In the bustling world of finance, where every tick and tock of the clock can hold untold fortunes, the expiration of after-hours trading options carries immense significance. It’s a time of both anxiety and exhilaration, as traders eagerly await the unveiling of their fortunes. But what exactly is after-hours trading, and why does its expiration matter? Let’s embark on a journey to unravel the mysteries of this intriguing realm, empowering ourselves with knowledge and unlocking the boundless opportunities it presents.

Image: www.investorsunderground.com

Defining After-Hours Trading and Its Significance

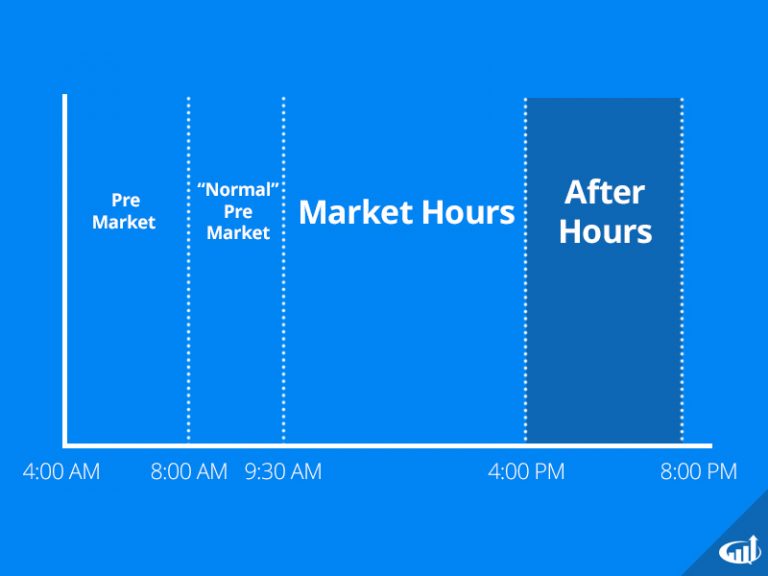

After-hours trading refers to the trading of stocks, options, and other financial instruments outside of the regular market hours, typically between 4:00 PM and 8:00 PM EST. Unlike regular trading, where orders are executed immediately during market hours, after-hours trading orders are held and executed when the market reopens the following day. This extended trading window offers several unique advantages and opportunities for traders. It allows them to react to late-breaking news and events, adjust positions, or enter new trades when the wider market is closed. For those who work during the day, after-hours trading provides flexibility and access to trading after traditional working hours.

The Power of Options: Unleashing Flexibility and Limitless Options

Options, a cornerstone of the financial markets, are versatile financial instruments that offer a wide array of opportunities for traders. They grant the holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specified price (the strike price) before a specific expiration date. This flexibility allows traders to tailor their strategies to suit their risk tolerance and profit targets. By understanding the nuances of options and leveraging them effectively, traders can unlock the limitless possibilities offered by after-hours trading.

The Impact of After-Hours Trading Options Expiration: Unveiling Fortunes and Navigating Risks

The expiration of after-hours trading options marks a pivotal moment for traders. It’s the culmination of their research, strategy, and risk management efforts. Depending on the closing price of the underlying asset relative to the strike price, options can either expire worthless or be exercised, leading to substantial profits or losses. For example, if a trader holds a call option with a strike price of $100 and the underlying asset closes above $100 at expiration, the option will be in the money, granting the holder the right to buy the asset at the strike price. This can result in a significant profit if the market price continues to rise. Conversely, if the underlying asset closes below $100, the option will expire worthless, resulting in a loss of the premium paid.

Image: ezpaydaily.com

Mastering the Art of After-Hours Trading Options Expiration: Strategies and Considerations

Navigating the intricacies of after-hours trading options expiration requires a combination of skill, strategy, and emotional resilience. Traders must carefully consider factors such as market volatility, news and events, and the time value of options. Effective risk management practices are crucial to mitigate potential losses and protect trading capital. By continuously refining their knowledge, staying up-to-date with market trends, and adapting to changing conditions, traders can optimize their chances of success in the dynamic world of after-hours trading options expiration.

Empowering Traders: Expert Insights and Actionable Tips

To further enhance our understanding of after-hours trading options expiration, let’s delve into expert insights and actionable tips. Renowned financial analysts and experienced traders offer valuable perspectives, sharing their knowledge and strategies for navigating this complex terrain. They emphasize the significance of thorough research, disciplined risk management, and the ability to adapt to rapidly evolving market conditions. By embracing these insights and incorporating them into our trading approach, we empower ourselves to make informed decisions and enhance our overall trading outcomes.

Embracing the Journey of After-Hours Trading Options Expiration: Overcoming Challenges and Embracing Triumph

After-hours trading options expiration is a journey filled with challenges and triumphs, a path where rewards are often commensurate with the effort invested. It demands resilience, adaptability, and a relentless pursuit of knowledge. Embracing this journey requires embracing both the wins and the losses, learning from our experiences, and continuously refining our approach. By doing so, we not only enhance our trading skills but also cultivate a mindset of continuous growth and improvement, ultimately setting us on the path to long-term success in the ever-evolving world of financial markets.

After Hours Trading Options Expiration

Embark on Your After-Hours Trading Adventure: Invest in Knowledge and Unlock Your Financial Potential

As we reach the end of our exploration into after-hours trading options expiration, we recognize that the true journey lies not merely in understanding the concepts but in actively applying them to our own trading endeavors. It’s an adventure that requires a commitment to knowledge, a pursuit of excellence, and an unwavering belief in our abilities. By delving deeper into the intricacies of options trading, staying abreast of market trends, and continually seeking mentorship from experienced traders, we equip ourselves with the tools and mindset necessary to navigate this dynamic and rewarding realm. Remember, knowledge is the key that unlocks the door to financial empowerment—embrace it, and let the adventure of after-hours trading options expiration lead you to your financial aspirations.