Introduction

The world of financial markets offers a plethora of investment opportunities, each with its unique set of strategies and risks. Among these, options trading stands out as a sophisticated strategy that allows investors to tap into the potential of underlying assets while managing their risk appetite. Of particular interest to experienced traders are option spreads, which involve the simultaneous buying and selling of options with different strike prices and expiration dates. This article aims to provide a comprehensive guide to trading option spreads, exploring their complexities, strategies, and potential rewards.

Image: www.overdrive.com

Understanding Option Spreads

An option spread is a strategy that involves the purchase or sale of multiple options on the same underlying asset to create a specific profit or loss profile. By combining different option types and strike prices, traders can tailor their strategies to meet their investment goals and risk tolerance.

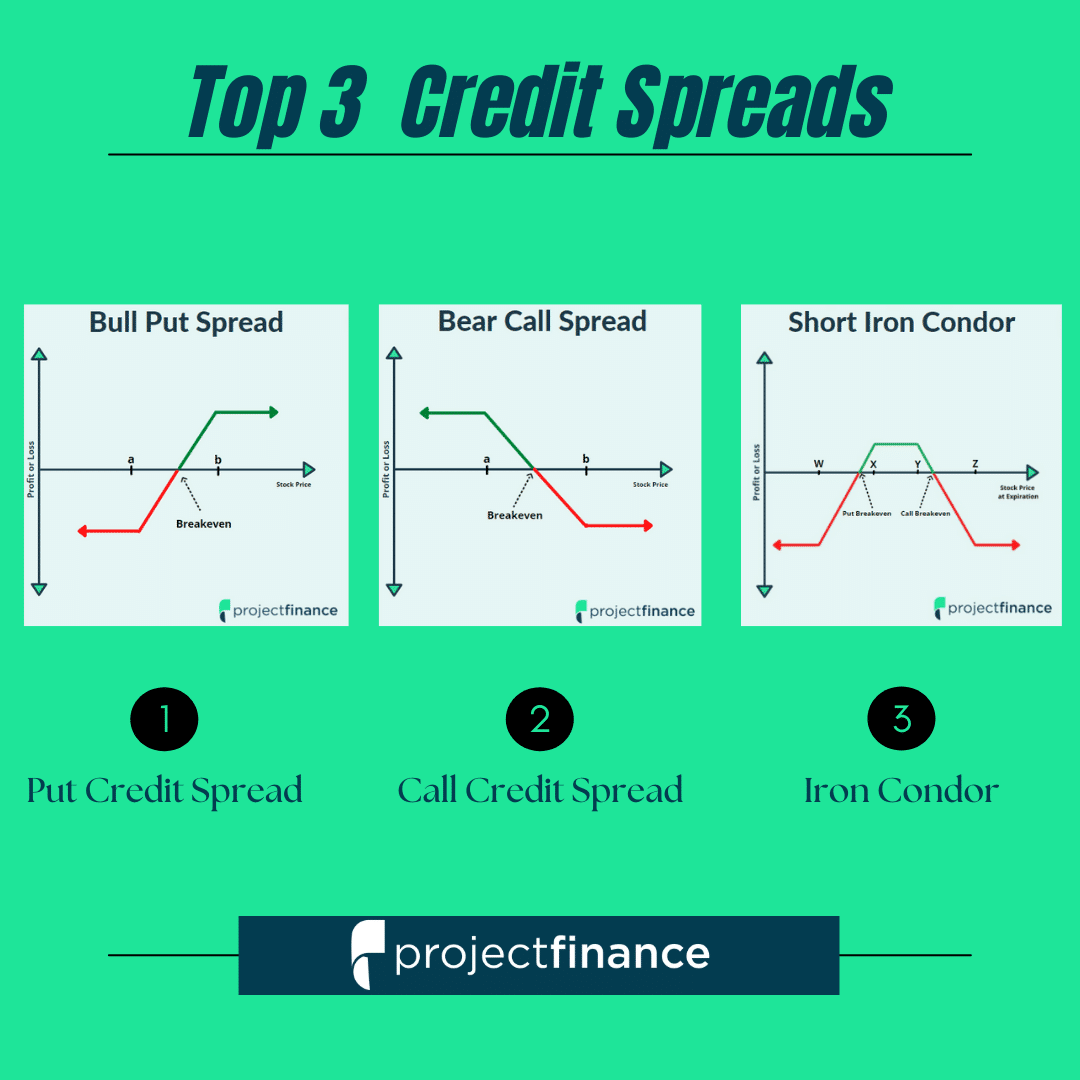

The primary types of option spreads include bull spreads, bear spreads, butterfly spreads, and condor spreads, each designed to capitalize on specific market expectations or volatility. Bull spreads are employed in bullish markets, anticipating an increase in the underlying asset’s price, while bear spreads benefit from a decline. Butterfly and condor spreads are more complex, seeking profit from volatility or range-bound movements in the underlying asset’s price.

Strategy Considerations

Trading option spreads requires a thorough understanding of factors such as the time to expiration, strike price, volatility, and liquidity. The time to expiration determines the duration of the option contract, affecting its premium and potential for profit or loss. The strike price is the price at which the underlying asset can be bought (for a call option) or sold (for a put option), while volatility measures the expected fluctuations in the asset’s price. Liquidity refers to the ease with which an option can be traded without significantly affecting its price.

Traders must carefully consider these factors when selecting options for their spread strategy. The goal is to create a spread that maximizes profit potential while minimizing risk, considering the underlying asset’s historical volatility and liquidity.

Image: fabalabse.com

Trading Option Spreads

https://youtube.com/watch?v=S127D07P30I

Risk Management

While option spreads offer the potential for higher returns than traditional options trading, they also come with increased risk. Effective risk management is crucial to avoid substantial losses.

Diversification is a key strategy in risk management, involving the creation of multiple option spreads with different underlying assets or expiration dates. This reduces exposure to any single asset or market factor and enhances the overall resilience of the portfolio.

Additionally, traders should consider hed