Unlocking the Secrets of this Critical Measure

In the realm of option trading, understanding the delta metric is imperative to unlocking the complexities of this financial instrument. As a fundamental concept, delta plays a pivotal role in assessing the relationship between the price of the underlying stock and the option. This article embarks on a comprehensive exploration of delta, unraveling its meaning, significance, and applications in the dynamic world of options trading.

Image: www.brrcc.org

Navigating the Options Landscape: What is Delta?

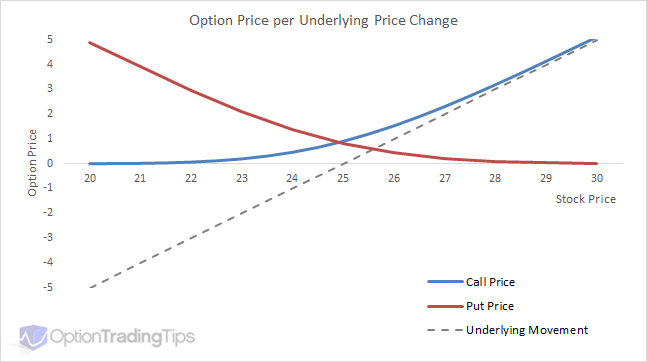

Delta, in its quintessential form, measures the sensitivity of an option’s price to changes in the underlying stock price. It demonstrates the number of shares that each option contract represents and how their value fluctuates with the stock’s performance. Precisely, delta quantifies the change in the option premium for every $1 movement in the stock price.

Options with a positive delta are known as bullish, reflecting an increase in the option’s price as the stock price rises. Conversely, options with a negative delta are bearish, signifying a decrease in option value with a decline in stock price.

Demystifying Delta Calculations: Practical Applications

Calculating delta involves meticulous mathematical considerations, but the essence lies in understanding its practical applications. For instance, consider an option with a delta of 0.5. This indicates that if the underlying stock price climbs by $1, the option’s premium is anticipated to increase by $0.50. Similarly, a delta of -0.8 suggests that a $1 decrease in the stock price may result in a decline in the option premium by $0.80.

Delta’s Significance in Option Strategies: Risk Management and Profit Potential

Delta holds profound significance in option strategies, empowering traders to craft tailored trading plans. Its versatility allows for diverse strategies, including hedging, speculation, and income generation.

Hedging involves utilizing options with negative delta to minimize risk by offsetting potential losses in the underlying stock. Speculators, on the other hand, leverage options with positive delta to amplify gains when they anticipate stock price appreciation. Income-generating strategies harness options with high delta to capitalize on option premiums.

Image: markettaker.com

Interpreting Delta in Real-World Scenarios: Trading Insights

Navigating the intricate world of option trading requires a thorough understanding of delta interpretation in real-world scenarios. This necessitates monitoring market conditions, assessing the underlying stock’s volatility, and considering the time decay of options.

The Greeks – a set of metrics encompassing delta, gamma, vega, and theta – provide a comprehensive framework for option traders to decipher market signals. By meticulously examining these measures, traders gain invaluable insights into option dynamics.

What Does Delta Measure In Option Trading

Image: brilliant.org

Conclusion: Unlocking the Power of Delta

Delta stands as a cornerstone of option trading, offering traders a lucid lens through which to decipher market movements and calibrate their strategies. Embracing the principles of delta analysis empowers traders with the knowledge and confidence to navigate the complexities of this financial arena. By skillfully leveraging delta and its counterparts within the Greeks framework, traders can enhance their decision-making, mitigate risks, and harness the full potential of option trading.