The thrill of options trading, with its potential for substantial gains, can be addictive. However, the excitement of a profitable trade can quickly fade when you confront the intricacies of taxes. Imagine this: you hit a home run with a call option, watching your investment skyrocket. But as you bask in the victory, the unsettling question lingers – how much of this gain will go to the IRS?

Image: widetax.com

That’s where understanding options trading taxes becomes crucial. It’s not just about filing your taxes correctly; it’s about maximizing your profits by strategically planning for tax implications. This article delves into the world of options trading taxes, equipping you with the knowledge to navigate the complexities and optimize your trading strategy.

Understanding Options Trading Taxes: A Deep Dive

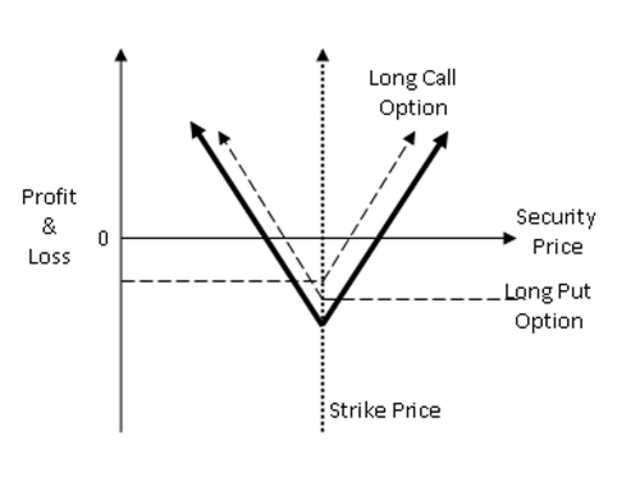

Options trading, in essence, is the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a certain date. This right comes with a cost, known as the premium. The tax implications of options trading stem from the nature of these premiums, which can result in both gains and losses.

The IRS classifies options trading as a **short-term capital gain or loss** if the option is held for less than a year and a **long-term capital gain or loss** if held for a year or more. Understanding this distinction is paramount as tax rates differ significantly between short-term and long-term capital gains.

Dissecting the Tax Implications

Here’s a detailed breakdown of the tax treatment of options trades:

- Premiums Paid: Premiums you pay for purchasing options are considered a **capital expense** and are deducted from your capital gains when calculating your tax liability.

- Premiums Received: When you sell an option, the premium you receive is considered **capital income.**

- Exercise or Assignment: If you exercise a call option, the difference between the strike price and the market price of the underlying asset at the time of exercise is considered a **capital gain or loss.**

- Covered Calls: When you write a covered call, the premium received is taxed as **short-term capital gain** if the call expires worthless. However, if the underlying asset is exercised, you’ll have a **short-term capital gain** on the difference between the share price and the strike price of the option.

- Options Expiring Worthless: If your options expire worthless, you can deduct the premiums you paid as **capital losses** on your tax return.

Navigating the Tax Landscape: Strategies and Tips

The following strategies can help you minimize your tax burden on options trading:

- Long-Term Holding Strategies: Holding options for more than a year can convert your gains into **long-term capital gains,** which are taxed at a lower rate than short-term gains. This strategy is particularly beneficial for options with a high probability of expiring in the money.

- Tax-Loss Harvesting: This strategy involves intentionally selling losing options to offset your gains. By pairing profitable trades with offsetting losses, you can reduce your overall tax liability.

- Utilizing Wash Sale Rules: The IRS’s wash sale rule prevents you from claiming a loss on an option if you repurchase a substantially similar option within 30 days before or after the sale. Understanding this rule is crucial when employing tax-loss harvesting strategies.

- Spreading Your Gains: Spreading your gains across multiple years can help you avoid exceeding your tax brackets. Try to time option expiration dates and exercises strategically to manage your tax implications over time.

Remember that tax laws are complex and constantly evolving. It’s always wise to consult a financial advisor or tax professional for guidance tailored to your specific trading strategy and financial situation.

Image: platformaxxi.org

Frequently Asked Questions (FAQ)

Q: How do I report my options trading income and expenses on my tax return?

You must report all your options trading activities on **Schedule D** of Form 1040. Within Schedule D, you’ll categorize your options trades based on their duration (short-term or long-term), and then calculate your net capital gains or losses.

Q: Can I deduct my options trading losses against other income?

Yes, you can deduct capital losses against other income, such as wages or salary. However, there are limits on the amount of capital losses you can deduct in a single year. Any losses exceeding the limit can be carried forward to future tax years.

Q: Are there any specific tax forms for options trading?

While there aren’t dedicated forms for options trading, you’ll use **Form 1099-B** to report your brokerage transactions, including options trades. This form will include all the necessary information for reporting your options trading activity on your tax return.

Options Trading Taxes

Conclusion

Navigating the complexities of options trading taxes requires meticulous planning and a thorough understanding of IRS regulations. By following the strategies outlined above, you can minimize your tax burden and maximize your profits. Remember that seeking expert advice from a financial advisor or tax professional can provide the best guidance tailored to your specific trading needs.

Are you interested in learning more about specific options trading strategies for tax optimization? Let us know, and we’ll be happy to delve deeper into the intricacies of maximizing your returns while minimizing your tax liability!