasoned traders have accumulated valuable experience that can guide your options trading journey. Here are some tips to consider:

- Start with paper trading: Practice trading options in a simulated environment before committing real capital.

- Learn from experienced traders: Follow industry experts, attend workshops, and read books to gain insights and expand your knowledge.

- Use volatility to your advantage: Options trading thrives on volatility, so stay informed about market conditions and adjust your strategies accordingly.

- Manage risk effectively: Set stop-loss orders, monitor your positions regularly, and avoid overleveraging.

- Stay updated on market news: Pay attention to economic indicators, corporate announcements, and geopolitical events that may impact the markets.

FAQs on Options Trading on Robinhood

Q: Is options trading suitable for beginners?

A: While options trading can be an exciting prospect, it’s important for beginners to approach the market with caution. Start with small trades, educate yourself thoroughly, and seek professional advice if needed.

Q: What is the minimum amount required to trade options on Robinhood?

A: Robinhood has no account minimums, allowing you to trade options with as little as you’re comfortable with.

Q: What is the maximum number of options contracts I can trade?

A: The maximum number of contracts you can trade at any given time is 500. However, your trading privileges may be restricted based on your trading activity and account information.

Trading Options On Robinhood Youtube

Conclusion

The world of options trading on Robinhood is a fascinating and dynamic one, offering both opportunities and challenges. By understanding the basics, embracing the latest trends, and implementing proven strategies, you can embark on this journey with confidence.

Are you ready to unlock the potential of options trading on Robinhood?